TAG: EUR

Central banks preview: Fed, ECB and BoE on the radar this week

It’s a busy week ahead for the central bank calendar, with 5 major central banks set to report on their monetary policy. The two-day showdown will be kicked off by the Federal Reserve (Fed) on Wednesday, followed by the European Central Bank (ECB), Bank o...

7 months agoEURSEK: Hits fresh 2024 high at 200-day SMA

EURSEK hits highest level in 2024 Riksbank signals future rate cuts Krona ↓ Vs. most G10 MTD Prices bullish on D1 but RSI overbought Moment of truth at 200-day SMA The EURSEK hijacked our attention on Wednesday after hitting a fresh 2024 high above 11....

6 months agoKey events on April 2: fundamental analysis for beginners

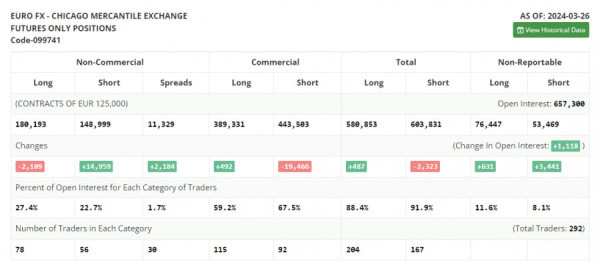

Analysis of macroeconomic reports: There are slightly more macroeconomic events scheduled for Tuesday. However, on Monday, there was the important US ISM Manufacturing PMI data, which triggered a significant decline in both currency pairs. On Tuesday, we...

6 months agoAnalysis and trading tips for EUR/USD on April 2

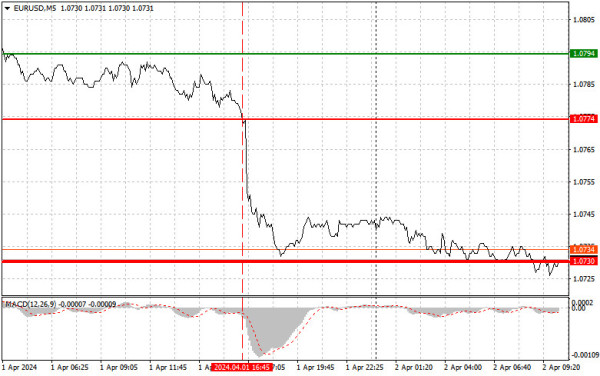

Analysis of transactions and tips for trading EUR/USDFurther decline became limited because the test of 1.0774 occurred during the sharp drop of the MACD line from zero. Strong data on manufacturing activity in the US led to the rise of dollar and decline...

6 months agoEUR/USD: trading plan for European session on April 2. USD picking up steam

Yesterday there were no signals to enter the market. I suggest we look at the 5-minute chart and figure out what happened. In my precious forecast, I paid attention to the level of 1.0769 and planned to make decisions on entering the market from there. A...

6 months agoEUR/USD: trading plan for the US session on April 2nd (analysis of morning deals). Manufacturing activity in the eurozone did not help the euro

In my morning forecast, I drew attention to the level of 1.0744 and planned to make decisions based on it for market entry. Let's look at the 5-minute chart and figure out what happened there. Growth and the formation of a false breakout after the Eurozon...

6 months agoAnalysis and trading tips for EUR/USD on April 2 (US session)

Analysis of transactions and trading tips on EUR/USDNo price tests occurred in the pair due to low market volatility. Nevertheless, euro rose after the release of manufacturing activity data of eurozone countries, even though the indicators did not report...

6 months agoOverview of the EUR/USD pair. April 2nd. ECB may cut rates in 2024 twice as much as the Fed

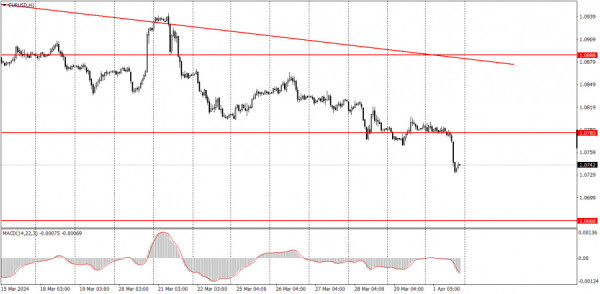

The EUR/USD currency pair traded with low volatility and a slight downward trend for most of Monday. The most significant event on Monday was the ISM Manufacturing Purchasing Managers' Index in the United States, which was released later in the day, but i...

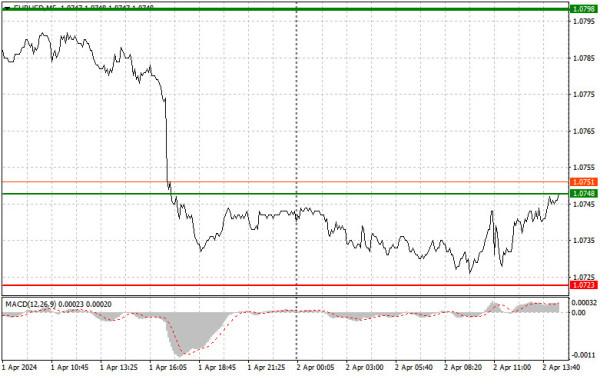

6 months agoEUR/USD and GBP/USD: Technical analysis on April 2

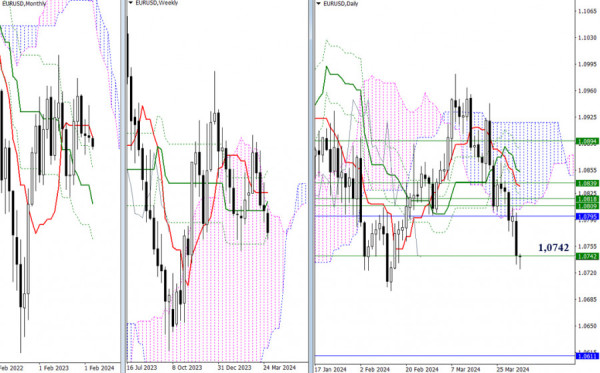

EUR/USDHigher TimeframesYesterday, the bears continued their downward pressure and reached the final support of the weekly Ichimoku cross (1.0742). Breaking the golden cross will open up new prospects for the bearish part of the market. As a result, we ca...

6 months agoUS dollar posts steep gains

On Monday, the euro and the British pound suffered heavy losses against the greenback. This was attributed to objective reasons. Recent data indicated an unexpected surge in US manufacturing activity in March, fueled by a sharp recovery in production and...

6 months agoTrading Signal for EUR/USD for April 2-4, 2024: buy above 1.0742 (0/8 Murray - rebound)

The euro is trading around 1.0747, above 0/8 Murray, and inside the downtrend channel forming since March 8. On the H4 chart, we can see that the euro reached the bottom of the downtrend channel around 1.0720 and from that level, it is bouncing and is lik...

6 months agoAnalysis of EUR/USD. April 2nd. ISM index allowed the market to move in the right direction

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. At the moment, we observe the construction of the presumed wave 3 in 3 or c of the downtrend segment. If this is indeed the case, the decline in quotes will continue for a very...

6 months agoAnalysis of EUR/USD. April 5th. There is still no positive news from the E

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. At the moment, we are observing the construction of the assumed wave 3 in 3 or c of the downward trend section. If this is indeed the case, then the decline in quotes will conti...

6 months agoEUR/USD: trading plan for the US session on April 5th (analysis of morning deals). The euro hit 1.0842

In my morning forecast, I drew attention to the level of 1.0842 and planned to make decisions based on it for market entry. Let's look at the 5-minute chart and figure out what happened there. The rise and formation of a false breakout at this level provi...

6 months ago