The Daily Fix – A better tone to risk but little has changed

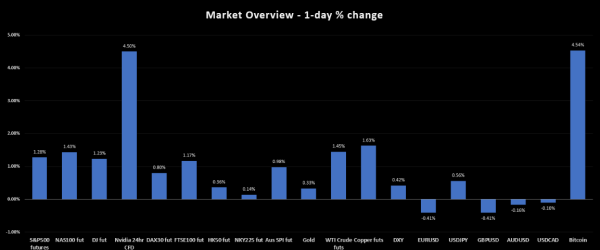

We’ve seen a better tone to risk through Monday’s trading session, but it feels early to say this rally has legs, and after the sharp sell-off we saw on Friday, the snapback we’ve been treated to needs real work to convince. In the absence of any new news to drive further downside in risk, the flows feel purely positioning driven, with shorts taking some off the table and funds re-weighting their long exposures.

Preview

PreviewMany took inspiration from the NKY225, where after another tough Monday open, with the NKY225 cash trading 3.1% lower to 35,247, the buyers stepped in fairly empathically and pushed the index to close -0.5% and near session highs. S&P500 and EU index futures followed in sympathy, with other risk markets – such as crude and copper – also finding a better tone. This set the stage for the session ahead.

Taking some of the gloss off broad sentiment was China equity once again failing to participate, with the CSI300 making yet another lower low. China gets close attention again in the session ahead, with the release of the August trade data, where we see loose expectations that exports will increase by 6.6% y/y and imports increasing modestly by 2.5% y/y. China’s monthly trade data is a hard one to reconcile (and price risk off), not just because forecasting this data is a finger-in-the-air exercise, but there is also no set time for the release. However, given how sensitive markets are to China’s growth trajectory at present, when we do know the outcome, it has the potential to impact commodity markets, as well as the China proxies (AUD, NZD, and copper for example).

EU and UK equity has been well traded, with a notable gain in the FTSE100 cash (+1.1%), with the index closing near its session highs – participation was solid here, with 86% of FTSE constituents higher on the day. It was a similar vibe in the US, with the S&P500 closing +1.2%, NAS100 +1.3% and DJ +1.2% respectively. Participation within the S&P500 constituents was also upbeat, with all S&P500 sectors closing in the green, led by consumer discretionary, Industrials and tech – in all, 83% of S&P500 companies closed higher on the day.

S&P500 futures daily

Preview

PreviewThe US equity bulls will take the fact that the S&P500 futures are respected and pushed higher from the 100-day MA. Constructive, however, S&P500 futures daily printed a clear inside day, and therefore index traders will be using Friday’s high of 5532.5 (the 50-day MA at 5537.71 is also important) and low of 5394 as two key levels that will guide the near-term directional bias into the US Presidential debate and US CPI - as they remain two clear risks for the week that will need to be priced.

NAS100 futures also saw the same inside-day price action set-up, with price eyeing a break on either side of 18.972 and 18.339 to set off directional flows.

With limited data to drive, we’ve seen little change in US rates and the Treasury market. 32bp of implied cuts remain for the September FOMC meeting, with 108bp of cuts implied for the December FOMC meeting. The US 2-year Treasury added 2bp to 3.66%, but with fixed income traders holding a sizeable long position in the US 2- and 5-year part of the Treasury curve, a 2bp rise is really just a rounding error and again speaks to positioning going into the presidential debate (tonight 9 pm EDT, Wednesday 11 am AEST) and US CPI print (Wed 22:30 AEST).

The USD has found buyers and has gained ground against all the major currencies I track closely, except for the MXN, which has been the place to be on the session. Again, USD positioning is a major factor, and with the market short of USDs, and having priced in a fair degree of Fed easing, many feel the risk-to-reward trade-off is becoming more balanced.

GBPUSD gets good attention from clients, and we see on the daily timeframe that spot has printed a lower low and has closed below the 3 Sept pivot. EURUSD sits on the 3 Sept low of 1.1026, where a closing break here and USD shorts would likely reduce more aggressively, with the prospect of 1.0950 coming into play. NZDUSD is starting to bear trend, with rallies into the 5-day EMA used to add to shorts – one to watch.

Commodity markets look a bit more constructive with Dalian iron ore +2.3% in the overnight session, with copper and crude closing over 1% higher. Similar to the price action in the S&P500 and NAS100 futures, WTI crude printed an inside day, and I would be using Friday’s high-low levels ($70.13 and $67.17) to guide the near-term directional bias.

Preview

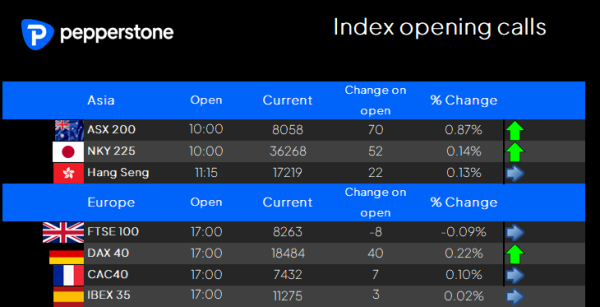

PreviewTurning to Asia and our open it’s the ASX200 which looks to outperform on the day, with our call sitting at 8058. Materials and energy plays should work, although BHP’s ADR suggests an open 0.2% higher – so, banks, tech and industrials may add in the points. China/HK equity should open largely unchanged, and we can see the NKY225 adding to the intraday rally we saw yesterday, although the bulls will need to step up given our call suggests the gains on open won’t be overly prolific.

Good luck to all.