The Daily Fix – An ugly start to the new month

Risk and growth-sensitive assets were looking heavy going into the US ISM Manufacturing report, with bubbling concerns on China’s growth dynamic, reports that Libya are imminently due to bring back 500k barrels to the market, and the S&P Global US manufacturing report revised down to 47.9 (from 48.0) also in the mix - but it was the US ISM Manufacturing report that dominated the headlines, and it was poor. The headline print came in at 47.2, with the new orders sub-component sliding to 44.6 and this paints to poor picture of future demand.

Make of the ISM survey what you will – the ISM survey does have its critics – but the market is the market, and you can’t really criticise the collective weight of capital that has reacted to the outcome.

I had gone into the week seeing a higher probability of a move higher in a number of major equity markets, but that view, at this stage seems well off the mark and incorrect. Obviously, the new news around the growth data points coming in softer has seen the market speak out. So, we react and when the facts change and sentiment evolves, we change. And sentiment, while fickle, has evolved, and the platform has been laid to suggest a very low tolerance to any further downside surprises in the US, and to an extent China’s upcoming economic data flow.

Ugly scenes if we see a miss in the NFP report

If markets do remain heavy into NFP, then a miss in Friday’s US jobs report (relative to consensus) and it could get pretty ugly out of there, and the changing market environment will mean traders have to have their make sure their approach to risk management and position sizing is on point.

The cross-market reaction on the day

Preview

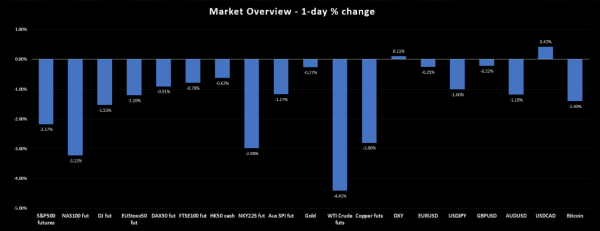

PreviewThe de-risking and risk aversion was noticeable across the entire market. In the volatility space, the VIX has gained 5.17 vols to 20.7%, with big buying seen in S&P500 1-month put volatility. We can see some hefty open interest (over 200k lots) in S&P500 options expiring 20 September (the monthly expiration) – so as the S&P500 traded through 5550 strikes dealers (who sold the options) would have likely been shorting S&P500 futures to hedge their exposures. We can add in other flow-based activity into the mix, with CTAs and volatility and price-sensitive players selling down risk as volatility increased, amid a renewed unwind of JPY-funded carry positions.

S&P500 futures printed a bearish daily reversal, where a subsequent breakthrough of 5616.75 in the session ahead will confirm the reversal. The intraday tape of S&P500 futures shows a steady bleed through European and US trade and with 1.82m futures contracts traded there was solid volume traded here, as we also saw in the US cash equity.

72% of S&P500 stocks closed lower, with tech, energy and comms services all taken down hard, although there were some pockets of brightness, with rotation seen into staples and REITS. Nvidia naturally get the headlines though with the share price falling 9.5% and seeing the biggest loss of market cap for a company ever. The NAS100 saw its biggest one-day drop since July.

Commodities have come into full focus, with Brent crude -5% and WTI crude -4.5% and breaking the multi-month range lows, with the moves attracting solid client flows. Copper is nearly 3% lower at $4.09 p/lb. and looking like it may test the 7 August low of $3.92 p/lb. Dalian iron ore sits -1.8% in the overnight session. Gold went on a whippy intraday ride, trading into $2473, before finding better buyers, with spot now $2492.

US Treasuries have seen good buying interest, with yields lower by 5-7bp across the curve. US interest rate swaps markets, however, have seen little movement and expectations for the September FOMC see little change on the day, with 32bp of implied cuts for the meeting – clearly the NFP print may alter that pricing. Further out, and US swaps markets have added an additional 4bp of cuts out to 12 months. In credit markets, high-yield credit spreads have widened 16bp – punchy, and something to monitor.

In FX markets, the DXY is largely unchanged, however, that is merely a reflection that EURUSD is down smalls. USDJPY traded to a low of 145.15, with spot now 145.46, and we see the JPY was arguably the currency to be long, with some big moves higher vs the CLP, AUD, NOK and ZAR. Pro-growth/cyclical currencies have been sold liberally.

Preview

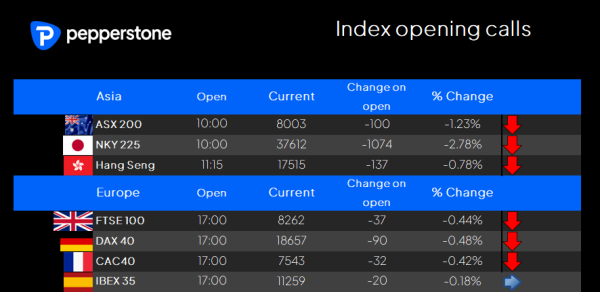

PreviewLooking ahead – Our opening calls for Asia equity indices look shaky, where notably the NKY225 is called -2.8%. The ASX200 eyes an open towards 8000, with BHP likely to open around 1.6% lower, and it clearly won’t be a good day to be long ASX200 tech or energy plays. Let’s see how the market fares from around 10:30 AEST, as it will tell us a lot about sentiment – that is, once we’ve had the shake-out of the morning orders, we look to see whether the buyers step in with calmer head prevailing or whether funds liquidate further, pushing the ASX200 through 8k.

By way of upcoming event risk, China Caixin PMIs are due (11:45 AEST) and given the refocus on growth this survey has the potential to impact sentiment. We also navigate Aussie Q2 GDP (11:30 AEST), US JOLTS job openings and the Bank of Canada meeting, where we will almost certainly get a 25bp cut.

Good luck to all.