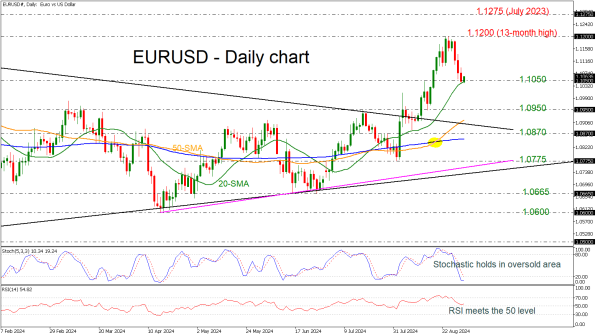

Technical Analysis – EURUSD pauses bearish correction near 1.1050

EURUSD recoups some losses

Finds support near 20-day SMA

Stochastics and RSI point north

EURUSD is recovering somewhat after three consecutive red days from its 13-month high of 1.1200. The price is flirting with the 20-day simple moving average (SMA) and the 1.1050 support level, while the technical oscillators are showing some improvement. The stochastic is trying to tick up in the oversold region, and the RSI is pointing marginally higher above the 50 level.

If the market maintains its upside structure and remains above 1.1050, it may challenge the previous peak of 1.1200. The bulls may even surpass the peak of 1.1275, registered in July 2023.

Alternatively, the next support could come around the 1.0950 barricade ahead of the 50-day SMA, which stands around the descending trend line of 1.0915. Steeper declines could lead the market to the 1.0870 mark before testing the 200-day SMA at 1.0850.

Summarizing, EURUSD is creating a notable bearish correction, but the broader outlook remains bullish in the short- and medium-term timeframes.