Technical Analysis – US 100 stock index meets familiar support zone

US 100 stock index turns red after all-time high

Downside risks balanced above 20-day EMA

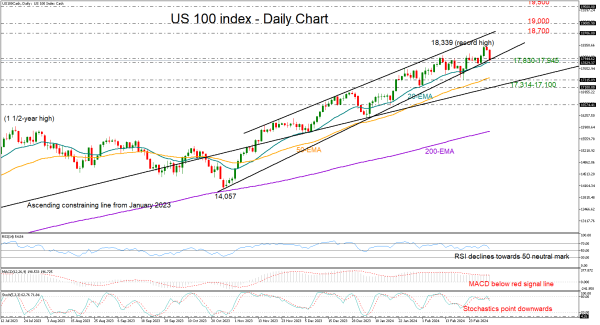

The US 100 stock index (cash) has been in a clear uptrend since October 2023, gaining 28% to pause at a record high of 18,339 on Monday.

The index opened at the back foot on Tuesday, but the bearish move is not a concern yet. Instead, the negative action can be considered part of the upward pattern as long as the price holds above the 17,945 level. Notably, this is where the support trendline from October is placed, while the 20-day exponential moving average (EMA) is within breathing distance too. Hence, an extension below the latter is expected to upset some traders, likely causing a downfall towards the previous low of 17,315 and the 50-day EMA. A continuation lower could meet the constraining ascending line from January 2023 at 17,100, which helped the index to pivot in January 2024.

Alternatively, a bounce on the 17,945 base might renew bullish pressures, although the negative reversal in the technical indicators is favoring the bears at the moment. In this case, the focus could shift back to the resistance line at 18,700, while the 19,000 psychological mark might induce some consolidation before the 19,500 comes in examination.

In brief, the US 100 stock index has switched into corrective mode, with sellers waiting for a close below 17,945 and the 20-day EMA to take the lead.