Record ETF inflows since June. What does this mean for Bitcoin's price? 🎯

Bitcoin ended yesterday with a gain of 5.20%, reaching $66,080. The increase wasn't driven by a single catalyst but rather supported by positive sentiment in the stock market. The U.S. SP500 index hit a new all-time high, and US500 CFD contracts broke through the 5,900-point level.

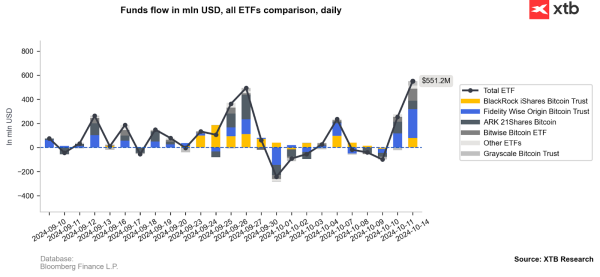

The dynamic gains in the cryptocurrency market were also fueled by record net inflows into ETFs, totaling $551 million only for yesterday. This is the 10th largest net inflow on record, with the previous high of $886 million occurring on June 4, 2024. This is also the first significant move in months, following the summer lull.

Below is a chart showing the 10 largest and smallest daily inflows to spot Bitcoin ETFs historically. Excluding the rapid increases from February and March, the largest ETF inflows have typically coincided with local price peaks. However, it's worth noting that this was during a period of multi-month consolidation in Bitcoin's price. If Bitcoin breaks out upward and returns to a bull market, we may see a repeat of similar situation as in February and March earlier this year. However, if Bitcoin remains in consolidation, the current record ETF inflows could even suggest a local top.

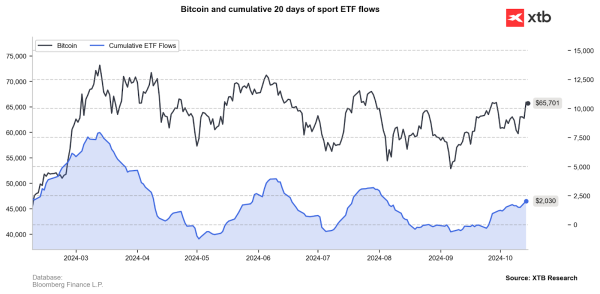

In this context, it's useful to look at cumulative spot ETF flows over the past 20 days. Here, local lows tend to be a more reliable reference point. If net flows fall to around zero or below, it may indicate a local low in Bitcoin's price. During the summer, we have been around this level constantly. The lack of significant outflows from ETFs also indicates that investors are not yet willing to sell, and the market is currently dominated by long-term investors accumulating Bitcoin. The recent slow rise in cumulative net flows to $2 billion suggests that capital and liquidity may be gradually returning to the market.

Bitcoin has paused its growth near the upper boundary of the sideways trend that has been in place since March this year. Increased selling pressure at these levels is understandable, and further correction is possible. However, if the bulls manage to break above this line permanently, we can expect further gains toward $69,000-$71,000. This scenario is also likely to be accompanied by further positive inflows into ETFs.

Source: xStation 5