Technical Analysis – USDJPY’s decline faces 200-day SMA

USDJPY extends its retreat from recent 38-year high

The bears tested 200-day SMA for first time since January 9

Momentum indicators start to warn of oversold conditions

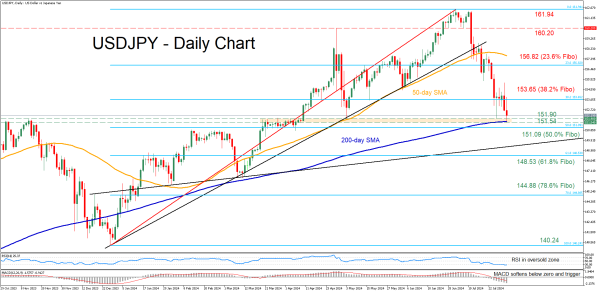

Should bearish pressures persist, the price may face the congested 151.90-151.54, which includes the May low, a June support and the 200-day SMA. Lower, the bears may attack 151.09, which is the 50.0% Fibonacci retracement of the 140.24-161.94 upleg. Further retreats could then cease at the 61.8% Fibo of 148.53.

Alternatively, bullish actions could propel the price towards the 38.2% Fibo of 153.65. Failing to halt there, the pair might advance towards the 23.6% Fibo of 156.82 ahead of the April peak of 160.20. A decisive break above the latter could set the stage for the 38-year high of 161.94.

In brief, USDJPY remains under selling pressure in the short term, while the BoJ’s hike on Wednesday acted as an additional tailwind. That said, a downside violation of the 200-day SMA could signal the start of a trend reversal.