Technical Analysis – NZDUSD still bullish but rally looks overstretched

NZDUSD is up almost 5% so far in August

Further gains are likely, but risk of near-term correction is high

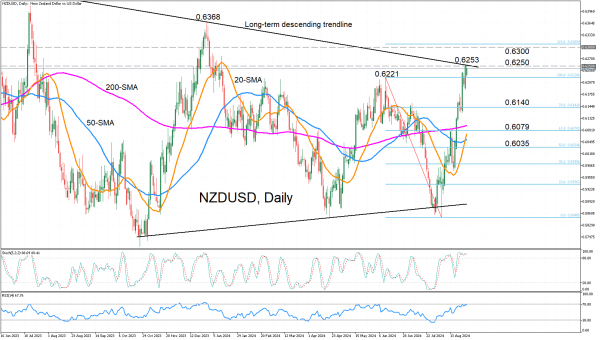

NZDUSD is trading near seven-month highs on Wednesday, as the pair continues its August bull charge. However, there appears to be some resistance in the 0.6250 area where the intersecting long-term descending trendline is providing additional friction.

The technical indicators remain bullish but point to fading positive momentum in the near term. The stochastic oscillator has flatlined in the overbought region, while the RSI is hovering just beneath the 70-overbought mark.

Should the pause in the rally turn into a selloff, NZDUSD could initially slip towards the 78.6% Fibonacci retracement of the June-August downleg at 0.6141. A drop lower would bring the 61.8% Fibonacci of 0.6079 into view. Both the 200- and 20-day simple moving averages (SMA) are also in the vicinity, potentially, making it difficult for the bears to make much progress from hereon.

However, a successful break lower towards the 50% Fibonacci of 0.6035 could mark a shift to a more neutral outlook in the short-to-medium term.

On the other hand, if the price is able to overcome the 0.6250 resistance, the next stop could be the 123.6% Fibonacci extension slightly above 0.6300. Even higher, attention is likely to turn to the December 28, 2023 high of 0.6368.

In brief, NZDUSD’s uptrend has gone from strength-to-strength, but conquering the 0.6250 level will be key to extending the winning streak.