The Daily Fix – Pre-positioning in Nvidia drags down the NAS100

Yet, despite better US data – with US durable goods increasing 9.9%, a lift in the Atlanta Fed Q3 GDP Nowcast model to 2%, and calls from Fed member Mary Daly that it is now time for the Fed to ease, we saw the S&P500 close -0.3% and NAS100 -1%, while we saw small gains in the Dow and Russell 2k.

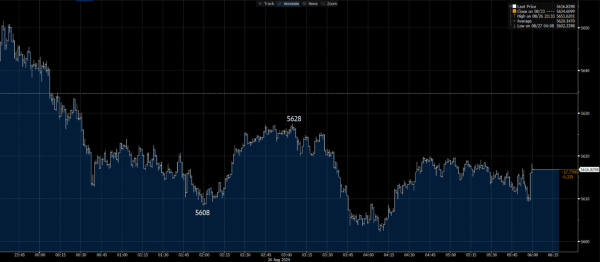

S&P500 cash – intraday tape

Preview

PreviewThe intraday tape of the S&P500 highlights a market that never really got going, and the sellers won over from the outset, with the S&P500 cash rolling lower into 5608, before staging a mini rally into 5628. Any attempt to take the S&P500 back to the flatline was cut back without too much issue, and the buyers lost the impetus, with the index moving sideways into the close.

Preview

PreviewDrilling down into the sectors, we see that the sector performance was finely balanced, with 53% of S&P500 companies higher on the day. Energy was the standout sector, backed by consumer staples. Tech and discretionary plays underperformed, a factor that resulted in the underperformance in the NAS100, with the NAS100 futures testing, but ultimately holding last week’s low of 19525.

Nvidia closed -2.3%, with a few taking a bit of length off the table ahead of Wednesday's earnings, but again, after the initial sell-off in the first hour, Nvidia traded sideways holding a range of $127.50 and $125.50. Tesla closed -3.2%, where sentiment continues to sour, and after a series of higher lows (on the daily chart) from the 5 Aug low, the share price now lacks trend, and where a downside break of $210.32 would attract better attention from the short sellers.

Preview

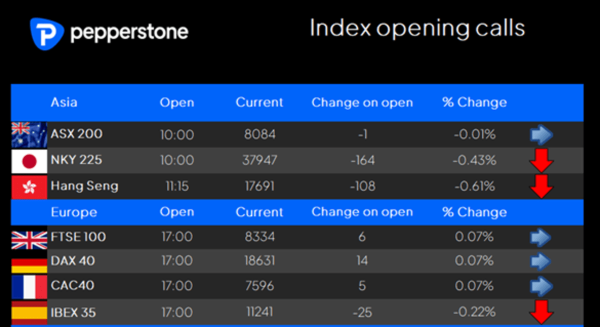

PreviewThe leads set Asia equity up for a calm open, with our call for the ASX200 largely unchanged, with the NKY225 and HK50 called to open modestly lower.

On the day, we’ve seen stability in the recent US Treasury buying, with the sellers starting to get a better say with Treasury yields rising 2bp across the curve. The US bond market gets close attention this week, not just because of potential month-end rebalancing flow, but we also see the US Treasury Department issuing $69b in 2yr paper, $70b in 5yr paper, and $44b for 7yr paper. Any further uplift in yield would likely lead to USD shorts covering, and with the market a punchy USD short position, subsequently, it wouldn’t take much to see some taking some off the table.

Scanning FX moves through the session, the USD has closed the session higher against most G10 currencies, except for the CAD and CHF. MXN screens well for traders wanting movement, with USDMXN (+1.5%) and eyes a re-test of the August highs of 19.60. MXNJPY shorts are working well, with price printing a lower low, and the anti-carry trade gets further legs. USDCAD traded to a lower of 1.3643, although the CAD has been better traded against the FX cross rates.

In Commodity markets, US crude has seen good trader interest, with front-month futures rising through European trade into $77.60 before closing at $77.16 (+3.1%) - traders pointing to news that Libya will halt oil exports, a factor which has hit the oil price already seeing better technical buying. Dalian iron ore futures sit +2.3%, while copper futures are +0.5%. Gold (+0.2%) saw good buying through European trade, pushing into $2526, before seeing choppy price action into the session close.

Good luck to all