Stocks Go from Oversold to Overbought – What a Year!

At MAPsignals we study the Big Money flows.

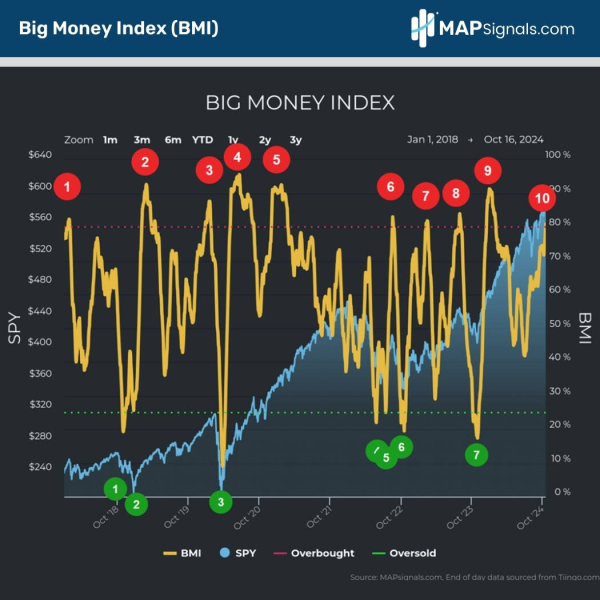

One way we do it is with the Big Money Index (BMI). The BMI is produced by our proprietary data and algorithms. They identify Big Money signals. The BMI is a 25-day moving average of those signals netted, with the ultimate output being a ratio of buys to sells.

When the BMI is between 0% and 25%, selling is rampant. These rare periods don’t last long and tend to precede broad market rallies. It’s one of the most powerful risk-on signals you’ll find.

At the other extreme, a BMI above 80% means we’ve entered a period of runaway buying. Periods like this can last longer – 22 days on average, but sometimes 80 days or more – and come before pullbacks.

Stocks Go from Oversold to Overbought – What a Year!

One year ago, extreme oversold conditions ignited a rally for the ages. Today, stocks are in the rare overbought zone.

Stocks go from oversold to overbought – what a year!

For those keeping score, both the S&P 500 (represented by the exchange-traded fund SPDR S&P 500 ETF Trust (SPY)) and Nasdaq 100 (represented by the Invesco QQQ Trust (QQQ)) are both up 35% since.

But now stocks are overbought. Since 2018, the BMI has produced seven oversold readings and 10 overbought readings:

The BMI has gone from oversold (point seven above) to overbought for a second time (point 10 above) in a year. Again, the market rose 35% in that time.

When The Tide Goes Out, Equity Prices Fall

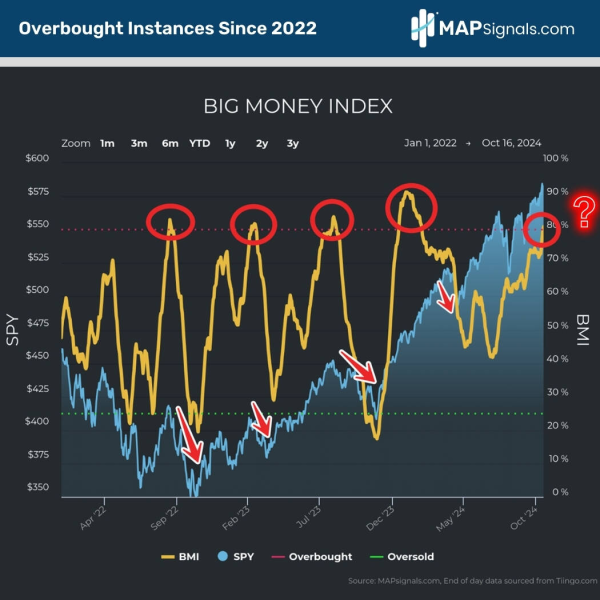

But what happens now?

Once the BMI drops – and it will eventually – dips tend to occur:

It’s simple: when the tide goes out, equity prices fall.

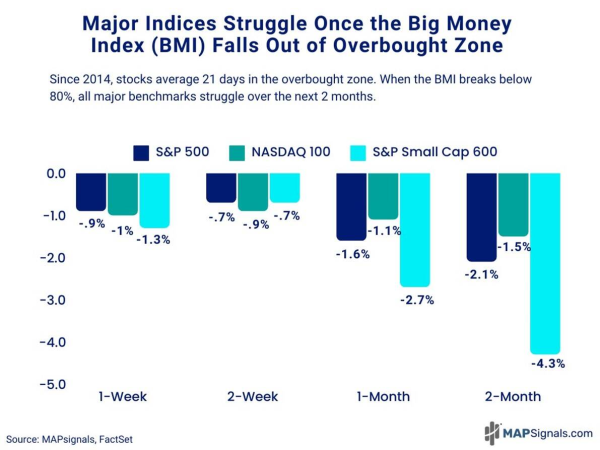

In fact, large- and small-cap stocks (represented by the iShares Core S&P Small-Cap ETF (IJR)) are negative on average up to two months after the BMI leaves overbought territory:

The chart above will come in handy once the BMI signals the bid for stocks is fading. Keep it close so you can keep your mind focused on the long-term prize – painful drops are when opportunity arises!

A Buying Opportunity Is Likely Near

Congratulations if you stuck with stocks the past year. An extreme reading (oversold BMI) lit a monster rally.

Now we’re in the overbought area.

If you’re new to the MAPsignals process and missed out on the outstanding gains the last year, don’t fret. As I showed in this piece, a buying opportunity is likely near.

You just need a MAP to see it!

Let the BMI be your guide.

Trusting it and the MAPsignals process can show you where the Big Money flows!

If you’re a serious investor, Registered Investment Advisor (RIA), or a money manager looking for hedge-fund quality research, get started with a MAP PRO subscription today.