Technical Analysis – AUDUSD declines to fresh 2-month low

AUDUSD extends retreat to its lowest since May 1

Oscillators are flagging oversold conditions

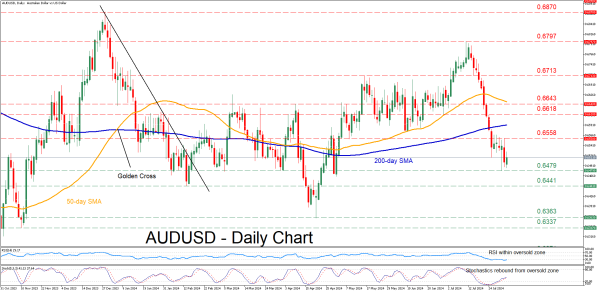

AUDUSD has been in a steady retreat since July 11, violating both its 50- and 200-day simple moving averages (SMAs). Although the pair posted a fresh two-month low on Wednesday, the risk of a bounce to the upside has increased given that the momentum indicators are warning of an overdone decline.

Should bearish pressures persist, the bears may attack the recent two-month bottom of 0.6479. A violation of that zone could open the door for the February low of 0.6441. Failing to halt there, the pair could descend towards its 2024 low of 0.6363.

On the flipside, if the price reverses back higher, initial advances could stall at 0.6558, a region that acted as both support and resistance in recent months. Slicing through that hurdle, the pair could face 0.6618 ahead of the April-May resistance of 0.6643. Higher, attention might shift to the May peak of 0.6713.

In brief, AUDUSD has come under heavy selling pressure in the short term, losing more than 4.5% from its July high. However, the bears should be cautious as the short-term oscillators are signalling oversold conditions.