Technical Analysis – NZDUSD leads the pack as FOMC rate decision looms

NZDUSD bulls retake control; fight for a close above 20-SMA

Short-term bias is positive, but there are more obstacles on the upside

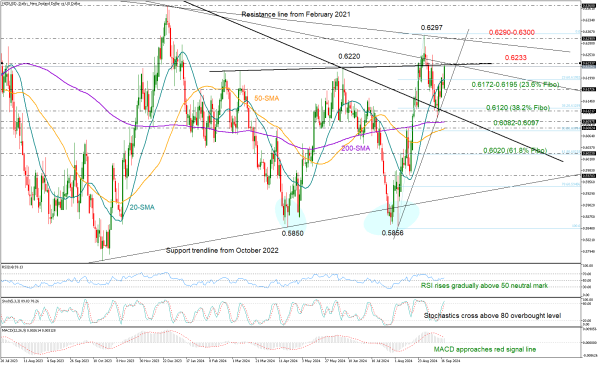

NZDUSD is a top performer today as investors are actively waiting for the Fed’s rate decision. The pair picked up positive momentum above its 20-day simple moving average (SMA) at 0.6195, which has been rejecting bullish actions over the past week. A close above this line might encourage more buying, but investors might need more progress to increase their exposure in the market.

Specifically, a break above the descending line, which connects the February and December 2023 highs at 0.6233, might secure more gains towards the descending line from July 2023 at 0.6290. The 23.6% Fibonacci retracement of the October 2022-February 2023 uptrend is within breathing distance at 0.6300. Hence, a step above it might be necessary for an acceleration towards the December 2023 peak of 0.6368.

If the pair retreats below its 20-day SMA once again, it may immediately pause near the support trendline at 0.6172. A violation there could reach the 38.2% Fibonacci retracement level of the latest upleg at 0.6120 and the long-term falling line from February 2022. If this floor cracks too, the pair could seek shelter somewhere between the 200- and 50-day SMAs. Then, an aggressive sell-off might follow towards the 61.8% Fibonacci of 0.6020.

Technically, the bias is skewed to the upside given the positive slope in the indicators, though with the stochastic oscillator climbing above its 80 overbought level, there is a risk of failure near 0.6233.

Summing up, despite holding a bullish bias, NZDUSD has two more obstacles to overcome at 0.6233 and 0.6300 before its short-term outlook can be upgraded.