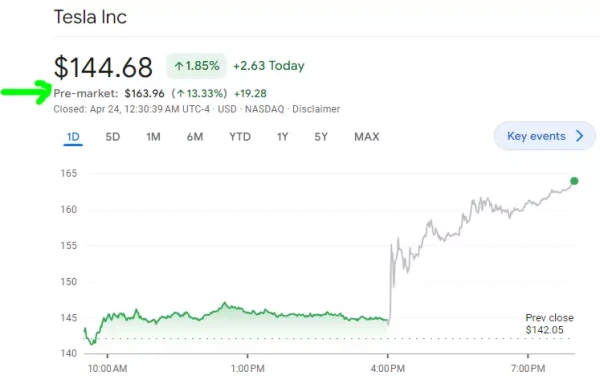

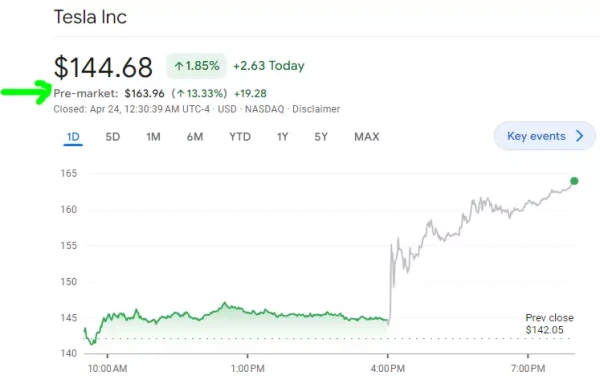

Tesla share price surges after Q1 results

Tesla share price surges after Q1 results

Tesla, the first of the Magnificent 7 to report earnings, surged after it announced plans to build more affordable electric vehicles (EV).

New affordable model plans offset earnings miss

Tesla shares surged in after-hours trading as the electric vehicle maker announced plans to accelerate the launch of new affordable EV models, despite reporting first quarter (Q1) earnings that missed Wall Street estimates.

For the Q1 of 2024, Tesla reported revenue of $21.3 billion, down 9% year-over-year, attributed to reduced vehicle average selling prices and a decline in deliveries. Analysts had expected revenue of $22.15 billion.

Adjusted earnings per share (EPS) came in at $0.45, slightly below the consensus estimate of $0.46.

Investors cheer plans for cheaper models

In a statement accompanying its Q1 2024 earnings report, Tesla said it plans to launch new models, including more affordable EVs, ahead of its previously communicated start of production in the second half of 2025.

"These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up," the company stated.

Cost reduction plans trimmed

Tesla acknowledged that this accelerated timeline "may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times."

Gross margins hit by price cuts

Gross margins at Tesla were 17.4% in Q1, down from 19.3% a year ago, reflecting the impact of the company's repeated price cuts on its vehicles to boost demand.

Tesla stock price: technical analysis

Despite the earnings miss, Tesla shares surged 6.3% to around $153 in after-hours trading following the release of its Q1 report and new EV model launch plans with these now showing a pre-market price of around $164.

Tesla had seen its stock price fall more than 43% so far in 2024 amid concerns about pricing pressure and layoffs prior to the Q1 report.

Tesla weekly candlestick chart

For the July 2023 to April 2024 downtrend to be questioned, a bullish reversal would need to take the Tesla share price to above its late-March high at $184.25 on a weekly chart closing basis. While this is not the case, the Tesla share price remains in a downtrend as a series of lower highs and lows can be made out on the weekly chart.