S&P 500 Momentum Report

Debate for soft landing intensifies

A rough start to the month of August was met with some near-term calm, as resilient US services activities data for July reflected more of a moderation in growth as opposed to one that is in line with a recession. Importantly, services employment marked its first expansion in six months (51.1), which aided to downplay the recent weakness in the US July non-farm payrolls.

That said, a data does not make a trend and the broader growth outlook no doubt remains fragile. A look at the US economic surprise index revealed its lowest level since August 2022, which will leave markets actively seeking out stronger economic data to justify views of a soft landing. With fingers pointing to the rapid unwinding of the yen carry trade as a reason for the recent market sell-off as well, positioning suggests that there could still be room for further rolling back. Either way, volatility seems set to persist ahead, potentially through September if market seasonality is considered.

Nasdaq 100: Buyers defended 200-day MA for now

The Nasdaq 100 has recently found support from an upward trendline at the 17,300 level, with the formation of a daily hammer reflecting some dip-buying in place. For now, buyers have managed to avert any close below the 200-day moving average (MA), which may offer some relief for trend traders. This comes as near-term technical conditions moderates from oversold conditions, while sentiments attempt to stabilise upon touching “extreme fear” territory (CNN Fear and Greed Index).

Further relief could lead the index to retest the 18,920 level, where a resistance confluence may arise from its previous trendline and its lower edge of its daily Ichimoku Cloud. On the downside, any renewed move back to retest its 200-day MA could suggest sellers taking greater control, with any breakdown of the key MA line potentially unlocking fresh pressures towards the 15,900 level next.

Levels:

R2: 20,000

R1: 18,920

S1: 17,300

S2: 15,900

Source: IG charts

S&P 500: Attempt to stabilise from recent rout

Similarly, the S&P 500 is attempting to stabilise from its recent rout as risk sentiments recover. However, a breakdown of an upward channel formation may still be significant, which could leave resistance at the 5,480 level on watch. This is where the previous lower channel trendline will now be looked upon as resistance to overcome.

On the downside, yesterday’s low will be crucial, which stands just inches away from its 200-day MA. That will leave the 5,100 level on watch for defending ahead, as its daily relative strength index (RSI) below the mid-line for the first time since May this year still leave sellers in broad control.

Levels:

R2: 5,480

R1: 5,270

S1: 5,100

S2: 4,946

Source: IG charts

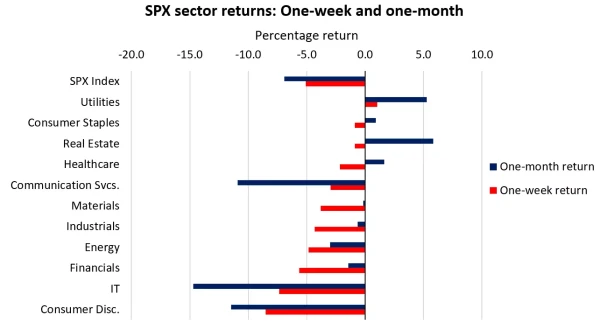

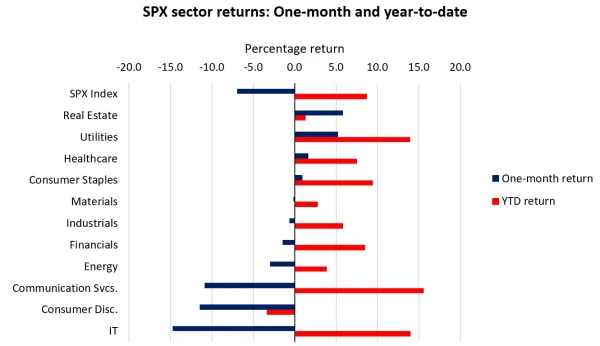

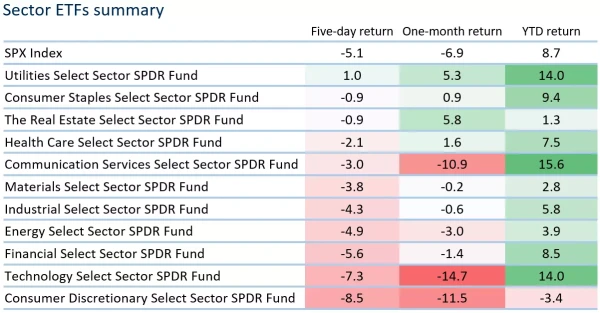

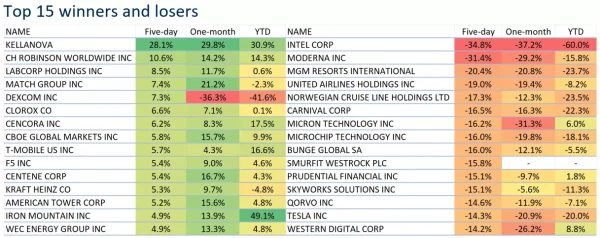

Sector performance

Asset performance over the past week saw a rush to safe-haven assets, as market participants grappled with US recession fears before finding some calm on resilient US services activities. Ten out of 11 S&P 500 sectors were in the red, with a clear lean into the defensive sectors such as utilities, consumer staples and healthcare. The real estate sector registered minor losses as well, with traction for a more aggressive Federal Reserve (Fed) rate easing process offering some cushion. Growth sectors underperformed, with both the technology and consumer discretionary sectors down more than 7%. Having outperformed the broader market year-to-date, an outsized downside reaction in the megacap tech stocks may be expected with any risk unwinding. Nvidia, Tesla and Amazon was down more than 10% for the week, while Microsoft, Apple and Google was down in the mid-single digit.

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

*Note: The data is from 30th July – 5th August 2024.

Source: Refinitiv

*Note: The data is from 30th July – 5th August 2024.

Source: Refinitiv

*Note: The data is from 30th July – 5th August 2024.