Rate cuts may be round the corner as economic growth drivers are losing momentum

By Aurodeep Nandi

Is India’s growth picking up or slowing down? Simple question but complicated answer. On the one hand, GDP growth fell to 6.7 percent year-on-year (y-o-y) in the first quarter, Q1 FY25, from 7.8 percent in Q4 FY24. It was below expectations of 6.8 percent. On the other hand, gross value added (GVA) growth rose to 6.8 percent from 6.3 percent, above market expectations (6.4 percent). Riddle me this!

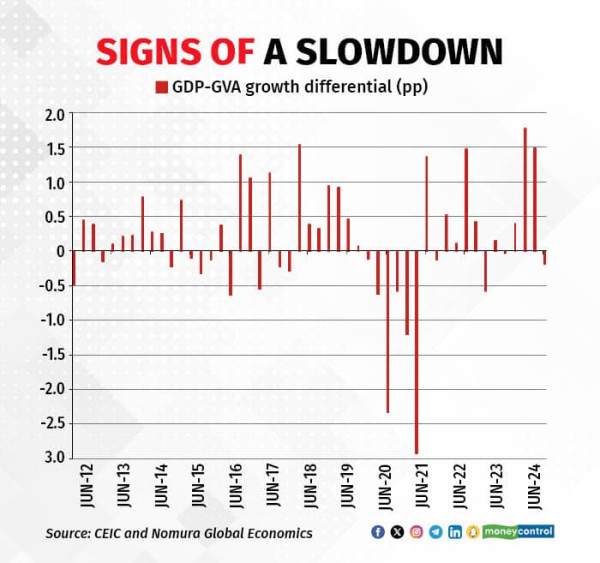

GVA-GDP’s changing dynamics

The past three quarters have witnessed this play out in reverse. GDP growth soared, while GVA growth wilted, making for a messy growth outlook. GDP is equal to GVA + (indirect taxes - subsidies).

So, GVA growth exceeding GDP suggests lower indirect taxes and/or higher subsidies outgo. We also note that GDP growth tends to undershoot GVA growth during economic slowdowns, due to lower net indirect taxes. In our view, GVA growth exceeding that of GDP cannot be ruled out in coming quarters.

GDP’s drivers

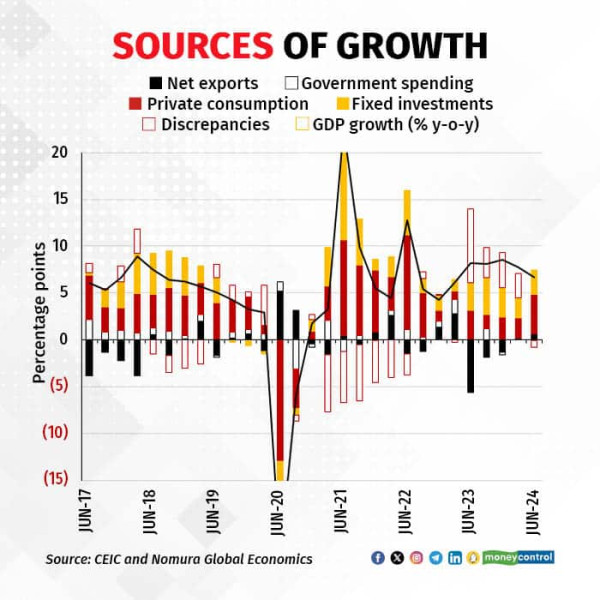

So what has driven growth in Q1 FY25? On the GDP side, the growth moderation was primarily owing to a contraction in government consumption by -0.2 percent y-o-y, despite a favourable base, underlining the election-led dip in government spending.

The sharp rise in private consumption growth to 7.4 percent y-o-y from 4 percent in Q4 FY24 and a near two-year high is surprising, considering the heatwave should have had a negative impact.

Fixed investment also maintained robust growth of 7.5 percent from 6.5 percent in the prior quarter, despite monthly fiscal data suggesting a fall in public capex growth. This suggests private investment picked up, likely led by housing. Strong export growth and weak import growth led to net exports’ contribution rising.

GVA drivers

On the supply side, agricultural GVA growth remained weak at 2 percent y-o-y in Q1 FY25 from 0.6 percent in Q4 FY24, reflecting weaker rabi crop production.

Industrial GVA growth moderated to a still-elevated 7.4 percent from 8.3 percent in the previous quarter, reflecting strong growth in utilities and mining, and some moderation in manufacturing growth. That said, we had expected a bigger drop in growth, owing to muted corporate profits.

Services GVA growth rose to 7.7 percent from 7 percent, with solid performance across construction, public administration (despite lower government spending), and the financial, real estate & professional services sectors. By contrast, growth in the labour-intensive “trade, hotels, transport and communication” sector remained weak at 5.7 percent y-o-y versus 5.1 percent, possibly reflecting tepid domestic demand.

What lies ahead

That said, where is growth headed hereon? Early data for Q2 FY25 suggest a mixed start. Among the consumption indicators, passenger vehicles and MHCV sales have underwhelmed and the trends are likely to broadly continue into August. Meanwhile, two-wheeler and tractor sales are performing comparatively better, reflecting a gradually recovering rural economy amid robust rainfall. Air travel and cargo traffic growth have been healthy. As India enters the festive months from September onwards, we will monitor whether sales this year improve from last year’s levels.

Of the investment/industrial indicators available thus far in the current quarter, steel, cement, and electricity production have eased on a sequential basis, although y-o-y growth rates have picked up. July trade statistics also point towards falling industrial import growth. Meanwhile, merchandise export growth continued to contract in July, even as services exports have been healthy.

Fiscal data for July suggest that following a sharp slump in public capex growth in the past two months, it has picked up in July. However, revenue expenditure growth has fallen, underlining the government’s struggle to revive government spending.

With sub-7 percent GDP growth in the first quarter of the fiscal year, and a mixed start to the second, we lower our GDP growth forecast to 6.7 percent y-o-y in FY25 from 6.9 percent previously. The slump in government spending should reverse and the mix of good monsoons, and lower inflation bodes well for the rural economy. This, along with stable public and household investment, stable global growth and ebullience in parts of the services sector continue to propel growth in India.

Weakness in sources of aggregate demand

On the flip side, cracks are emerging in urban demand, and despite its revival, rural terms of trade remains low by historical standards and real rural wage growth continues to contract.

The continued weakness in the labour-intensive trade, hotels, transportation and communication component of the GVA is concerning.

In addition, while corporate investment improved in FY24, it has been a sober recovery and a strong upswing is still pending, despite cleaner balance sheets. As the benefits of sharp input cost disinflation fades, so will likely terms-of-trade tailwinds for corporates, resulting in lower corporate profits.

We also expect the RBI’s tighter macroprudential measures to result in a slowdown in credit growth. That said, India’s strong medium-term growth drivers, robust fundamentals and continued reforms should ensure GDP growth of ~7 percent (FY25: 6.7 percent; FY26: 7.2 percent), although we see rising downside risks for FY26 as well.

RBI may ease monetary stance

How will the RBI react? GDP growth of 6.7 percent is 0.4 percentage point lower than the RBI's forecast of 7.1 percent, so this is a dovish outturn. We expect the RBI to lower its FY25 GDP growth projection of 7.2 percent by at least 0.1 percent at the October meeting.

Thus far the RBI has downplayed softer GVA trends, and focused on GDP growth numbers to flag growth resilience. Consequently, the faster rise in GVA growth should not be of much consequence. We continue to expect a policy pivot coming up. The RBI has thus far maintained a hawkish drumbeat, emphasizing the potential generalization of higher food inflation and the policy space awarded by the robust growth outlook. This has effectively ruled out consensus expectations of any easing in policy rates in the near term. However, we differ in our assessment.

Underlying inflationary pressures are muted, growth is softening, the global rates cycle is pivoting, and the RBI doesn’t provide any forward guidance. We expect the RBI to deliver the first cut in October, ahead of consensus expectations of December or later, with 100 basis points of cumulative easing in FY25.

(The author is India Economist, Executive Director at Nomura.)

Views are personal and do not represent the stand of this publication.