Quick Brief – US labour market data boosts both the dollar and stocks

- Non-farm payrolls jump by 254k, a 6-month high

- Unemployment dips and hourly earnings surprise to the upside

- Dollar benefits, US stocks also bounce higher

The September non-farm payrolls report printed at 254k, a 6-month high, and well above forecasts for a 140k increase. With the August print revised slightly higher to 159k, the unemployment rate dropping to 4.1% and the average hourly earnings growth jumping to 4%, one could say the latest set of labour market data was unexpectedly strong.

The chances for a 50bps rate cut by the Fed in November have taken a sizeable hit, as the market is currently pricing in only a 9% probability for such an aggressive move, down from almost 50% at the start of the week.

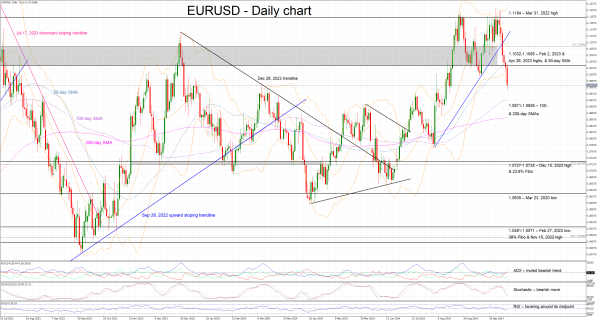

The market reacted positively to the stronger data releases with the dollar extending this week’s rally. Euro/dollar has quickly dropped below 1.1000, and, at the time of writing, it is hovering at the lowest level since mid-August. Surprisingly, US stock indices also appear to be enjoying this labour market report, with the S&P500 index being in the green today and attempting to recoup part of this week’s losses.