The Daily Fix – It's Showtime

But here we are, and we stare down with great anticipation at today's Fed meeting - where the tone of the messaging and the level of concern or control that we read in the statement and hear from Jay Powell will be the deciding factor that guides broad market sentiment.

Preview

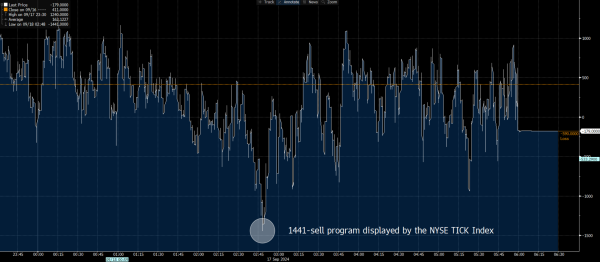

PreviewPortfolio positioning and risk management have been the central focus today, and have been the factors driving moves in equity, US Treasuries, the USD, and gold. Traders and money managers have weighed up the propensity and the possible extent of cross-asset volatility and have massaged exposures according to their risk framework. We saw this play out in US equity, where the buyers initially stepped in on the open before a punchy 1441-stock sell program (seen in the NYSE TICK index) hit the market 3 hours into trade – with the selling pushing both the NAS100 and S&P500 into the red before the respective indices flatlined in a tight range into the close.

The result was a largely unchanged close in the US equity indices, with the internals finely balanced, with 54% of S&P500 companies closing higher on the day. Energy, consumer discretionary and industrials outperformed, while healthcare, staples and REITs lost ground.

The better-than-expected US data and the Atlanta GDP Nowcast revision promoted selling and repositioning in US 2yr Treasuries with yields closing +5bp to 3.59%, resulting in the Treasury curve undergoing modest bear flattening. Near-term Fed cut expectations didn’t change and remain perfectly split on a 25bp vs 50bp outcome, with 39bp of cuts priced for today’s meeting, although we’ve seen around 7bp of cuts come out of the forward meeting pricing.

Fixed income traders remain heavily long of US Treasuries, and while that position has been reviewed, it feels a tall order to think we’ll see a sustained move higher in yields, as this would require significant repricing in expected rate cuts over the next two years.

With the market short of USDs, the rise in US bond yields triggered modest USD buying vs the GBP, EUR, and CHF, although USD repositioning has been most pronounced in USDJPY, with the spot rate trading above 142.

Asia has its chance to react to the rally in USDJPY, so we’ll see if further squaring can lift the pair towards 143 – it certainly seems prudent to reduce size positions and run very modest USD risk into the FOMC meeting - as the potential outcomes for USD risk are truly dispersed and if you ask 10 people how they see the FOMC meeting going down, you’ll likely get 10 different answers. We also see USDJPY closing above the 5-day EMA, which has defined the recent run lower from 2 September, so the downside momentum has clearly shifted.

The UK CPI report (16:00 AEST) due in the session ahead will obviously be a secondary consideration to the Fed meeting, but it could have some bearing on price action in GBP, so it’s still a minor consideration for our risk assessment. It would also require a significant deviation from consensus expectations to really move the dial though, and with core CPI expected to rise 30bp to 3.6% y/y, any rise in core inflation should only solidify pricing for the BoE to be on hold at this week’s meeting.

In commodity markets, we’ve seen a further push higher in crude, while some of the heat has come out of the recent gold move, with the yellow metal closing -0.5%. Gold is at ATHs for a reason though and I see the strong probability that pullbacks will be well supported, and on the day, should the US 2yr yield and the USD initially spike, I would be seeing how gold reacts (should it get there) into the former range highs and breakout level of $2525. Conversely, if the market hears something that truly inspires new money to be put to work in gold longs, and this may ironically require equity to also rally, then an upside break of $2589 is there for chasing.

Preview

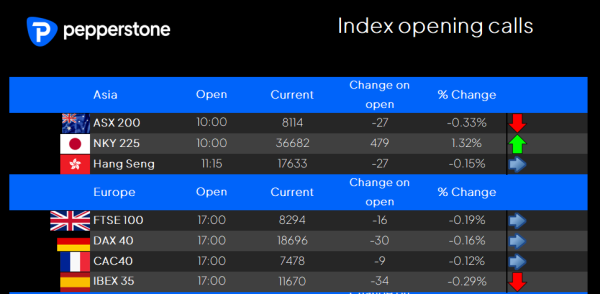

PreviewTurning to Asia and our opening calls suggest the NKY225 will respond favourably to the JPY move and outperform. After hitting a new ATH yesterday (8150.5) the ASX200 looks to open on the back foot, and with the Fed meeting holding the potential to significantly volatility, there are clearly enough reasons for would-be buyers to sit on their hands, and while shorts may look to cover, the prospect of a day where we see a grind lower through trade on lighter volumes seems highly plausible.

Good luck to all,