Technical Analysis – GBPJPY pulls back near uptrend line

GBPJPY correcting lower, but staying above uptrend line

RSI and MACD point to further declines

A rebound above trendline could aim for 208.15

A break below 200.00 could shift the outlook to bearish

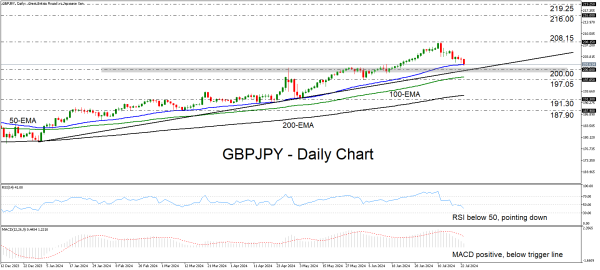

GBPJPY has been correcting lower since July 11, when it hit 208.15, a level last seen back in August 2008. That said, the pair remains above the uptrend line drawn from the low of January 2, currently hovering near the 50-day exponential moving average (EMA).

The RSI and the MACD are suggesting that some further declines may be possible, at least until the uptrend line. The former is lying below its 50 line, pointing south, while the latter, although slightly positive, is running below its trigger line.

If the bulls set their alarms to wake up when the pair tests the uptrend line, then a potential rebound may allow another test near 208.15, the break of which would confirm a higher high and perhaps set the stage for extensions towards the highs of July 2008, at around 216.00.

On the downside, for a bearish reversal to start being examined, GBPJPY may need to drop and close below the round number of 200.00. Such a move would take the action below the aforementioned uptrend line and may initially aim for the 197.05 barrier. Another break lower could see scope for declines towards the 200-day EMA or the 191.30 area.

To recap, GBPJPY has been pulling back lately, but holding above an uptrend line, which keeps the chances of a potential rebound elevated. For the outlook to change, a dip below 200.00 may be needed.