Riding the Fed-ECB Policy Divergence

What happened this week?

- US CPI for March came in hot yet again. This was the third consecutive print of higher-than-expected inflation, questioning why the Federal Reserve needs to cut rates. Markets now price in the first full Fed rate cut only in September and less than two full rate cuts for 2024 from the Fed.

- Meanwhile, the European Central Bank left policy rates unchanged at its April meeting, but the Governing Council’s updated policy statement clearly indicated an intent to start cutting rates at its next meeting in June, even as data-dependency was a key message.

What does this mean?

- The economic resilience, sticky inflation and a pushback from Fed speakers are making a case for the Fed to lag the next easing cycle. Green shoots in Europe and China are signalling an upturn in the manufacturing cycle, shelter inflation (a large component in US CPI) remains sticky, and the labor market still remains tight.

- Euro-area inflation slowed more-than-expected in March with CPI at 2.4% YoY from 2.6% in February. This adds to the case that inflation could return to the 2% target in Q2 and supports the case for the ECB to start cutting rates in June.

- Services inflation is still a risk for the ECB, which could mean that the ECB may remain cautious about the pace of easing cycle after June. Any weakness in EUR could also mean imported price pressures, especially if commodity prices remain high.

- However, if the Fed starts to cut rates as well, there could be room for the ECB to remain more aggressive in the current easing cycle.

Investment implications

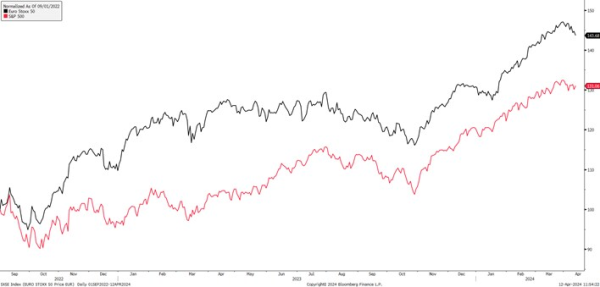

- European equities could outperform US peers: The upturn in manufacturing cycle and signs of bottoming out in China have already helped European stocks to outperform the US equities YTD. EuroStoxx 50 is up ~10% YTD as against gains of 9% in S&P 500. Valuation discount and diversification away from technology also make European equities a great choice for investors. The ECB rate cuts from June could potentially bring the next leg of outperformance in European equities. Read more on the investment case for European equities from our Head of Equity Strategy, Peter Garnry, in this article.

- Outperformance of European sovereigns over US: An early start of the rate cut cycle by the ECB compared to the Fed could boost the European sovereign bonds over the US Treasuries. The gap between the benchmark 10-year German and US borrowing costs has widened to over 200bps, its highest levels since November. Further evidence in the data to suggest that the ECB could continue to be more aggressive in its easing cycle compared to the Fed can further widen this spread. Current high yields provide an attractive carry and potential for ECB rate cuts boosts the potential for capital gains from European sovereigns. Read more on the investment case for European sovereigns from our Head of Fixed Income Strategy, Althea Spinozzi, in this article.

- EURUSD is threatening to break below YTD lows: EURUSD tested the February low of 1.0695 following the ECB announcement on April 11. Fed-ECB divergence spells further downside for EUR and our technical strategist is expecting a bearish breakout and next key level at 1.0660 followed by 1.0596. On the crosses, EURNOK could be pressured lower with NOK being supported by higher crude oil prices and a higher wage growth negotiated in Norway which could signal a delay in rate cuts from Norges Bank. EURCHF could also reverse the gains seen since the start of February as geopolitical risks remain on the radar.

- Slowdown in commodity rally: The recent momentum in commodities could be at risk of a correction if the dollar strengthens on the back of weakness in EUR. Note that EUR has the highest and over 50% weight in the Dollar (DXY) index which makes dollar vulnerable to the moves in EUR.

-----------------------------------------------------------------------

Other recent Macro/FX articles:

12 Apr: Global Market Quick Take - Asia

11 Apr: ECB rate decision: How to trade the event

9 Apr: CAD vulnerable as market underprices dovish Bank of Canada risks

9 Apr: US inflation report: How to trade the event

8 Apr: Macro and FX Podcast: NFP, CPI, ECB and Japan

8 Apr: Weekly FX Chartbook: US CPI, geopolitics and dovish pivots from ECB and Bank of Canada in focus

3 Apr: Chinese yuan bears are undeterred by PBoC’s grip

25 Mar: Macro & FX Podcast: Swiss central bank surprises; PCE and China

25 Mar: Weekly FX Chartbook: The return of US exceptionalism

22 Mar: Swiss National Bank’s bold move will kickstart the G10 rate cut cycle

20 Mar: Thematic Podcast: Japan's route to abolish negative interest rates

20 Mar: Japan’s exit from negative rates: Implications for the economy, yen and stocks

19 Mar: FOMC rate decision: How to trade the event

18 Mar: Macro & FX Podcast: Central bank meetings all over

18 Mar: Weekly FX Chartbook: Heavy central bank focus as FOMC, BOJ, BOE, SNB, RBA meet

14 Mar: FOMC vs. BOJ: Who moves the Yen?

12 Mar: Dampening equity sentiment could test GBP resilience

11 Mar: US inflation report: How to trade the event

6 Mar: Bitcoin fever is running high, again

5 Mar: FX & Macro Podcast: US jobs data, China's "Two Sessions" & Super Tuesday

28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

23 Feb: Nvidia momentum spills over to FX markets

21 Feb: Central bank divergence on the radar: Hawkish RBNZ, Dovish BOC and SNB

15 Feb: Swiss Franc’s bearish view gets more legs

14 Feb: Sticky US inflation could make dollar strength more durable

9 Feb: Japanese Yen is throwing a warning

8 Feb: FX 101: USD Smile and portfolio impacts from King Dollar