Technical Analysis – EURJPY stubbornly fights for an upturn

EURJPY remains resilient above pivotal territory

Some recovery likely, but short-term risk not bullish yet

Eurozone Q2 GDP growth +0.3% q/q vs +0.2% q/q expected

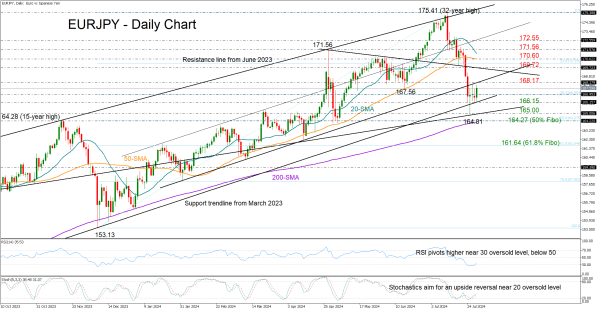

EURJPY is making another attempt to pierce through the 168.00 level and the support-turned-resistance trendline from February at 168.17.

Although previous efforts were fruitless, the pair keeps defending itself above long-term trendlines for the fourth day, and with oversold conditions detected by the technical indicators, there is a possibility of positive outcomes for the bulls.

A close above 168.17 might confirm an extension towards the 169.72 barrier, though only a break beyond the 20- and 50-day simple moving averages (SMAs) and April’s top of 171.56 would brighten the short-term outlook. A continuation higher could halt near the 172.55 territory, where the price got rejected in mid-July. Another success there might clear the way towards July's high of 175.41.

Should selling forces resurface, the price might again seek shelter somewhere between 166.15 and 165.00. The 200-day SMA and the 50% Fibonacci level at 164.27 will be closely monitored too. A breach could lead to a swift decline towards the 61.8% Fibonacci level of 161.65.

As regards the market trend, the pair has charted a lower low below June’s trough of 167.56, raising concerns of a bearish trend reversal as the 20- and 50-day SMAs approach a negative intersection.

To summarize, EURJPY is still exposed to downside risks, but there is a chance of a rebound or consolidation as the pair seems to be emerging from oversold conditions.