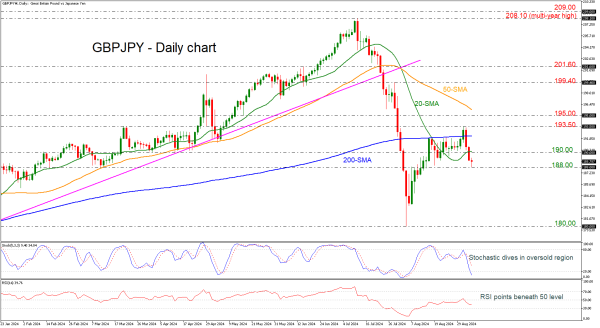

Technical Analysis – GBPJPY continues selling interest below 190.00

GBPJPY stands beneath 200-day SMA

Momentum oscillators look neutral-to-bearish

GBPJPY has been in a considerably descending movement, losing around 3% after it topped at 193.50. The market is currently testing the 188.00 round number with the technical oscillator confirming strong bearish tendency in the short-to-medium-term view. The stochastic plunged into the oversold territory with strong momentum, while the RSI is sloping down below the neutral threshold of 50.

Steeper declines could open the way towards the next support level, which comes from the 180.00 psychological level but first the price may fight with the previous round numbers such as 185.00, 182.00.

On the flip side, a rally above the 190.00 mark and the 20-day simple moving average (SMA) may drive the market towards the 200-day SMA at 192.20. More advances could see the 193.50 top ahead of 195.00.

All in all, GBPJPY is easing again after the notable correction from the eight-month trough of 180.00, remaining in a negative structure.