Technical Analysis – GBPUSD loses 3% from 2½-year high

- GBPUSD stops near 1.3100

- Momentum oscillators suggest upside recovery

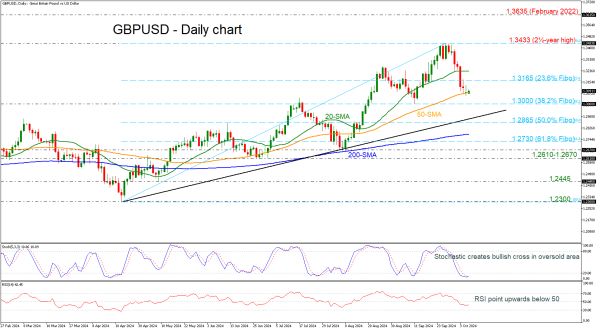

GBPUSD is pausing its downward wave that started from the two-and-a-half-year high of 1.3433, hovering near the 50-day simple moving average (SMA) marginally beneath the 1.3100 round level.

The pair has lost around 3%, with the technical oscillators indicating the end of the southward move. The stochastic posting a bullish crossover within its %K and %D lines in the oversold area and the RSI pointing up beneath the 50 territory.

Should the pair manage to strengthen its positive momentum, the next resistance could come around the 23.6% Fibonacci retracement level of the up leg from 1.2300 to 1.3433 at 1.3165. Slightly higher, the 20-day SMA at 1.3235 is coming next and any break above the 1.3433 top would shift the bias to a more bullish one and open the way towards the February 2022 peak at 1.3635.

However, if prices are unable to break the 23.6% Fibo level in the next few sessions, the risk would shift back to the downside, with the 38.2% Fibonacci at 1.3000, which is a key level for traders, coming into focus. A drop below this mark, would take the market towards the medium-term uptrend line and the 50.0% Fibonacci of 1.3865.

In the bigger picture, the pair is bullish as long as it holds above the 200-day SMA and the ascending trend line. In case it violates these lines, the bears could gain the upper hand.