Quick brief – WTI oil prints double bottom amid rising geopolitical risks

Geopolitical risks are not going away anytime soon; may keep supporting oil prices

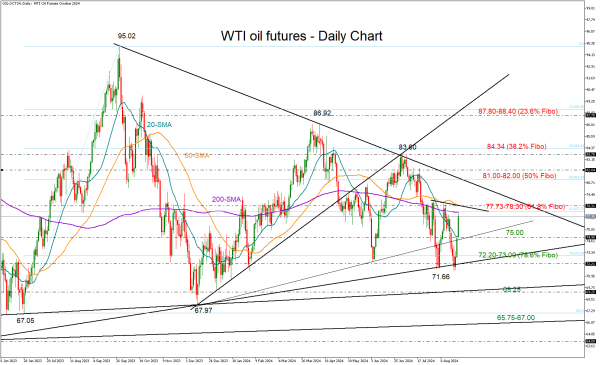

WTI crude oil creates bullish trend pattern; confirmation awaited above $78.30.

Israel’s military and the Iranian-backed Hezbollah army exchanged one of their heaviest waves of rockets in ten months across southern Lebanon on Sunday, helping crude oil prices to stage another bull race on Monday.

With three deaths confirmed in Lebanon and one in Israel, the two sides declared victory and signaled that they are not looking for further escalation. But it’s difficult to believe that there will be no similar episodes in the near term as Israel said that this is "not the end of the story" and Hezbollah described the barrage as a "first phase of retaliatory attacks" against the assassination of its commander Fouad Shukr last month.

Moreover, as long as ceasefire talks over Gaza continue to hit a wall, the risk of a wider regional geopolitical escalation in the Middle East accompanied by output disruptions in oil fields might get larger. Note that Libya’s eastern government closed oilfields and halted exports on Monday, providing no specific deadline for their resumption, while Waha oil Company, which is a subsidiary of the National Oil Corporation, announced gradual output reductions and a complete halt to production in the face of protests and pressures.

WTI oil futures are currently up by 3.14% on the day, testing the 200-day simple moving average (SMA) at $77.73/bpd. The latest bounce followed the creation of a double bottom structure near the key support trendline at $71.66 and a decisive close above $78.30 is now required to confirm the positive pattern. Still, only a rally above the $81.00-$82.00 region and beyond the previous high of $83.60 would mark a new higher high in the short-term picture.