TAG: USDJPY

USDJPY | Analysis: Consolidation Watch & Shocking US Employment Data | Forex

Hello traders, thank you for joining us for today’s update. Let’s dive into the latest on the USDJPY. Following surprising US employment data last Friday, the USDJPY saw a boost. Now, we’re curious if this momentum will persist. Currently, the price remai...

7 months agoUSDJPY | Daily Chart | Deciphering Consolidation Patterns, BOJ Dynamics, and Market Trends | FOREX

Hi, traders; thanks for tuning in for today’s update. Today, we are looking at the USDJPY on the daily chart. Simple story today: will the current price consolidation break higher (with trend) or break lower, setting off distribution? We find it’s impo...

6 months agoUSDJPY Softens As Intervention Risks Grow

Intervention ChatterUSDJPY is reversing heavily today following further comments from Japanese officials after the Yen weakened to its lowest level against USD in 34 years. After hitting 151.97, Japanese Fin Min Shunichi Suzuki warned that authorities wou...

6 months agoBitcoin Price Forecast: Potential Correction Ahead

The price of Bitcoin has formed a false breakout at the level of 68998, confirming the bullish trap. This means that the price of the asset is likely to undergo a correction soon. So, let’s observe whether it is going to happen.Currently, the asset’s pric...

6 months agoAnalysis and trading tips for USD/JPY on April 2

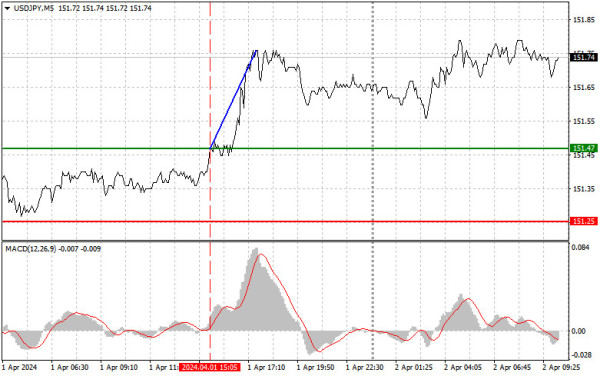

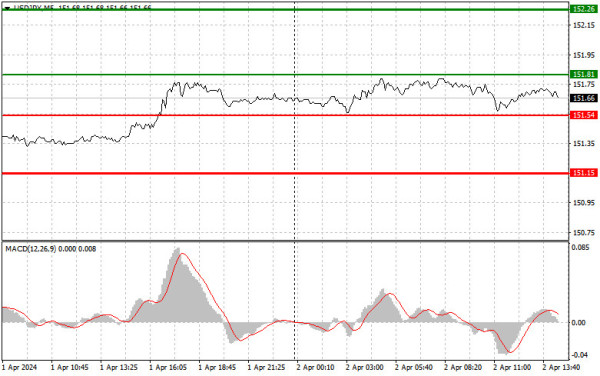

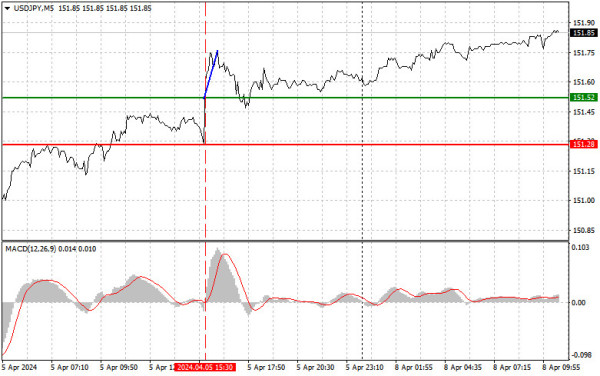

Analysis of transactions and tips for trading USD/JPYThe test of 151.47, coinciding with the rise of the MACD line from zero, provoked a buy signal that led to a price increase of around 30 pips.Strong manufacturing activity in the US let buyers break out...

6 months agoAnalysis and trading tips for USD/JPY on April 2 (US session)

Analysis of transactions and trading tips on USD/JPYNo price tests occurred in the pair. FOMC members will speak today, and their position may help dollar and resume the upward movement, which stalled around the yearly high. Data on manufacturing orders,...

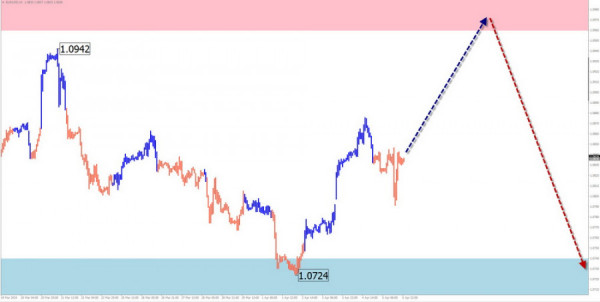

6 months agoTrading Signal for EUR/USD for April 2-4, 2024: buy above 1.0742 (0/8 Murray - rebound)

The euro is trading around 1.0747, above 0/8 Murray, and inside the downtrend channel forming since March 8. On the H4 chart, we can see that the euro reached the bottom of the downtrend channel around 1.0720 and from that level, it is bouncing and is lik...

6 months agoUSDJPY Holds Near Highs Despite Hawkish BOJ Comments

BOJ Tightening ExpectationsUSDJPY has recovered off the day’s lows with the pair trading back in the green now ahead of key US labour market readings due later today. JPY had been stronger initially on comments today from BOJ governor Ueda which appeared...

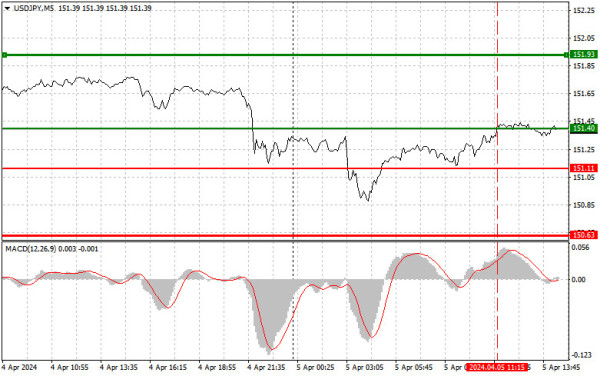

6 months agoAnalysis and trading tips for USD/JPY on April 5 (US session)

Analysis of transactions and trading tips on USD/JPYFurther growth became limited as the test of 151.40 coincided with the sharp rise of the MACD line from zero.Dollar bulls took advantage of the morning dip, but everything could change upon the release o...

6 months agoTrading Signals for GOLD (XAU/USD) for April 8-10, 2024: sell below $2,350 (6/8 Murray - overbought)

Gold reached a new high around 2,354.14 during the European session. Since the market opened this week around 2,323 due to strong volatility and low liquidity, gold rose in a few hours to 2,254.Although Friday's Non-Farm Payrolls data was favorable for th...

6 months agoWeekly forecast based on simplified wave analysis of EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold

EUR/USDAnalysis:On the chart of the European currency, the direction of price fluctuations since September of last year sets a descending wave algorithm. The wave structure forms a horizontal corrective plane. Extremes on the chart create a "pennant" patt...

6 months agoAnalysis and trading tips for USD/JPY on April 8

Analysis of transactions and tips for trading USD/JPYThe test of 151.52, coinciding with the rise of the MACD line from zero, provoked a buy signal that led to a price increase of around 25 pips. Dollar's consolidation above the level of 151.50 indicates...

6 months agoTrading Signals for EUR/USD for April 8-10, 2024: buy above 1.0833 (3/8 Murray - 21 SMA)

EUR/USD is trading around 1.0832, within the downtrend channel formed on the H1 chart, and around the 21 SMA. We can see that the euro is above the 200 EMA. It means that there could be a sharp break of this channel and EUR/USD could continue its rise and...

6 months agoTrading Signals for GBP/USD for April 8-10, 2024: buy if breaks 1.2634 (3/8 Murray - symmetrical triangle)

The British pound is trading around 1.2625, consolidating for several hours around this area and forming a symmetrical triangle pattern. This pattern could give us a clear signal in case of a breakout.If this scenario occurs, we could look for opportuniti...

6 months ago