Stocks Face Increased Uncertainty Ahead of Earnings

Investors are anticipating more quarterly earnings reports, with Tesla’s (TSLA) release in focus after today’s session. The S&P 500 index is likely to open 0.3% lower, extending its short-term consolidation.

Despite more advances of the stock market, investor sentiment slightly worsened last week, as shown by last Wednesday’s AAII Investor Sentiment Survey, which reported that 45.5% of individual investors are bullish, while 25.4% of them are bearish, up from 20.6% last week.

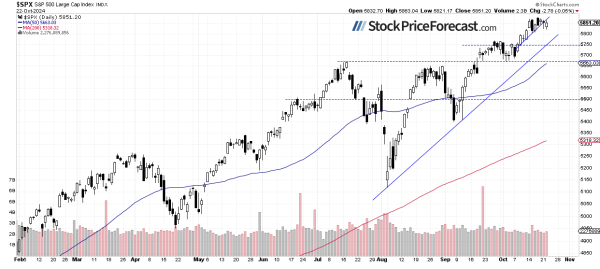

The S&P 500 continues to trade sideways, remaining close to its record high, as we can see on the daily chart.

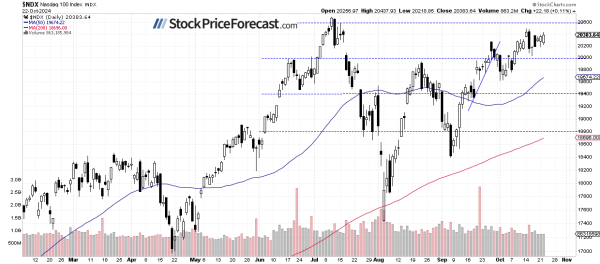

Nasdaq 100: Moving Sideways

The Nasdaq 100 gained 0.11% on Tuesday, continuing its short-term consolidation above the 20,000 level, though still below the record high of 20,690.97 set on July 10.

Last Tuesday, I wrote that “tech stocks may experience a period of uncertainty as investors await quarterly earnings and future outlooks.” That still holds true.

VIX Remains Below 20

On September 6, the VIX index, a measure of market fear, reached a local high of 23.76. On September 26, it fell to 14.90 as stock prices were advancing toward new record highs. Recently, the VIX has been fluctuating around the 20 level, and last Friday, it moved towards 18, signalling less fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures Contract: Below 5,900

The S&P 500 futures contract keeps moving sideways, remaining slightly below the 5,900 level. The support level is at 5,850, marked by short-term lows, while resistance remains at 5,900-5,925.

Conclusion

Stock prices are expected to open slightly lower this morning. The S&P 500 index continues to fluctuate as investors await important quarterly earnings releases, including Tesla’s (TSLA) report later today.

The key question remains: is this a topping pattern or just a consolidation before another leg up? For now, it looks like a consolidation and a flat correction of the record-breaking rally.

For now, my short-term outlook is neutral.

I think that no positions are justified from the risk/reward point of view.

And if you’re not yet on our free mailing list, I strongly encourage you to join it – you’ll stay up-to-date with our free analyses that will still put you ahead of 99% of investors that don’t have access to this information. Join our free stock newsletter today.