The Daily Fix – the wheels are falling off the tech trade

Well, it appears as though we may have our answer, and it comes from both the Trump and Biden camps, with both presidential candidates beefing up their rhetoric towards the scene and notably towards Taiwan, and companies (most notably ASML) who are providing advanced semiconductors technology to Taiwan. This matters, a lot, because Taiwan manufactures around half the world’s semiconductors and 90% of all advanced chips, and much of these chips are sold to US AI-related corporates.

Preview

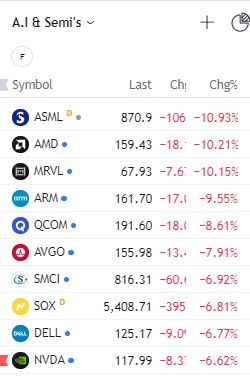

PreviewThe result has been a savage unwind of a very popular and crowded trade, with semis and AI-rated names taking a bath. This has resulted in the S&P500 Tech sector closing -3.7%, and the NAS100 -2.9% - the worst 1-day performance since Dec 2022.

US banks are on fire

Some have liquidated tech holdings, or at least reduced exposures and rolled into US staples, energy, and banks, where names like JP Morgan are on fire. But we’ve also seen increased interest from fast money players to take short positions in Nvidia, Broadcom, Marvell, and AMD, and that is new as traders have been loath to take bearish directional trades on these names for some time.

In the options world, we can see interest to buy put options and positioning for protection (of equity longs), or purely for speculative purposes, and we can see Nvidia's 1-month implied volatility puts trading at a 1.3 volatility (vol) premium to 1-month call volatility.

We can also see traders buying index volatility, with the VIX index gaining 1.2 vols to 14.48%, and the NAS100 VIX +2.11 vols to 20.46% - importantly, volatility typically begets higher volatility, as there are some huge hitters (namely pension and insurance funds) who weight their portfolio equity allocations based solely on the volatility in the index – so when vol rises they reduce exposures, and that just compounds the issue and leads to further drawdown in the index.

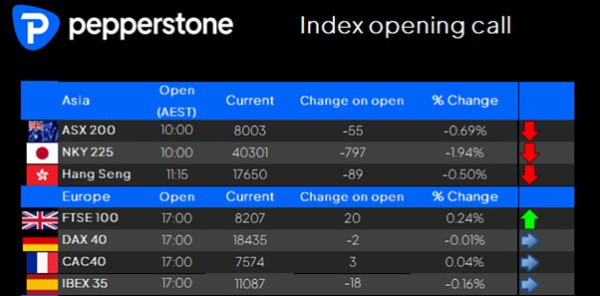

We watch for the reaction now in Japan, notably in names like Tokyo Electron and in Taiwan, where one can expect some big moves in the chip plays. I would also expect the TWD (Taiwanese Dollar) to be sold hard when it opens at 11 am AEST. Our call for the NKY225 looks very shaky, with the index eyed to open around 2% lower, where the downside has been offered additional risk from the rally seen in the JPY, aided lower by MoF JPY intervention, with USDJPY breaking trend support and the 50-day MA.

The question now is how much more has this move out of tech got to go?

In my thinking, the rhetoric on protectionist measures offers such limited visibility to efficiently price risk and with limited confidence to price the near-term future it feels like this rich positioning has further to unwind. I, for one, am not a buyer of tech or the NAS100 at this time and would be selling rallies in the NKY225.

Pockets of positivity still plentiful

All is not lost though, there are pockets of positivity in equity – notably in healthcare, with UnitedHealth adding 160 points into the Dow, and almost single-handedly helping the Dow close higher. We have seen demand for the JPY and CHF, suggesting some flight-to-safety-buying, but gold is -0.5% lower and there has been very little move in the US Treasury curve.

Trump playing his hand

Calmer heads would see the tactics being played by Trump as a pure negotiating tool. Revisiting the playbook, and as we saw in 2016 when Trump would talk tough on a range of protectionist measures, most notably towards Mexico – What eventuated was that many of the calls were walked back significantly through his presidential years. The 60% tariffs highlighted to be placed on China’s imports, won’t settle at 60%, and will likely be far lower if they are seen at all. We also hear that John Paulsen or Jamie Dimon are being lined up for Treasury Secretary and that if one of these two market-respect individuals is appointed, then it more than offsets the hawkish appointment of JD Vance as Trump’s running mate.

Either way, if one was looking towards late August/early September to put on US election trades, then you’re re-evaluating that call, as the action is playing out, right here, right now.

Preview

PreviewAsia opening calls and impending event risk for the session ahead

As our equity opening calls attest to, Asia is in for a rocky start, and we watch to see if traders look to sell into the equity further when the respective exchanges open – it will tell us a lot about the evolving sentiment.

By way of event risk for the session ahead, we see Aussie employment (11:30 AEST), where the consensus is for the unemployment rate to tick up to 4.1% (from 4%), with 20k net jobs created – AUDUSD flatlines for now, but we are seeing better selling in the AUD vs the CHF, EUR, GBP, and JPY. We also get UK jobs, with GBP attracting huge client flow of late, notably with GBPUSD trading into 1.3000. We also see the ECB meeting statement, with Christine Lagarde speaking shortly after – the meeting should get traders attention (due 22:15 AEST) and while expectations for EUR volatility are low, it is an event risk to manage. Clearly, we keep our eyes on headlines from the Republican National Convention with Trump due to step and talk to the party.