TAG: Fundamental Analysis

Key events on April 2: fundamental analysis for beginners

Analysis of macroeconomic reports: There are slightly more macroeconomic events scheduled for Tuesday. However, on Monday, there was the important US ISM Manufacturing PMI data, which triggered a significant decline in both currency pairs. On Tuesday, we...

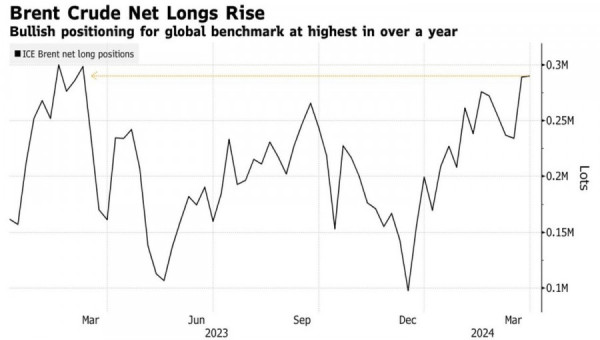

6 months agoOil at $100 per barrel: How soon?

The dam has burst - and the elements can no longer be stopped. After breaking out of the consolidation range of $75-84 per barrel, Brent is growing like wildfire. Since the beginning of the year, the North Sea grade has already gained 14% thanks to increa...

6 months agoXAU/USD: Gold market is building a strong base, hedge funds continue to support prices

According to the latest data from the Commodity Futures Trading Commission (CFTC), as precious metal prices continue their upward trend, the gold market is building a strong base, although bullish speculative interest among hedge funds is gradually slowin...

6 months agoEUR/USD: Why is the dollar rising?

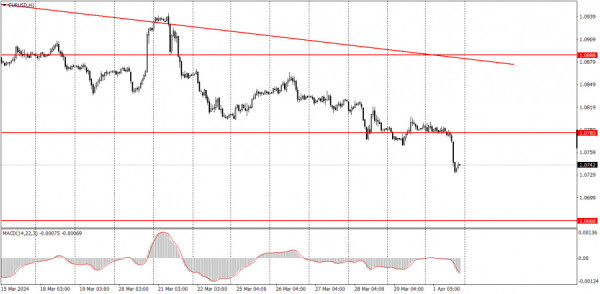

April brought good news for the dollar. At least yesterday's release favored the dollar bulls, allowing the greenback to strengthen its positions across the market. This includes its pair with the euro: the EUR/USD price sharply declined and is currently...

6 months agoOverview of the GBP/USD pair. April 2nd. The British pound continues to ignore the fundamental background

The GBP/USD currency pair on Monday continued to pretend to trade until the release of the ISM index. Inexperienced traders may think that a downward trend has formed in the 4-hour timeframe, but we want to note that this is not the case. First, switch to...

6 months agoOverview of the EUR/USD pair. April 2nd. ECB may cut rates in 2024 twice as much as the Fed

The EUR/USD currency pair traded with low volatility and a slight downward trend for most of Monday. The most significant event on Monday was the ISM Manufacturing Purchasing Managers' Index in the United States, which was released later in the day, but i...

6 months agoUS dollar posts steep gains

On Monday, the euro and the British pound suffered heavy losses against the greenback. This was attributed to objective reasons. Recent data indicated an unexpected surge in US manufacturing activity in March, fueled by a sharp recovery in production and...

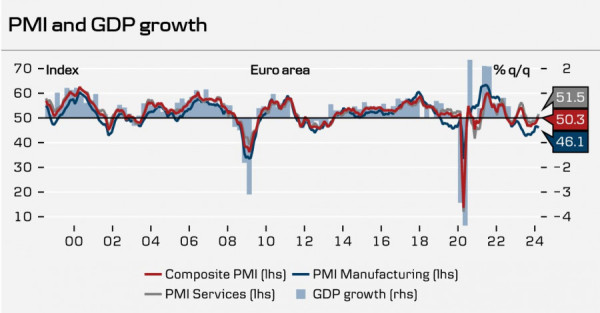

6 months agoEUR/USD: ECB may get ahead of the Fed

From the European Central Bank, signals of a dovish nature are increasingly emerging, indicating that the regulator will begin lowering interest rates at the June meeting. The latest reports on CPI growth for March, reflecting a slowdown in inflation both...

6 months agoWhat to expect for the pound next week?

The pound remains within the horizontal part of the trend, which is not actually a trend. I would like to remind you that currently, a downward wave set is still being formed. It is assumed that the wave 2 or b is, but it could also take on a more prolong...

6 months agoWhat to expect for the dollar next week?

The dollar missed plenty of opportunities to strengthen against the euro and the pound. Fortunately, the greenback will have another chance next week. On Wednesday, the U.S. will release its inflation report for March, and there's a good chance that it wi...

6 months agoWhat to expect for the euro next week?

We just saw strong U.S. data and a very weak reaction from the market. I want to highlight that the demand for the U.S. currency was supposed to increase much more strongly, but throughout the week, the market was more focused on selling the dollar than b...

6 months agoOverview of the EUR/USD pair on April 8, 2024

The EUR/USD currency pair attempted to resume its downward movement on Friday but failed to establish itself even below the moving average. All the necessary information was present, but the pair traded strangely and illogically throughout the past week....

6 months agoOverview of the GBP/USD pair. April 8th. US inflation may present a new unpleasant surprise

The GBP/USD currency pair also showed illogical and unjustified movements on Friday. It may seem that the downward trend in the pound is still intact, but this is not the case. Just switch to the 24-hour timeframe, where a 4-month flat is clearly visible....

6 months agoEuro could tumble after ECB meeting

Inflation in the euro area fell to 2.44% year-on-year in March, with price growth in the services sector slowing to 4%. Core inflation also declined due to a sharp slowdown in food price growth to 2.7% on an annual basis. According to the ECB, rising core...

6 months ago