The Daily Fix – The US Election cycle kicks into gear

The focus firmly shifts to the US presidential debate, with Kamala Harris and Donald Trump slugging it out an hour into ASX200 and NKY225 cash trade, and as HK cranks up. Market participants will be watching closely, although unless we see a dramatic slip-up, or a clearly dominant performance from a respective candidate, then it is somewhat unlikely that the debate will prove to be a volatility event for markets, and we will likely wait to see how the relative performances impact the upcoming polls.

Presidential debates do have a history of moving polling by a couple of points and given a recent NY Times/Siena survey highlighted that 28% of respondents want to know more from Harris (9% for Trump), the debate feels like its Harris’s stage to show remaining undecided and lose swing voters that she has a has a strong plan to lead the US forward. Looking at the history of polling, and while this time is different, in both 2016 and 2020 it was from exact this point into the election cycle that the DEMs made a charge and we saw both Clinton and Biden pull ahead markedly in the polls – we’ll see if the debate can see this form guide repeat.

Preview

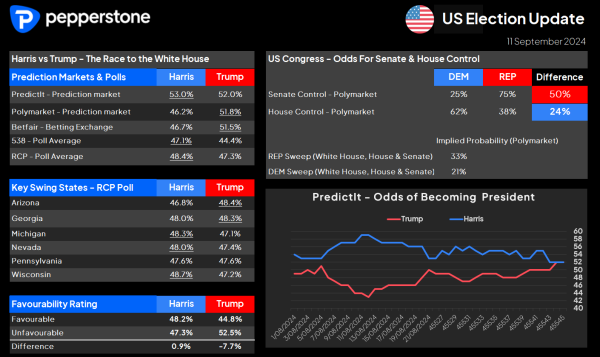

PreviewAs it stands, Trump is modestly ahead in the prediction markets, while Harris is ahead in the average national polls. In the key battleground states, Harris has a small edge in Wisconsin, North Carolina, Michigan, and Nevada, with Trump edging it in Georgia, and Arizona. Pennsylvania, with its 19 electoral college seats, is tied and it's this state that may make the ultimate difference to the electoral college outcome on the day.

Trump will likely steer the conversation as best he can towards the economy and immigration, and position Harris as dangerous and on the extreme left. Harris will look to position voter perception that she is a strong and considerate leader, with a focus on Trump’s temperament and character. For markets, while Trump’s trade policy is a potential landmine for risk, on-balance promises of deregulation, lower corporate tax policy and the potential for increased fiscal deficits edge Trump out as having the greater positive impact on markets – however, the market price action and the collective weight of money will settle that.

Leading into the debate we see some lively moves across markets, although there were no signs that traders were prepositioning and seeing risk around the debate. US Treasuries have seen notable buying flows, with the US 2-year -7bp to 3.59% - a new cycle low. With limited US data to drive on the session, the focus has been news on news that regulators are now proposing that the big US banks increase capital by 9% to limit potential widening in the SOFR rates curve, although this is lower than the 19% that was originally put on the table. Adding to this, JPM President Daniel Pinto lowered expectations on net interest margins, which resulted in JPM closing 5.2% lower.

The moves in crude would have been a factor too, with Brent lower by 3.1%, and gasoline hitting a 4-year low. Crude has been well traded by clients, with a big technical breakdown playing out in both brent and WTI crude. Futures curves have flattened out, where we see front-month Brent futures $0.37 from trading at a discount to the 2nd-month futures contract – this is another bearish factor for crude, as it essentially means that traders will pay up carry when if they choose to roll the futures contracts.

The buying in US Treasuries (lower yields) resulted in USDJPY trading from 143.70 to 142.20, with USDCHF also finding sellers on the day. Elsewhere the USD has held firm, with better USD buying vs the LATAM currencies (BRL, MXN, COP, and CLP). The clear risk ahead is the US CPI report (22:30 AEST), where we see analysts forecasting headline CPI to fall to 2.5% (from 2.9%), while core CPI is expected to remain at 3.2%.

S&P500 cash – intraday price action

Preview

PreviewUS equity markets hand over a positive lead, with the NAS100 +0.9% and SPX500 +0.5%. 52% of S&P500 companies closed higher on the day, led by REITs, consumer discretionary and tech. The S&P500 Energy and financial sectors closed lower. As we see in the intraday tape, the cash index traded into a low of 5441, before the buyers stepped in and dominated, with the index closing on its highs. While there is clear buying pressure in the market, I still want to see a break of Friday's high in the S&P500 futures of 5532 to compel to trade US equity from the long side, and that may play out in the session ahead.

Preview

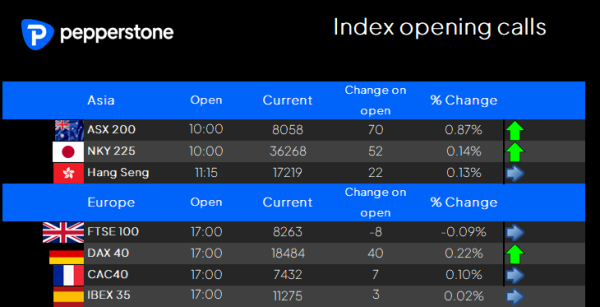

PreviewTurning to Asia, our opening calls suggest a weaker open for the HK50, with the index looking weak and struggling to find many friends in the market. The ASX200 and NKY225 will open on a flat note, and one can imagine that between 11am and 12pm AEST, very little activity will be seen with traders eyeing the debate.

Good luck to all.