RBNZ Preview: Rates expected to remain unchanged at final meeting of 2023

The RBNZ meets for the final time this year on Wednesday, 29th of November, 2023. We preview what to expect and how it could impact the New Zealand Dollar.

New Zealand unemployment rises, but inflation remains stubbornly high

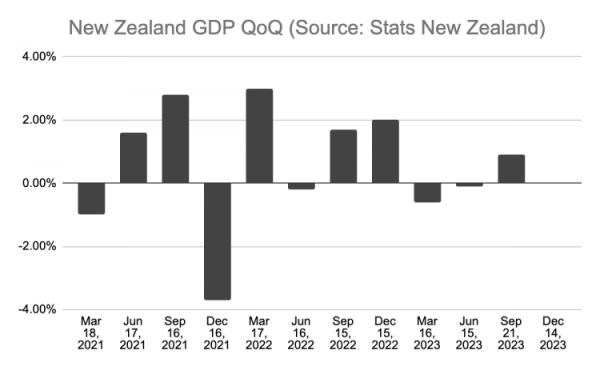

The New Zealand economy is experiencing stagflationary-like conditions, with inflation still significantly above target but the unemployment rate steadily rising. Despite the latest GDP data revealing New Zealand’s economy expanded by a larger-than-expected 0.9% q/q, the figures apply to the June quarter and a backward backward-looking. According to surveys conducted by Bloomberg, economists expect GDP growth to moderate in the final two quarters of this year as New Zealand's economy teeters on recession.

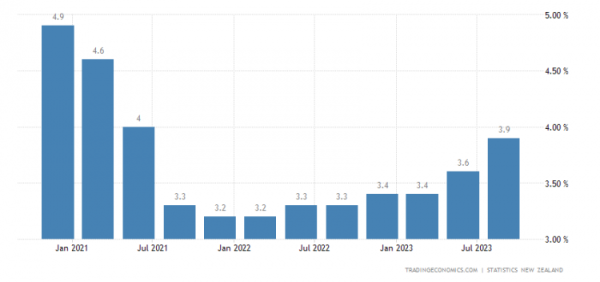

New Zealand’s jobless rate has progressively increased, with the unemployment rate currently around 3.9%. While a large part of this has been due to employment growth being outstripped by population growth amid elevated migration, the most recent labour market statistics revealed a contraction in employment growth.

(Source: Trading Economics)

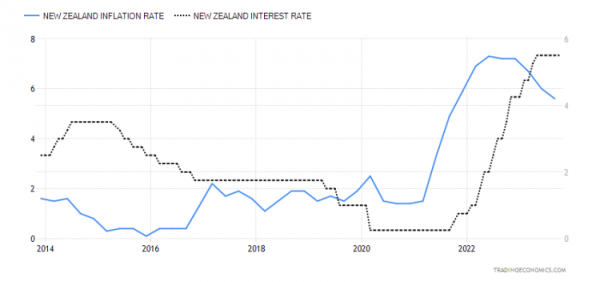

Although aggregate demand is weakening in New Zealand, inflation is falling at a moderate pace. The latest CPI data revealed that headline inflation was 5.6% in the September quarter, with core inflation still at a lofty 5.8%. Bloomberg data suggests that economists ought to end the year below 5%.

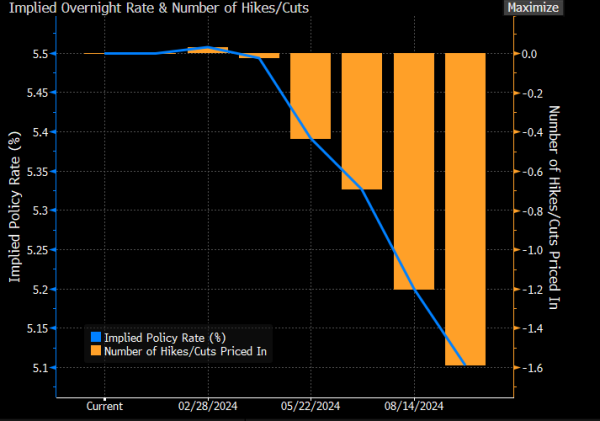

Interest rate markets imply no change to RBNZ policy

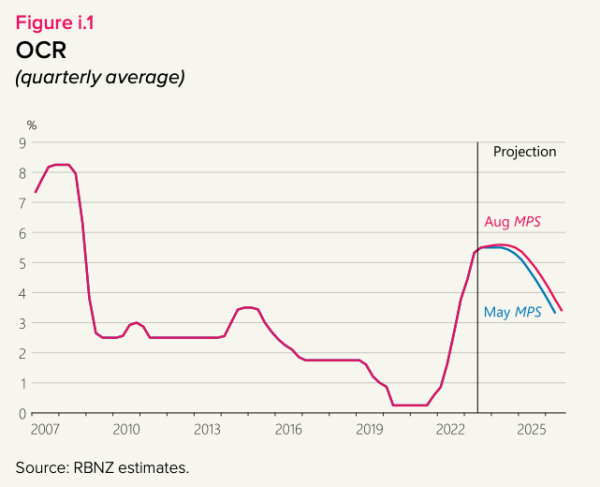

As illustrated in the chart below, rates markets imply that the RBNZ will keep policy unchanged at this meeting, with the overnight cash rate remaining at 5.5%. As GDP and jobs growth weakens, the markets are implying the next move from the central bank will be a rate cut, with almost two cuts baked in before the middle of 2024.

The RBNZ’s latest Monetary Policy Statement, released in August, suggested the central bank believes it has reached the peak in interest rates and ought to be cutting rates in 2024. However, the RBNZ sees a less aggressive rate-cutting cycle, with inflation exceeding the 1-3% target range until 2025.

(Source: RBNZ)

NZD/USD rises as markets bet on peak in US rates

The NZD/USD has been predominantly driven by a weaker US Dollar, as a spate of softer data, dovish commentary from the US Federal Reserve, and bets of a peak in US interest rates weigh on the Greenback. The pair is in a short-term uptrend with momentum skewed to the upside and is testing technical resistance at 0.6110. Price is carving out a rising wedge, potentially signalling a looming pullback. Technical support appears to be around 0.6050.

(Past performance is not a reliable indicator of future results)