The Daily Fix – Upbeat momentum in risk as we close out the week

We roll out of US trade and look ahead to the final trading session of the week, and the bulls will be feeling quietly confident about the direction of travel - where if it weren’t for the landmine that is next week’s FOMC meeting, many would even consider adding to longs.

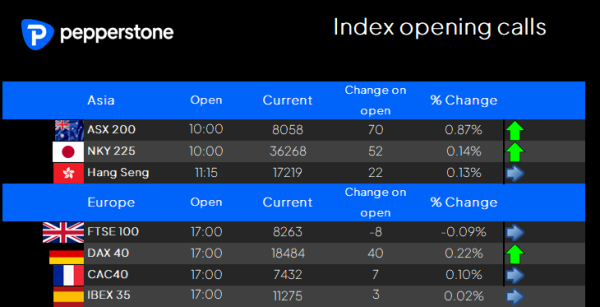

We move past the ECB meeting and US PPI print without any great unease, where the net effect of all flows resulted in broad equity appreciation, a weaker USD across the board (except the CAD), modest selling in US Treasuries, while crude and gold have found solid buyers. Sentiment evolves, and we head into Asia eyeing modest gains in the respective indices, with the ASX200 needing to find a further 36 points from our opening call to test the all-time high of 8148 set on 1 August.

Preview

PreviewThe leads from Wall Street are clearly constructive, with the S&P500 +0.8% and the NAS100 +1%, while US small caps found form, with the Russell 2k +1.2%. Intraday, we see the S&P500 cash pushing into 5600, before better supply kicked in, with the big number proving to be a barrier. That said, the technicals and price action look solid enough, and participation in the move was fine, with 74% of S&P500 companies closing in the green, with all S&P500 sectors offering tailwinds. The target now for the US index players is for S&P500 futures to push through the late August highs of 5669, and then we target new all-time highs.

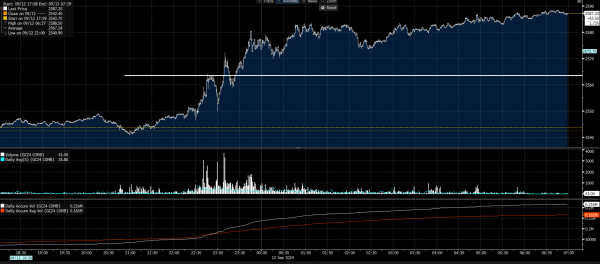

With equity marching higher, with traders modestly reducing volatility hedges (the VIX is -0.62 vols to 17.07%, and with the USD unloved on the day and US real rates largely unchanged, one could argue that gold has become the portfolio hedge of choice. The rally on the day won’t necessarily surprise given the clear buying support that we’ve seen through the recent consolidation phase, but the tape on the day has certainly been impressive.

Preview

PreviewI would put the gold rally down to positioning and flow, over news on the day, where we can see sizeable accumulation playing out as gold futures pushed through the all-time high price in gold futures of $2570 – so whilst the accumulation flows did occur over ECB president Lagarde’s press conference, and the moves in EURUSD would have offered gold tailwinds, the buying seems to be significantly affected by stops triggered through the former highs, married with momentum accounts buying strength in the breakout.

Gold miners have naturally feasted on the move in both spot gold and futures, with the GDX ETF +4.9%, and clearly if holding ASX200 gold equity life is good as we eye the ASX200 open.

Gold aside, our flows in EURUSD have been solid, notably in and around the ECB meeting and President Lagarde’s presser. I’m not sure how many would have read the ECB statement or listened to the presser, however, after trading a tight range into the ECB meeting, FX traders did react to the intraday low-to-high trend that played out on the break of 1.1023, where it was one-way buying into 1.1075. USDJPY also finds upbeat flows, with spot sitting at session lows and the lowest closing levels since January. Conversely, the moves in equity and broad risk semantics have lifted the higher beta risk-sensitive plays – NOK, SEK, and AUD, with AUDUSD pushing above the 67c handle, with longs looking to target the 0.6800 double top.

Looking forward, and there is little economic data to trouble positioning in the session ahead, although there is some gaping risk potential for the Monday open, with China releasing home sales, industrial production, retail sales, fixed asset investment, and property investment figures on Saturday. This is a consideration for those holding CN50 index exposures, as well as the China proxies (copper, AUD, and NZD). We head into the final session with positive momentum in risk, but, as we’ve witnessed of late, the market will go to wherever it wants to go, and the unexpected can often happen as we roll into the weekend, and many consider the risk of holding exposures through the closed period.

Good luck to all.