The Daily Fix – The flows turn towards crude and gold

Increased focus falls on the US lifting its military presence in the Middle East, ahead of a potential reprisal by Iran. Many also monitor headlines around the flow of gas between Russia and Ukraine to Europe, with EU Nat gas at one stage rising 6% to €42.90, before coming off 7% into the close, as headlines made their way around the floors that both Ukraine and Russia have limited intensions to halt their gas flows.

While EU gas price tailed off into the close, Brent crude maintained its bid through US trade, and subsequently closed above the recent downtrend (drawn from the 5 July high) and now eyes a move into the 200-day MA ($82.56). One considers then how much of the move was technical in nature, with the upside then exacerbated driven by low positioning - where gross long positions in Brent futures had heavily reduced of late to sit at multi-year lows.

XAUUSD – Daily chart

Preview

PreviewGold has printed a new all-time closing high of $2472.90, absorbing tailwinds from both the crude move, and buying across the US Treasury curve, and US 5yr real rates -5bp to 1.75%. Client activity towards the yellow metal remains upbeat, but few in the wider market are getting overly excited just yet, with gold options skew (1-month call implied volatility minus 1-month put volatility) largely unchanged on the day. Still, while few are expecting a more explosive move in price, we look to see a test and break of $2483 (printed on 17 July).

While we see some buying of gold as a geopolitical hedge, a weaker US CPI print tomorrow, and a below consensus read on US retail sales would likely be the kicker to take us to a new ATH, and possibly a test of $2500.

We may have seen crude, gold and possibly US Treasuries finding buyers on geopolitical news flow, but this hasn’t resonated in FX or equity markets. Granted, we have seen US small caps close lower, with the Russell 2k -0.9%, but S&P500 cyclical stocks have outperformed defensive plays, high beta stocks have worked well vs low volatility beneficiaries and S&P500 momentum names have seen reasonable buyers.

One could argue that equity is still in recovery mode after last week’s shake out, and holding out from really putting money to work until we get the key US data this week, where pricing US growth is still the main game in town. This may explain the poor volumes, with S&P500 volumes some 19% below the 30-day average. The low participation was also true in the options market, with 1.63 million S&P500 put options traded on the day, which while far higher than the 1.06m calls traded, was well under the 5-day average.

The intraday chart of the S&P500 was whippy, to say the least, with the index chopping around between 5371 and 5324. Given we’ve seen the S&P500 cash index trade in 200+ handle high-low ranges in the prior three sessions, a 46-handle high-low range on the day feels incredibly quiet. However, with the VIX index now at 20.7%, it feels like a lot of the short-volatility (vol) trades have been flushed out and volatility is now more correctly priced. The VIX isn’t calculated from the S&P500 daily high-low ranges, but both are of interest to short-term traders, who should be dynamic to the movement and vol in the market.

If geopolitical angst is on the rise in crude and gold, then we saw no real interest to buy the CHF or JPY as a hedge in FX markets, and we see a mixed picture for the USD on the day. That may well change if EU and US Nat Gas were to start trending sharply higher, and crude pushed through the various key moving averages (50-, 100-, 200-MA’s) – I guess in that dynamic we’d see far better buying of CHF as a hedge in the FX space.

Preview

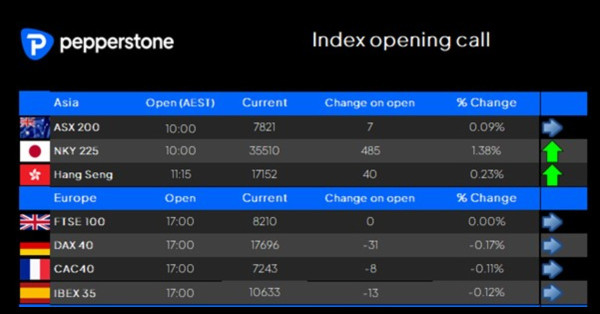

PreviewTurning to Asia our calls suggest that we see the NKY225 fire up and outperform in the region, with calm opens expected in HK and Australia. A break above 36k in the NKY225 would be of interest, and likely attract increased attention from the momentum players, and suggest holding for a test of the 200-day MA (36,911).

By way of event risk, in the session ahead we see the Aussie Wage Price Index (11:30 AEST), and while an important input for the RBA, it shouldn’t move the AUD too intently. In the UK we see the jobs and wages report, which may result in some moves in the GBP, while in the US we get PPI inflation – a key gauge to help economists price the all-important US core PCE inflation due on 30 August.

On the earnings side, we see numbers today from CSL (ASX200), and Home Depot (S&P500).

Good luck to all,