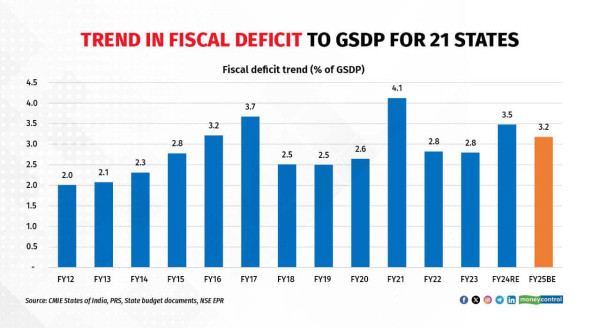

States to reduce fiscal deficit to 3.2% in FY25

Much like the Centre, states are likely to continue down the path of fiscal consolidation with 21 states targeting to reduce the combined fiscal deficit to 3.2 percent in FY25 from 3.5 percent in the previous year, according to a study by the National Stock Exchange.

However, despite the combined fiscal deficit of 21 states will likely be higher than the Finance Commission's target of 3 percent. FY25 is going to be the second year when the fiscal deficit breaches the 3 percent target set by the Finance Commission.

The combined fiscal deficit of centre and states was high in FY24RE at 8.6 percent. Ratings agencies have indicated that India needs to reduce the fiscal deficit to below 7 percent for a rating upgrade, as its combined deficit ratios hover higher than comparable economies.

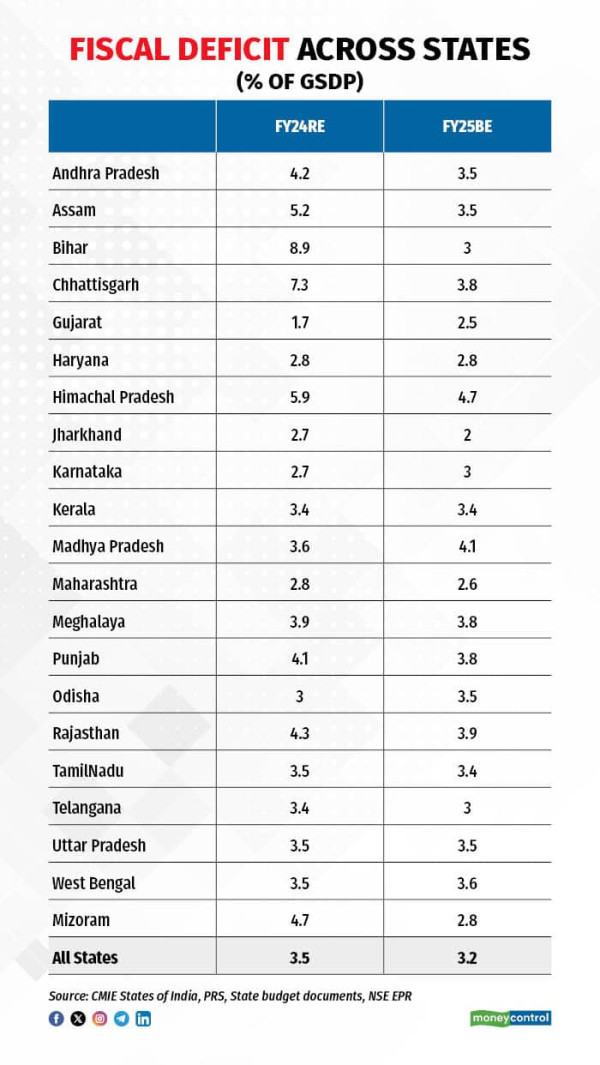

Among the states, Himachal Pradesh will have the highest fiscal deficit at 4.7 percent of the GSDP, while Jharkhand has budget the lowest at 2 percent. 13 of the 21 states have a higher deficit compared the recommended target.

Out of the 21 states, 16 have budgeted lower deficits compared to the previous year, with Bihar and Chhattisgarh leading the pack. On the other hand, Gujarat budgeted the highest increase, up 76 basis points to 2.5 percent for FY25BE.

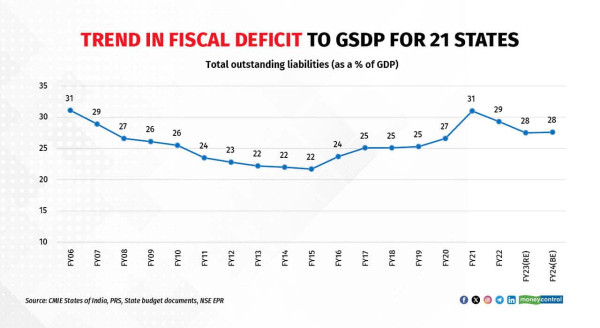

State liabilities above pre-COVID levels

The overall liabilities of the 21 states have remained flat at 27.6% in FY24, moderating after scaling a high of 31 percent in FY21. Out of the 21 states, Odisha, Gujarat and Maharashtra have the lowest share of outstanding liabilities to GSDP while Punjab, Himachal Pradesh, Meghalaya, West Bengal and Bihar have the highest.

Compared to the 36 percent jump in gross market borrowings of 21 states during FY24, which resulted in a higher fiscal deficit, the current year will see a rise of 7 percent. While Karnataka and Madhya Pradesh will see a jump of 25.7 percent and 27.4 percent, Maharashtra has estimated a decline to Rs 1.08 lakh crore.

"Interestingly, the progress in the fall in the aggregate share continues to be gradual and it remains notably higher than the pre-COVID level of 25.3 percent in FY19. In absolute terms, the aggregate outstanding liabilities continue to increase in double-digits, barring FY12 and FY23, broadly led by higher state development loans, which account for two-thirds of the outstanding liabilities (vs. 32 percent in FY11)," said the NSE study.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.