S&P 500 Update: Don’t Be an Uninsured Motorist

How Do You Use the Preferred and Alternate Paths to Your Advantage?

As you probably know, we primarily track the S&P 500 (SPX) using the Elliott Wave Principle (EWP). The EWP allows us to identify the potential paths the market can take based on known patterns, which must adhere to specific price-based rules. Since we cannot predict an uncertain future, the EW can help us identify the most likely path.

Moreover, since financial markets are non-linear, stochastic, and probabilistic, these paths, aka scenarios, are not certainties. That means we identify the most likely path and provide a plausible alternative should the primary path not play out if the price breaks above or below specific EW-based levels.

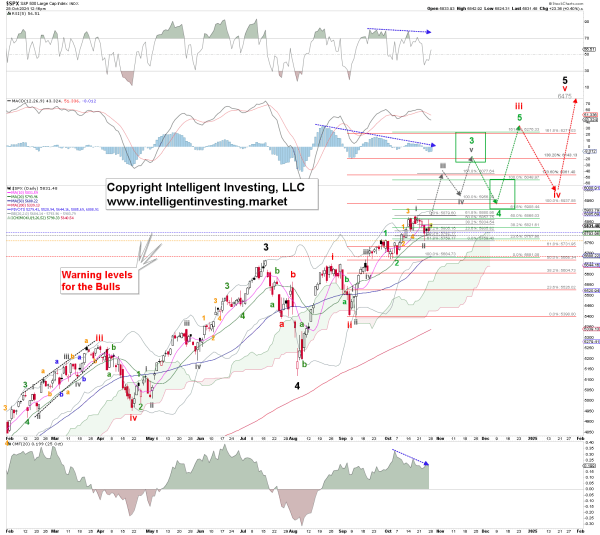

Figure 1 below shows the most likely path we have identified for the SPX, whereas Figure 2 shows the stock market’s possible alternative route. Both ultimately point higher as at least one wave up is still missing from the August 5 low.

Thus, if the index holds above the early October low, our red warning level for the Bulls, we can allow it to follow a more direct path to almost SPX6500. However, a break below last week’s low can trigger the alternative option, which has the index revisit SP5600+/-50 first before rallying again.

Unfortunately, many confuse a preferred and alternative EWP count presentation with, “So, all you’re saying is it can go up and down…” No, not at all. Such statements are a failed understanding of our message and the EWP. Namely, we always trade in the direction of the preferred EWP count and keep the alternative as our “insurance policy” if we speculate wrongly. It’s no different from entering a trade and placing a stop loss. In this case, those stop loss levels are based on the EWP’s invalidation levels and your risk tolerance. Ultimately, we are all speculators—people who guess about something uncertain.

For example, while we continue looking for SP6000+ (see our previous update here), we know there will be pullbacks along the way, which must stay above crucial price levels, such as the October and September lows.

Why “insurance”?

Because just like in your daily life, you also have car insurance, for example. Now, your preferred POV is that you will not get into an accident, and most don’t, but you don’t control that as it’s primarily other drivers who get you in trouble unless you drive like an idiot. The same goes for trading: “Your preferred POV is that you don’t lose money, most don’t, but you don’t control the markets and why you have to have stops.”

Meanwhile, we all know but ignore it when we get behind the wheel, and that is the fact that ~50,000 people die in car accidents each year in the USA. Hence, even something as mundane as driving a car is not without risk. So, while we hopefully never have to use our car insurance (but most will, from minor scratches and chipped windows to totaling your car), we must have one, just in case.

The same goes for speculating, of course. There’s no guarantee that there will only be winning trades. But, somehow, we think there is, even though we know many speculators, especially beginners, who lose most (all) their money in trading. Thus, since we don’t control the markets, we must have insurance (price level) to minimize our losses. Our analysis is that insurance, the monthly fee you pay for that, is your insurance premium. Once you see it that way, you understand why trading uninsured is not intelligent when speculating. And that is why we always sign off with “Trade safely!”