Technical Analysis – USDCAD bears take a break but are not done yet

USDCAD experiences worst week of the year

Selling pressure might persist; eyes on 1.3730

Canadian employment figures due at 12:30 GMT

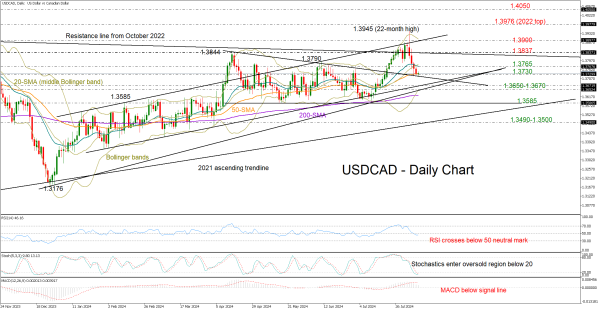

Since reaching a 22-month high of 1.3945, USDCAD has been steadily dropping towards its 50-day SMA at 1.3730, making it the worst-performing week of the year.

The broken resistance trendline drawn from April's peak is now providing support in the market, although there is no certainty of a bullish rotation according to the technical indicators.

Even though the Stochastic oscillator has entered its oversold territory, the negative cycles in the RSI and the MACD seem to be at an early stage, warning that the bearish wave in the price has yet to bottom out. Note that the price is trading comfortably above the lower Bollinger band, endorsing the bearish scenario too.

The next pivot point could develop between the ascending trendlines coming from December 2023 and January 2024 at 1.3670 and 1.3650 respectively. If selling forces breach that floor, the pair could tumble towards the critical 1.3585 base, a break of which would violate the horizontal move from April, likely prompting a fast decline towards the 2021 ascending trendline at 1.3500.

If the pair attracts new buyers around 1.3730, it may encounter resistance near the 20-day SMA at 1.3765. A step higher could face resistance around the constraining line from October 2022 at 1.3837, while higher, the bulls might push towards the 1.3900 barrier.

Summing up, USDCAD could remain under pressure as the bears seem to have the upper hand in the market. A close below 1.3730 might trigger the next downfall.