The Daily Fix – Equity bulls almost on cloud 9

Momentum is a powerful force when it cranks up and with the S&P500 only 1.1% away from the all-time highs (printed on 16 July), you can almost feel the buyers pulling it higher for that big re-test.

There was a moment where the S&P500 futures found supply into the 1 August pivot high at 5600, but it didn’t take much for the buyers to regain composure and push all the major US indices to close at or close to session highs. Shorts were covered hard yet again, with high short-interest stocks outperforming, but there was also real organic buying with systematic momentum players chasing the move higher.

Preview

PreviewParticipation was solid too, with 82% of S&P500 companies closing in the green, with tech, consumer services and discretionary leading the pack. Even the energy sector closed higher despite crude -2.9%, so there was broad love for equity.

Technically, despite 8 days of gains, the various indices are not yet overbought, but to the discretionary market players, these are levels which are now hard to chase. It is certainly rare to see such form in the S&P500, and since 2005 we’ve seen just six occurrences where the S&P500 has closed higher for 8 straight days, and in each occurrence, the S&P500 closed lower the following day.

Six is not a significant sample size, but it is worth highlighting that in most of those occurrences, the S&P500 was higher 5 days later – so the form guide does bode well for those positioned for new highs.

We’ve not seen much movement in US Treasuries or the interest rates markets, but despite the lack of action the FX markets have been lively, and notably, we’ve seen the USD index (DXY) print a YTD low close. The absolute low print was 101.34, so with the rate now at 101.87, USD sellers have a little more work to do.

EURUSD is clearly driving the DXY move (the EUR holds a 57% weight in the DXY calculation), and with EURUSD pushing strongly higher, in line with S&P500 futures, we see EURUSD testing levels I had not expected to come into play so early in the week. I was looking at short positions in the pair into these levels, but after such impressive range expansion, I am standing aside on that trade.

USDJPY initially drove the USD selling in Asia yesterday, trading into 145.18 although we’ve seen shorts cover and we see rates at 146.60 – I suspect this pair will be at the heart of USD flows through Asia today, with USDCNH also one to that could influence the broad USD performance.

It’s the high beta FX plays which have outperformed on a percentage basis, with solid buying in the CLP, SEK, NOK, and AUD.

It’s also been a lively session for gold traders, with some choppy price action and several big intraday reversals to contend with. Those positioned short would have been feeling happy with the move in early US trade into $2485, but the goodwill was short-lived as the buyers took it back above $2500. No real news to spark the reversal, and I see little influence from the US bond market or USD, so these are flows very much focused on gold in isolation.

Preview

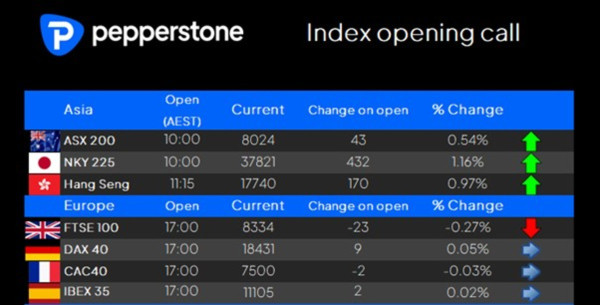

PreviewLooking ahead Asia should feed off the rally we’ve seen in the US, where we see the ASX200 opening +0.5%, HK50 +1% and Nikkei 225 +1.2%. The ASX200 has the impact from earnings which come in thick and fast, but with our call sitting at 8024, the index is not far off the ATH printed on 1 Aug of 8148. Even iron ore futures are providing tailwinds, with Dalian iron ore futures 1.1% higher from the ASX200 close yesterday.

By way of event risk, we see the China Prime Rate decision, where expectations for a change to either the 1- or 5-year rate are low. We also see RBA minutes, and the Riksbank meeting (Sweden), EU and Canadian CPI. We should see the Riksbank rates cut by 25bp, but this is fully priced by rates markets – keep an eye on SEK though, where we see interesting levels tested in EURSEK.

Good luck to all.