Smart Investor - ASML earnings: what happened and what to do next?

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks.

ASML earnings leak: What happened and what to do next?

1. What happened?

On October 16, 2024, ASML, the Dutch semiconductor equipment giant, mistakenly published its quarterly earnings report ahead of schedule. While the earnings themselves were in line with expectations, it was the company’s forward-looking guidance that caused shockwaves in the market. ASML lowered its forecasts, citing a slowdown in semiconductor demand and uncertainty in the macroeconomic environment, leading investors to reassess its growth prospects.

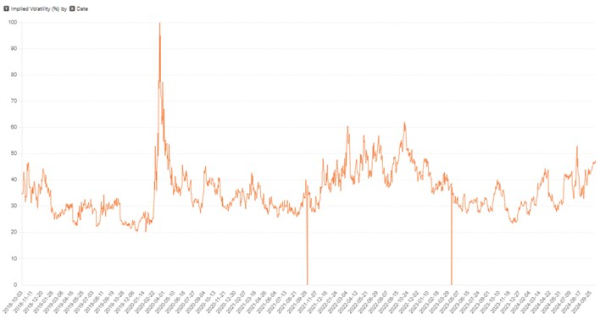

The U.S.-listed shares (ASML ADR) immediately reacted, dropping over 16%. The next morning, when European markets opened, the Dutch listing followed suit, sending many investors into a scramble to manage their positions. With volatility spiking, many clients who sold naked puts or held other options positions on ASML found themselves facing difficult decisions.

For a deeper dive into ASML’s earnings and how this report impacts the company’s long-term outlook, read our colleague's analysis: ASML earnings report – canary in the AI mine.

2. Ok, now what?

In times of sharp market drops, it’s easy to panic and make decisions based on emotion. However, before taking any immediate action, it’s important to assess your situation thoroughly.

Do you need to take immediate action?

If you have received a margin call due to a short put position, you may need to act quickly. Consider whether you have enough capital to cover the margin or if it’s necessary to adjust your positions (such as closing or rolling) to avoid forced liquidation.

For others who aren’t facing urgent margin requirements, take a deep breath. Before panicking, let’s walk through a few key questions that can guide your next steps:

- Has your long-term outlook on ASML changed?

- Do we need to focus on damage control, or is this an opportunity?

3. Evaluate the situation

Has your long-term outlook changed?

The first thing to consider is whether ASML’s long-term investment case is still intact. While the short-term guidance looks concerning, some analysts believe that ASML remains a pivotal player in the semiconductor and AI industries.

In the AI and advanced semiconductor markets, ASML holds a critical position, particularly with its leadership in extreme ultraviolet (EUV) lithography technology. Despite this earnings report, the long-term demand for AI chips and semiconductor technology could still provide substantial growth opportunities.

As highlighted in our colleague's detailed analysis ASML earnings report – canary in the AI mine, while there are immediate headwinds, ASML’s position in the supply chain for advanced AI chips could drive future recovery, even as the company navigates a tough short-term environment.

Damage control vs. opportunity

Depending on your view of ASML’s future, your response may differ:

Damage control: If you believe the company’s prospects have materially worsened, it might be time to manage risk and reduce your exposure to further downside. In this case, rolling options down or closing positions at a loss may be more prudent.

Opportunity: On the other hand, if you see this drop as an overreaction and still believe in ASML’s long-term potential, this could be an opportunity to increase your exposure at a lower price or to manage your options in a way that capitalizes on higher premiums from elevated volatility.

4. Strategy discussion

Once you’ve assessed the situation and your outlook, here are some strategies to consider:

For those who have sold naked puts, there are several paths forward depending on the position. If your puts are still out-of-the-money or have a longer time until expiration, you may prefer to wait and see if the stock recovers. However, if you're in-the-money or at risk of assignment, strategies such as rolling to take advantage of higher premiums, or accepting assignment and selling covered calls, could help manage risk and capitalize on the elevated volatility.

a. Taking assignment

For those who sold naked puts and still have confidence in ASML’s future, accepting assignment could be an attractive option. By accepting the shares at the strike price, you can hold the stock at a lower price while potentially benefiting from a future recovery. After assignment, you can sell covered calls to generate income while holding the stock.

- Take advantage of higher premiums: Due to the recent drop, implied volatility has increased, which could allow you to collect higher premiums on covered calls. Selling covered calls can help you generate additional income while holding the stock during its recovery phase.

b. Rolling down and out

If you’re looking to reduce risk but don’t want to close your position entirely, consider rolling your short puts to a lower strike price and a later expiration. This allows you to avoid immediate assignment while still collecting some premium due to the increased volatility.

- Benefit from elevated volatility: Rolling your puts when implied volatility is high can lead to higher premiums. This means you can collect more income from rolling your option while also adjusting the strike price to better fit your risk tolerance in light of the stock’s current price level.

c. Closing the position

For those who are uncomfortable with the current risk or don’t want to own ASML shares, closing the position may be the best option. Even though this may result in a loss, it allows you to avoid potential assignment and further downside risk if the stock continues to drop.

5. Looking to the future: How to avoid this in other positions?

This sudden drop in ASML is a reminder of how quickly markets can move, even for large, high-quality companies. While it’s impossible to predict or avoid every adverse event, there are key strategies that can help you manage risk and protect your portfolio from future surprises:

Diversification

Diversifying your portfolio across different stocks, sectors, and asset classes can help you mitigate the impact of sudden downturns like this one. Relying too heavily on one stock or industry exposes you to concentrated risk, which can amplify losses during an unexpected event.

Position sizing

Selling naked puts can be an effective strategy in the right conditions, but it’s crucial to manage position sizes carefully. Ensure that no single position is large enough to threaten the overall health of your portfolio. In the case of sharp market moves, like what we’ve seen with ASML, a well-sized position will help keep potential losses manageable.

Volatility awareness and risk-defined strategies

Consider using risk-defined strategies such as put credit spreads rather than naked puts. Spreads can still generate income while capping your maximum risk in case of a market shock. Furthermore, keeping an eye on volatility, especially around earnings or major news events, can help you decide when it’s safer to avoid selling naked options.

6. Closing thoughts

While the short-term drop in ASML’s stock price is unsettling, it’s important to take a measured approach. Evaluate your current positions based on your long-term outlook, and choose a strategy that aligns with your risk tolerance and investment goals.

For a more detailed analysis of ASML’s earnings and long-term prospects, we recommend reading ASML earnings report – canary in the AI mine, which explores the company’s position in the evolving AI and semiconductor sectors.

By staying disciplined and managing risk appropriately, you can navigate this challenging environment and position yourself for long-term success.

| Check out these guides and case studies: |

|---|

| In-depth guide to using long-term options for strategic portfolio management Our specialized resource designed to learn you strategically manage profits and reduce reliance on single (or few) positions within your portfolio using long-term options. This guide is crafted to assist you in understanding and applying long-term options to diversify investments and secure gains while maintaining market exposure. |

| Case study: using covered calls to enhance portfolio performance This case study delves into the covered call strategy, where an investor holds a stock and sells call options to generate premium income. The approach offers a balanced method for generating income and managing risk, with protection against minor declines and capped potential gains. |

| Case study: using protective puts to manage risk This analysis examines the protective put strategy, where an investor owns a stock and buys put options to safeguard against significant declines. Despite the cost of the premium, this approach offers peace of mind and financial protection, making it ideal for risk-averse investors. |

| Case study: using cash-secured puts to acquire stocks at a discount and generate income This review investigates the cash-secured put strategy, where an investor sells put options while holding enough cash to buy the stock if exercised. This method balances income generation with the potential to acquire stocks at a lower cost, appealing to cautious investors. |

| Case study: using collars to balance risk and reward This study focuses on the collar strategy, where an investor owns a stock, buys protective puts, and sells call options to balance risk and reward. This cost-neutral approach, achieved by offsetting the cost of puts with the premiums from calls, provides a safety net and additional income, making it suitable for cautious investors. |

| Previous "Investing with options" articles |

|---|

|

| "Saxo Options Talk" podcast |

|

| Other related articles |

|

| Why options strategies belong in every trader's toolbox |

| Understanding and calculating the expected move of a stock ETF index |

| Understanding Delta - a key guide for Investors and Traders |

|

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Bank's Terms of Use you will find more information on this in the Important Information Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Bank's website.