Tech rally turns to selloff ahead of NFP and US election - Stock Markets

- S&P 500 headed for second weekly dip as gains turn to losses

- Nasdaq pulls back from record highs as AI jitters return

- Apple earnings add to outlook worries but Amazon impresses

Tech rally stumbles

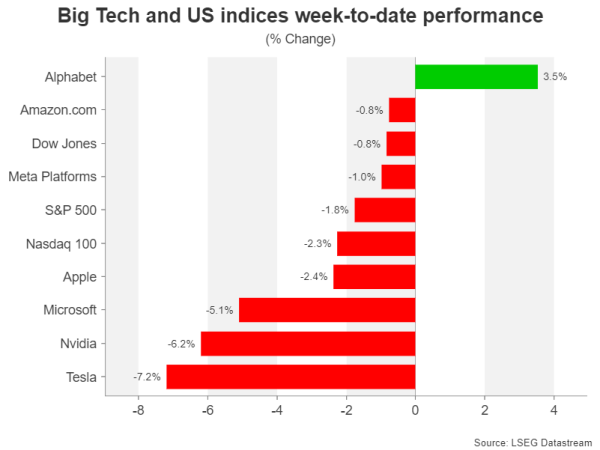

It’s been a turbulent week for Wall Street as, despite a positive start, renewed concerns about excessive spending on artificial intelligence (AI) dragged Big Tech stocks lower mid-week. Alphabet set a bullish tone after it reported stellar Q3 earnings on Tuesday, sending its stock up by almost 3%.

However, although Microsoft and Facebook parent, Meta Platforms, did not disappoint either when they posted strong results on Wednesday, investors’ reaction couldn’t be more different. Microsoft tumbled by just over 6.0% and Meta slid by 4.1%.

Microsoft’s earnings call sparked fears that the boost to revenue growth from AI may already be waning after the company issued underwhelming guidance for its cloud unit for the current quarter. For Meta Platforms, it was Zuckerberg’s warning that the company will “continue to require serious infrastructure” with respect to AI investment that spooked markets.

Apple fails to impress but Amazon bucks the trend

Apple appears to be following in the same direction as its share price slipped by around 1% in after-hours trading after the company said that sales growth for the crucial holiday quarter is expected to be in the “low to mid-single-digit” region. The cautious guidance overshadowed the record revenue that Apple recorded for the third quarter amid better-than-expected demand for its iPhone 16 series. Investors are likely worried by the decline in sales in China.

There was some relief from Amazon.com’s earnings, however, as the company posted an 11% jump in Q3 revenue compared to a year ago, driven by strong growth in its cloud unit. The company was also upbeat about the current quarter. Its shares surged by over 6% after the closing bell.

Should Amazon’s cheer spread to the broader market, the major US indices might just manage to trim their weekly losses. The S&P 500 is down by 1.8% so far this week, while the Nasdaq 100 has lost 2.3%. However, any last-minute rebound on Wall Street on Friday will depend on the October jobs report that’s due later in the day, as that will set expectations for the FOMC meeting.

Earnings in Q3 slowdown

On the whole, Q3 earnings growth is coming in at the lower end of estimates. According to FacSet, of the S&P 500 companies that have reported their earnings, 75% have beaten their earnings per share estimates. Nevertheless, annual earnings growth for the entire quarter is projected at just 3.6%, which would be the lowest since the second quarter of 2023.

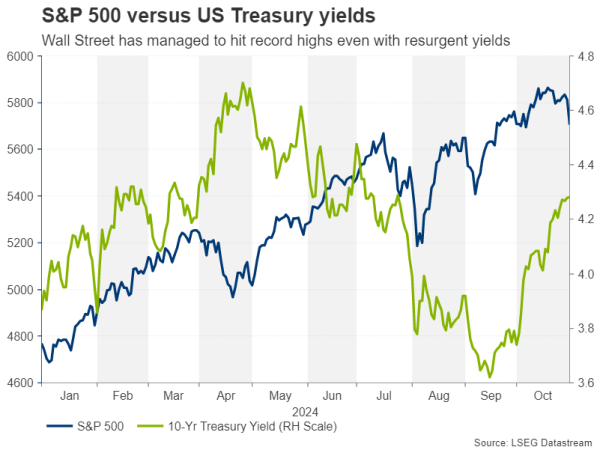

Adding to the growing pessimism over the earnings outlook is the uncertainty about the US presidential election as well as the pace of Fed rate cuts. Trump’s recent gains in opinion polls has pushed Treasury yields sharply higher on the expectation that a Trump presidency will enact inflationary policies.

Wall Street fights off risks, but maybe not for long

The effect on yields from election risks is likely being exacerbated by the continued upside surprises in US data. Even if there are no election upsets for the Democrats and Kamala Harris becomes the next president of the United States, the Fed might not be able to deliver as many rate cuts as currently priced in right now.

For the moment, though, rate cut odds are stable and this might be one reason why the stock market has been largely ignoring the rise in yields. It might not stay that way, however, as the outcome of both the US election on November 5 and the Fed decision on November 7 will be vital in determining Wall Street’s next direction.