Technical Analysis – AUDUSD bounces off 0.6700 but looks weak

AUDUSD flirts with weekly downtrend line

Stochastics create bullish cross

But RSI holds near neutral level

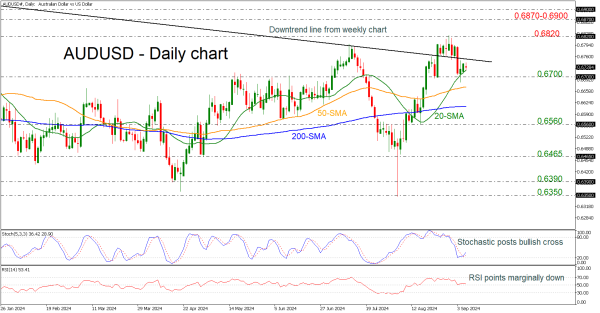

AUDUSD has reversed to the upside after the rebound off the 0.6700 round number with strong barrier coming from the weekly descending trend line around 0.6750. Over the last couple of weeks, the market has been developing back and forth of the aforementioned diagonal line, looking weak to change the outlook to a more positive one.

Technically, the stochastic oscillator posted a bullish crossover within its %K and %D lines above the oversold region; however, the RSI is heading down mirroring the latest red candle.

In case of another run above the 0.6750 level, then the market could re-challenge the 0.6820 resistance ahead of the restrictive region of 0.6870-0.6900.

On the flip side, a closing session beneath the 0.6700 mark could open the door to 50-day simple moving average (SMA) at 0.6670 ahead of the 200-day SMA at 0.6615. The latter level would be another tough obstacle to overcome before hitting the 0.6560 support.

Turning to the medium-term picture, the bearish outlook came back into play after the bridge back to the downside of the descending trend line. A jump above that point would restore the bullish mode. For a bull market though, traders need to wait for a clear close above 0.6900.