Rising aluminum prices elevate Alcoa's stock price 📈

Alcoa Corporation (AA.US) is gaining more than 8% today, thanks to a strengthening trend in aluminum prices, as well as news of an agreement to sell its stake in Ma'aden Joint Ventures for $1.1 billion.

Alcoa Corporation is one of the largest producers of aluminum products in the US. The company operates in two segments: Aluminum and Alumina, which includes mining, refining, smelting, product manufacturing and metal recycling. The company operates in nine countries on six continents.

According to media reports, there was an accident at an alumina refinery owned by Vedanta. The accident occurred due to extreme weather and pressure conditions in the catchment area of a dam at the Lanjigarh plant in India, causing a pond of red mud, a byproduct of the aluminum refining process, to spill onto nearby farmland. The Vedanta refinery supplies two aluminum-producing smelters, hence the problems are creating pressure on the supply of the metal, which is gaining more than 1.6% today.

ALUMINIUM contracts gain more than 1,6% over supply shortage concerns. Source: xStation

ALUMINIUM contracts gain more than 1,6% over supply shortage concerns. Source: xStation

As the price of commodity increases, Alcoa stock price is also gaining. In addition, the company announced Sunday an agreement to sell a 25.1% stake in Ma'aden Joint Ventures. The deal is valued at $1.1 billion, of which Alcoa will receive $150 million in cash, with the rest to be made up of shares in Ma'aden, the other party to the agreement. The company reported a June 30 valuation of the Ma'aden JV package at $545 million.

The transaction simplifies the company's current portfolio, and the additional cash will strengthen the company's liquidity. As part of a broader Ma'aden partnership, Alcoa expects to expand its mining operations in Saudi Arabia.

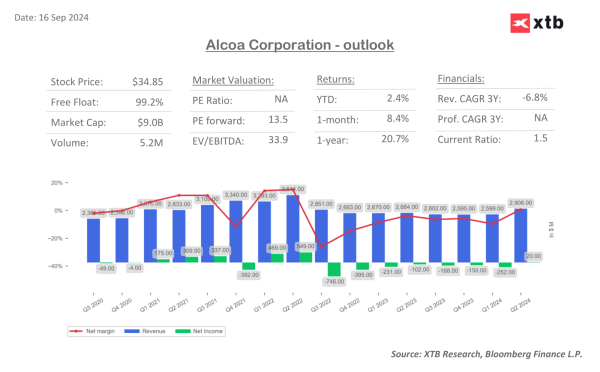

In the latest quarter, the company reported positive net income for the first time since 2022. In addition, the company's revenue rose above expectations to $2.905 billion, breaking a negative trend at the sales level that has lasted for seven quarters.

Alcoa (AA.US) chart (1D)

The company's stock price has been in a strong uptrend for a week. On the chart, we can see a shaping of a double-bottom formation, which implies a theoretical range of increases around $44.9. This is also the level of the 2024 peaks. If the breakout of the exponential moving averages (EMA50 and EMA100 - the dark blue and light blue lines on the chart, respectively) persists in the coming sessions, investors should look to the $37 and $42 levels as resistances on the way to realizing the range of the formation.

Source: xStation