The big rebound in equities, Palo Alto earnings on tap

Key points

- The Japanese rebound: The recent rebound in Japanese equities follows a market realization that the prior selloff was not justified by economic fundamentals, though potential volatility remains as the Bank of Japan prepares to gradually increase policy rates, creating fragilities in the financial system.

- A new Starbucks CEO: Following the appointment of Brian Niccol as CEO, Starbucks shares surged 26%, but the company faces challenges in revitalizing its brand amid pressure from activist investors and high expectations for Niccol's performance based on his past success at Chipotle.

- Home Depot vs Walmart: Home Depot's disappointing guidance reflects a cautious consumer, while Walmart's strong earnings and raised guidance indicate resilience in necessity spending, suggesting a potential pent-up demand in the discretionary retail sector as interest rates lower.

- European banks: UBS's positive Q2 results signal potential recovery for European banks, which have historically traded at a discount to US banks, with expectations that improved profitability may occur as interest rates stabilize above inflation levels

- The week ahead: Key macroeconomic indicators, including PMI figures and jobless claims, are anticipated, alongside earnings reports from major companies like Palo Alto Networks, which is expected to show resilience in the cybersecurity sector despite broader economic challenges.

Japanese equities have recouped almost all losses from the carry trade blowup

It has been an impressive rebound in equities over the past week as markets quickly realized that the big selloff in Japanese equities and dramatic jump in the VIX Index were not warranted based on economic fundamentals. Japanese equities have almost fully recovered from the losses. We cannot rule out more volatility in Japan as Bank of Japan is forced to slowly hike its policy rate regardless of the implications for financial markets because its policies are creating big fragilities in the Japanese financial system and economy.

Can Starbucks turn around with new CEO?

Starbucks shares are up 26% the past week as the global coffee and food chain announced Chipotle CEO Brian Niccol as its new CEO in a deal that is one of the most lucrative CEO deals in the US. Starbucks has had a flat to lower share price in the five year period before the new CEO announcement as the coffee chain has lost its former vibe among the consumer. The activist investor Elliott has been actively pushing the company to fix its problems and the big question is now whether the new CEO can turn things around.

Brian Niccol has delivered a formidable turnaround at Chipotle so the market is betting he can do the same. It will not be easy and the valuation metrics are not showing low expectations so immediate success might not be possible.

Earnings recap: Home Depot vs Walmart

The earnings season is now in slow motion, but the recent week showed some interesting observations about US retailing. Home Depot, which is big ticket items or discretionary spending, disappointed investors with another guidance cut as the US consumer is holding back. The weakening demand for home improvements might be driven by consumer behaviour changes as the US consumer is waiting for lowering interest rates before deciding on bigger housing projects. Our guess is that there is a rather large pent-up demand waiting in the US discretionary retail sector as soon as interest rates begin to tick lower.

Walmart on the other hand was a strong earnings release as spending on necessities is still keeping pace with inflation. Walmart also raised its guidance and saw a narrower loss in its e-commerce business. Overall, US retail same-store sales is still looking robust in the Redbook time series with around 5% growth rate.

In Europe, strong earnings from Carlsberg and Pandora were the positive highlights whereas renewable energy stocks such as Vestas and Orsted disappointed yet again in a blow to the green transformation from an investor point of view.

Can European banks close the discount gap?

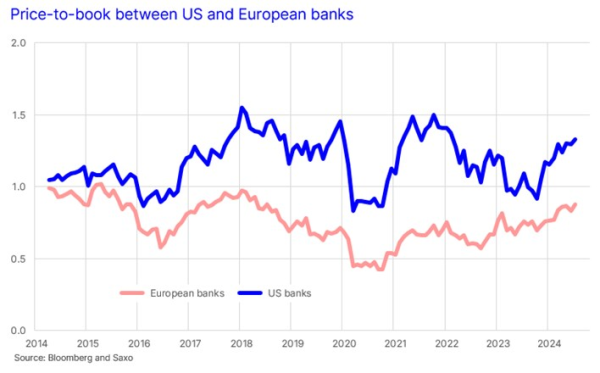

UBS reported strong Q2 results and guided a return to profitability levels before the merger of Credit Suisse. We used the UBS results to sum the European banking earnings and outlook in our equity note European banks: Strong Q2 earnings as rate cuts loom. Our strategic view is that financials is one of the more interesting sectors from an expected return perspective and as long as interest rates remain at inflation levels plus a 1-1.5% spread then we get expect profitability to slowly improve. Zooming out to get the bigger picture we observe that European banks are still generally valued as industry below 1 on price-to-book which indicates that the industry is still not generating returns on equity surpassing its cost of capital.

European banks have traded at a discount to US banks for 10 years now and European banks have not been above 1 on price-to-book (which is the magical line for banking stocks) except for a few months in 2015. With the current economic backdrop, larger fiscal impulse coming in Europe from higher military spending and generally a higher central bank rate going forward, because of structural inflation dynamics, we expect European banks to continue recover some of their discount to US banks.

The week ahead: PMIs, initial jobless claims, and Palo Alto earnings

The big macro focus is on Thursday with PMI figures from the Eurozone and the US. The earnings season is less busy but Palo Alto Networks, the world’s largest cyber security company, will be the key watch on earnings, and especially after the recent CrowdStrike fallout.

- PMIs: After some weakness in July macro figures the market will anticipate August preliminary PMI figures for the Eurozone and the US out on Thursday. Consensus is expecting a small decline in the Eurozone with the composite index expected to fall to 50.1 from 50.2 in July with manufacturing still being the weak spot. If we get good PMI figures the market will likely bolster its bet that the Fed only cuts by 25bps at the September meeting. High frequency indicators on the economy continues to signal trend growth in the US economy and improving economic activity in the Eurozone.

- Initial jobless claims: The recent better than expected initial jobless claims pushed US bond yields higher and pushing the market closer to the 25bps cut by the Fed in September than the “panic move” of 50bps. Another strong reading on initial jobless claims would ease some of the concerns several FOMC voting members have recently expressed on the US labour market.

- Earnings: The earnings season is fizzling out, but in the week ahead there are still some earnings releases are worth paying attention to. The three most important earnings to watch are Palo Alto Networks (Mon), Snowflake (Wed), and Target (Wed). Palo Alto Networks is the world's largest cyber security firm and thus it will grab a lot of attention. Analysts expect FY24 Q4 (ending 31 July) revenue of $2.16bn up 11% YoY and EPS of $1.41 up 103% YoY as the cyber security industry remains resilient despite the slowdown in some areas of the economy. Investors hoping for an upside in the earnings result are likely betting that the CrowdStrike fallout will add market share to other cyber security firms including Palo Alto. Snowflake reports FY25 Q2 earnings (ending 31 July) on Wednesday with analysts expecting revenue of $851mn up 26% YoY and ideally also a gross margin expansion.

Previous weekly equity market updates

- European banks: Strong Q2 earnings as rate cuts loom (14 August 2024)

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)