September 2024 ECB Preview: Another Cut Coming

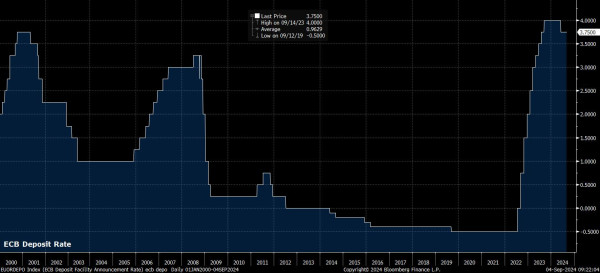

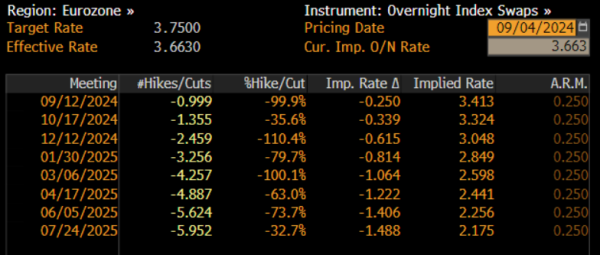

As mentioned, the ECB’s Governing Council are all-but-certain to announce a 25bp cut to the deposit rate at the conclusion of the September meeting. Such a reduction would be the 2nd in three meetings, and take the deposit rate to 3.50%, its lowest level since July 2023. Money markets, unsurprisingly, fully discount such a move, while the EUR OIS curve also implies a total of around 60bp of easing by the end of the year.

Preview

PreviewWhile that pace does seem a little overly-aggressive, the pricing is broadly in keeping with that of peers, with OIS curves across the G10 space continuing to price a rather rapid pace of policy easing. It would not be surprising to see some modest pushback on this from President Lagarde, owing to the loosening in financial conditions that such a dovish rate path would cause.

On the subject of rates, it is also worth noting that the ECB plan to introduce a new operational framework this month. The framework was announced in March, to allow the eurozone financial system time to adjust, with the principal change – to be implemented on 18th September – the narrowing of the spread between the deposit rate, and the main refinancing rate, from the current 50bp, to a much more modest 15bp. While such a change is technical in nature, it is designed to increase the ECB’s degree of control over short-term rates, while also acting as an attempt to reduce the stigma that is still associated with use of the ECB’s refinancing facilities.

At a broader level, this is part of the ECB’s ongoing efforts to move from a floor-based system of controlling market interest rates, to a ceiling-based one, where reserves within the financial system are less ample. Over time, this is likely to also see an increase in the usage of the ECB’s various refinancing operations, particularly as the balance sheet continues to shrink.

As noted, these changes are all to do with the plumbing of the financial system, and shouldn’t have any significant near-term policy impact. On the policy front, in conjunction with the aforementioned 25bp rate cut, the Governing Council are likely to broadly stick to the guidance issued after the July meeting – not “pre-committing” to any particular path, and instead following a “data-dependent and meeting-by-meeting approach”. Policymakers will likely also reiterate the three, now-familiar, factors which will influence their thinking, namely, an assessment of the inflation outlook; the dynamics of underlying inflation; and, the strength of policy transmission.

Preview

PreviewMeanwhile, the September ECB meeting will also see the release of the latest round of staff macroeconomic projections, as is customary.

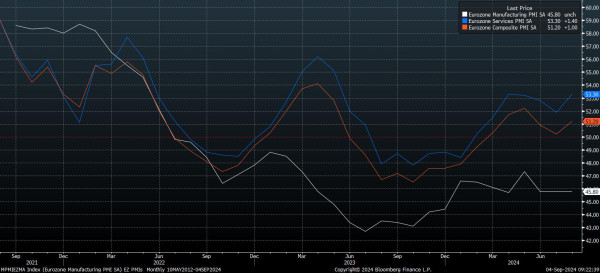

On the growth side, June’s 0.9% 2024 GDP growth projection continues to look rather over-ambitious, given the rather uninspiring performance of the eurozone economy of late, and continued significant downside risks with which the bloc must contend.

The most recent round of PMI surveys did show a marginal pick-up in overall output, with the composite gauge rising to 51.2, its highest level since May, though the manufacturing sector continues to contract at a rather rapid rate, and notable weakness in Germany – the eurozone’s economic engine – persists. This weakness, which is increasingly looking structural in nature, as flagged by the ECB’s hawks of late, is one of numerous downside risks that the bloc continues to battle. These include continued heightened geopolitical tensions, namely in the Middle East, and Ukraine, as well as China’s continued sub-par economic performance, with a debt-deflation spiral becoming ever-deeper.

Consequently, a downward revision to this year’s GDP forecast seems likely, while the balance of risks also points towards a downward revision to the 2025 and 2026 projections.

Preview

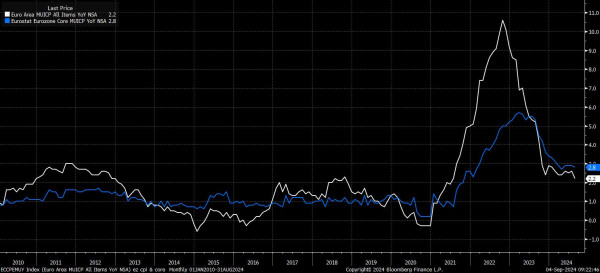

PreviewMeanwhile, on inflation, the ECB’s June projections assumed that the 2% headline inflation aim would be achieved in the fourth quarter of 2025, three months later than had been foreseen in the March forecast round.

Since the June forecasts, inflation developments within the eurozone have been somewhat mixed. Headline inflation has continued to decline, falling to 2.2% YoY in August, a 3-year low. This fall, however, was driven in large part by a fall in energy prices, with measures of underlying inflationary pressures painting a somewhat less optimistic picture. Core CPI, for instance, dipped just 0.1pp to 2.8% YoY, while services inflation ticked higher to 4.2% YoY, likely of concern to some of the Governing Council’s more hawkish members, particularly with earnings pressures remaining relatively intense within some of the eurozone’s larger economies.

Taking into account the overall balance of risks, it seems plausible that HICP projections remain unchanged across the forecast horizon, though recent progress back towards the inflation target will please Governing Council members.

Preview

PreviewBesides the forecasts, market participants will also pay close attention to President Lagarde’s post-meeting press conference. In keeping with the policy statement, Lagarde is unlikely to offer any pre-commitment to a set course of policy action, though may offer some modest pushback on the 66bp of total cuts that markets price by year-end, in order to avoid an undesirable loosening in financial conditions.

The other key area of focus during the press conference will be the degree of unanimity among GC members over both a September cut, and the future rate path. Recent ‘sources’ reports have indicated that splits may be emerging among policymakers between the doves, who see risks of a recession rapidly mounting, and the hawks, who believe that the economy is holding up ok, with consumption robust, while viewing lingering issues within the bloc, such as Germany’s ongoing weakness, as more of a structural issue. How a balance is found between these differing views will be of keen interest to participants.

As for potential market reaction to the ECB announcement, near-term implications on the EUR are likely to be relatively limited. This owes to markets already fully discounting a 25bp cut at the September meeting, while also pricing a policy path that is only a touch more dovish than that likely to be delivered by policymakers. Furthermore, the eagerly-anticipated FOMC meeting on 18th September stands as this month’s keynote risk event, with conviction likely to be lacking in advance of Powell & Co.’s decision, likely leaving any post-ECB moves to be relatively knee-jerk in nature.