Technical Analysis – AUDJPY stalls near 50-SMA ahead of RBA rate decision

AUDJPY pauses recovery phase around 50-day SMA

Risk skewed to the upside; major resistance near 100

RBA policy announcement due on Tuesday at 04:30 GMT

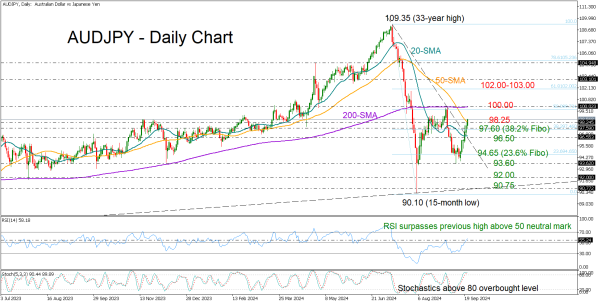

AUDJPY has been pushing for a close above its 50-day simple moving average (SMA) at 98.25 since Friday. The pair is encountering a sense of déjà vu from July when the same line led to a bearish continuation, but this time the bulls may have luck on their side.

With the RSI surpassing its previous high above its 50 neutral mark, there might be sufficient buying appetite for an extension towards the critical flattening 200-day SMA at 100, which ceased the bounce off the 15-month low of 90.10 at the start of the month. The area overlaps with the 50% Fibonacci retracement of July’s freefall, a break of which could confirm an extension towards the 102.00-103.00 region.

If the bears return, the 38.2% Fibonacci mark at 97.60 and the 20-day SMA might prevent a decline towards the 23.6% Fibonacci of 94.65. Should the floor at 93.60 crack too, the sell-off might expand towards the tentative ascending line, which connects the 2023 and 2024 lows, seen near 90.75, unless the former barrier around 92.00 comes to the rescue this time.

Summing up, AUDJPY bulls could stay active as the technical signals remain positive. For an outlook upgrade, the pair must find new buyers above 100.00.