Record demand explains gold’s current resilience

Key points

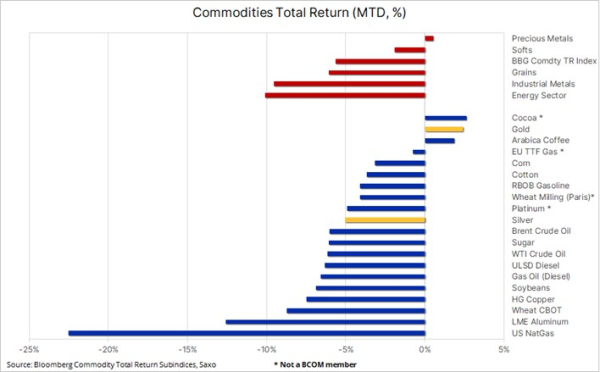

- The commodities sector has erased this year's gains with all sectors, except precious metals declining

- Demand from family offices, rich individuals, and central banks keep gold supported

- ETF investors are showing signs of life as the first US rate cut draws nearer

I have returned from my annual summer holiday to find the commodities sector has erased this year’s gains amid China growth worries, a sharp sell-off in energy led by natural gas, and weakness across industrial metals, with copper suffering a major round of long liquidation from investors due to a mismatch between weak short-term fundamentals and an overriding positive long-term outlook. Additionally, crop-supportive weather across the northern hemisphere has raised the prospect of another bumper crop production season.

These developments have caused the Bloomberg Commodity Total Return Index to suffer a 5% setback this month, leaving the index close to flat on the year, with the only sector barely in the black this month being precious metals, thanks to gold’s continued resilience amid a number of different supportive developments.

World Gold Council sees highest Q2 demand since 2000

This week the WGC published their Gold Demand Trends Q2 2024, and despite record prices, the organisation saw record demand with OTC investment demand from family offices and rich individuals as well as continued demand from central banks as being decisive. Among the highlights they wrote:

- The LBMA gold price averaged a record US$2,338/oz in Q2 – 18% higher y/y and 13% higher q/q. Gold reached a new record of US$2,427/oz in May.

- OTC investment of 329t was a significant component of Q2 total gold demand. Together with continued central bank buying, it helped drive the price to a series of record highs during the quarter.

- Total gold supply grew by 4% y/y to 1,258t. Mine production of 929t was a record for a second quarter. Recycling supply was the highest for a second quarter since 2012, responding to the rising gold price.

- Regional investment trends continued to diverge. Demand for bars, coins and ETFs, was robust in the East, compared with a marked decline in the West. Western ETF investment flows have, however, started to return so far in Q3.

- 2024 full year outlook: revived Western investment flows to balance out weaker consumer demand and potentially slower central bank buying vs 2023.

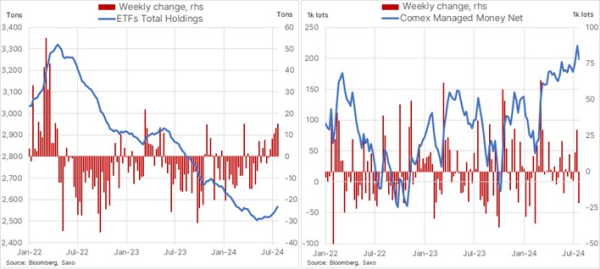

Gold reached a fresh record this month just below USD 2500—Saxo’s end-of-year target—after traders, following a succession of weaker US economic data print, lifted expectations a US rate cutting cycle could begin in September as opposed to a prior focus on December as the starting point. Lower funding costs for holding a position in a non-interest paying metal, such as gold, will increase its attractiveness, and during July we have seen some early signs that interest rate-sensitive investors have started to warm up to gold, with the total holdings across the major exchange-traded funds showing the biggest monthly increase since March 2022 when total holdings peaked above 3200 tons, only to suffer months of net selling amid rapid rising US interest rates.

Managed money accounts such as hedge funds and CTAs jumped into gold back in February and March at prices well below USD 2200, and deep in-the-money positions and with that the lack of selling pressure from position adjustments help explain why the yellow metal has only seen relatively small corrections during the past few months. As opposed to silver, which has suffered much higher volatility and bigger corrections after recent established longs were forced to reduce amid weakness across the industrial metals sector, not least copper.

Since April 2022 when the ETF holdings began reversing lower, gold has rallied from below USD 1900 to the current level around USD 2500, and it highlights gold’s strong support from multiple different sources other than yields, rates and the dollar, the most important being:

- Geopolitical risks related to Russia/Ukraine, the Middle East and not least uncertainty regarding the November US president election.

- Strong retail demand in China amid the desire to park money in a sector seen as relatively immune to a struggling economy and property woes and the outside risk of the Yuan devaluing.

- Continued central bank demand amid geopolitical uncertainty and de-dollarisation, and not least gold’s ability to offer a level of security and stability that other assets may not provide.

- Rising debt-to-GDP ratios among major economies, not least in the US, raising some concerns about the quality of debt. In other words, rising Treasury yields are not necessarily negative for gold as they raise the focus on overall debt levels and the sustainability of those.

- In addition, we are now increasingly seeing the positive impact of an incoming US rate cutting cycle, a period that historically has seen the yellow metal perform well.

Traders will be looking to Wednesday’s US FOMC meeting for guidance, and while we expect the meeting to have a minimal impact on rates repricing, the market is likely to maintain expectations of upcoming rate cuts, potentially already from September, based on concerns that inflation is now on a downward trajectory to 2% while the US economy is slowing as consumers are pulling back on spending, which accounts for roughly 70% of the country’s economic activity.

Since April, gold has made three successive record highs, the latest to USD 2484 taking it close to our end-of-year target. With three US rate cuts priced in this year, as opposed to the FOMC’s projection of just one, some short-term disappointment cannot be ruled out, but overall the direction towards higher prices in the months and quarters ahead remains. Key support can be found in the USD 2280 area while short-term resistance has emerged around USD 2325.

Recent commodity articles:

29 July 2024: COT: Energy and metals selling cuts hedge fund long to four-month low

4 July 2024: Sluggish US economic indicators boost demand for gold and silver

4 July 2024: Podcast Special: Quarterly Outlook - Sandcastle Economics

2 July 2024: Quarterly Outlook - Energy and grains in focus as metals pause

1 July 2024: COT: Crude long builds ahead of Q3 while grains selling accelerates

28 June 2024: Metals and natural gas propel commodity sector to quarterly gain

26 June 2024: Crude seeks support from seasonal demand strength

24 June 2024: Copper's resilience despite China weakness

18 June 2024: Precious metals go through prolonger period of consolidation

17 June 2024: COT: Dollar long jumps; Funds start rebuilding crude long

14 June 2024: Commodity weekly: Energy sector gains counterbalance metal consolidation

13 June 2024: Oil prices steady amid divergent OPEC and IEA demand projections

10 June 2024: COT: Brent long cut to ten-year low; metals left exposed to end of week slump

3 June 2024: COT: Crude length added before OPEC+ meeting; gold and copper see profit-taking