Reserve Bank of New Zealand Preview: RBNZ could become more dovish as inflation eases and growth softens

The Reserve Bank of New Zealand (RBNZ) meets on Wednesday, May 22, 2024. We preview what to expect from the meeting and its possible impact on the NZD/USD.

The price information and economic data in this article are sourced from Bloomberg and Trading Economics

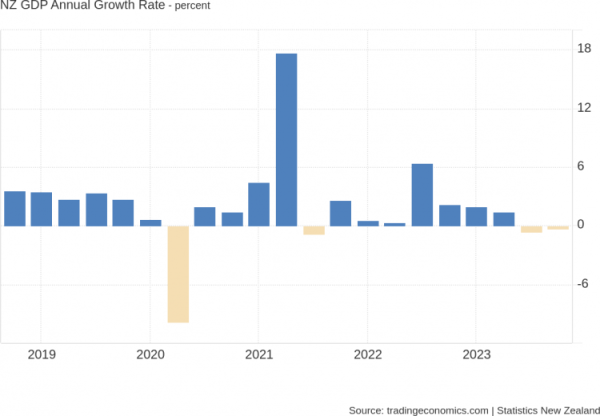

RBNZ juggles above-target inflation with negative growth

The RBNZ is battling difficult economic conditions. Inflation remains above target, but growth is contracting, with the unemployment rate rising. The latest GDP figures revealed a second consecutive quarter of negative growth, putting New Zealand in a technical recession.

(Source: Trading Economics)

(Source: Trading Economics)

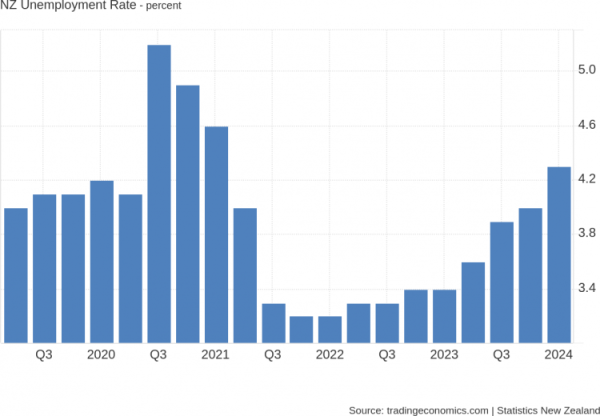

Softer demand can also be witnessed in the jobs market, with the unemployment rate trending higher. According to the latest New Zealand labour force data, the jobless rate rose to a three-year high of 4.3%, which is consistent with pre-pandemic levels.

(Source: Trading Economics)

(Source: Trading Economics)

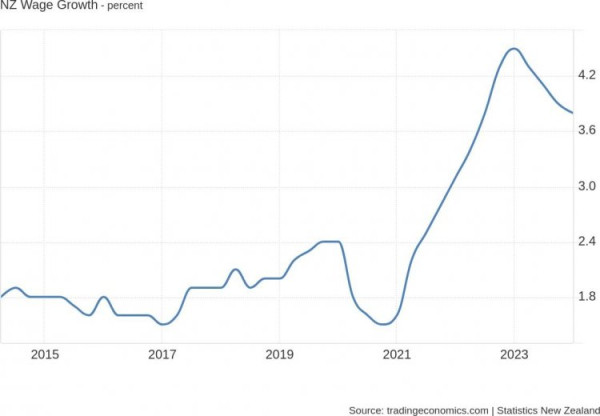

Despite greater slack in the labour market, wage pressures are persistent. New Zealand's wage growth is moderating from its highs but remains well above pre-pandemic levels and is falling at a slower rate than the unemployment rate is rising.

(Source: Trading Economics)

(Source: Trading Economics)

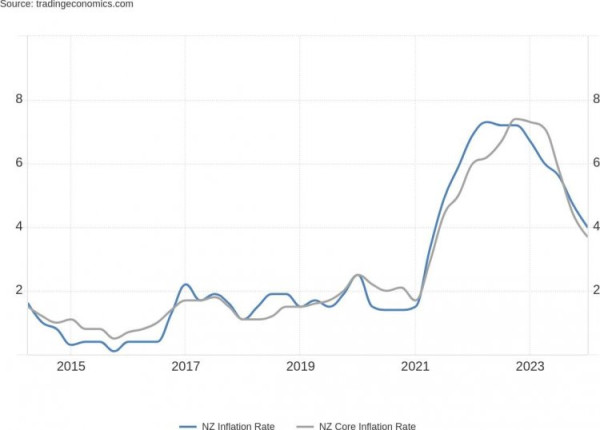

Inflation remains above the RBNZ’s 1-3% target band, with core CPI at 3.7%, although it is steadily trending lower.

(Source: Trading Economics)

(Source: Trading Economics)

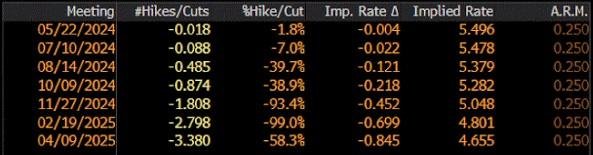

The last inflation print delivered a slight downside surprise, consolidating the view that RBNZ policy conditions are sufficiently restrictive. This RBNZ decision comes with updated forecasts in the central bank’s Monetary Policy Statement. Softening inflation and weaker economic activity open the door for a downward revision in GDP and CPI forecasts and, therefore, the interest rate outlook. Currently, futures imply a high probability of two rate cuts from the RBNZ this year.

(Source: Trading Economics)

(Source: Trading Economics)

Technical analysis: NZD/USD

The NZD/USD was coiled in a short-term range but appears to be breaking to the downside, with support around 0.6100 giving way. An intermediate level of support might be found around 0.6070/80, while a major level remains the 200-day moving average just below 0.6040.

(Past performance is not a reliable indicator of future results)

(Past performance is not a reliable indicator of future results)

The price information and economic data in this article are sourced from Bloomberg and Trading Economics