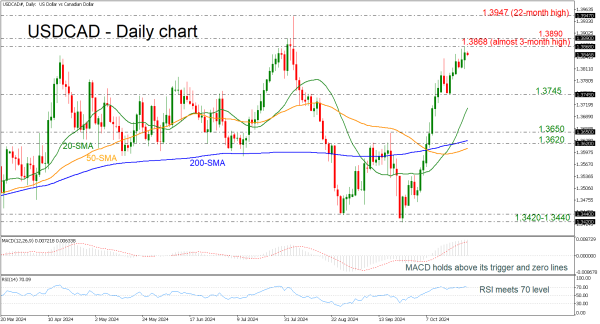

Technical Analysis – USDCAD still near the almost 3-month high

- USDCAD adds 3.4% from 1.3420

- Remains well above the SMAs

- MACD and RSI indicate overbought levels

USDCAD has been creating a notable bullish rally since the bounce off the 1.3420 support level, taking the price to an almost three-month high of 1.3868. The pair added 3.4% on this rally, trying to switch the medium-term outlook to positive.

Technically, the RSI is moving horizontally near the 70 level, while the MACD oscillator is losing some momentum above its trigger and zero lines. Both suggest that the market is overstretched, and a potential bearish correction may be on the cards.

Steeper upside movements may drive the market until the 1.3890 barrier ahead of the 22-month peak of 1.3947.

On the other hand, a downside retracement could first find support at the 1.3475 level before testing the 20-day simple moving average (SMA) at 1.3710. Even lower, the inside swing high of 1.3650, taken from the peak on September 19, may pause the bearish move.

All in all, USDCAD is experiencing aggressive buying interest, and only a dive beneath the 200-day SMA, which lies near the 1.3620 bar, may change the bias to neutral.