The Daily Fix – USD down, head to the JPY

The US Treasury market has been the main game in town, and the buying across the curve has been solid. US 2yr Treasury yields have closed 10bp lower at 3.75% and the lowest close (in yield) since Sept 2022 – Fixed income traders reacting to the weaker US labour market data, with JOLTS job openings falling 3% m/m, with the ratio of job openings to unemployed fell from 1.16 to 1.07.

With that in mind, the bar to a 50bp cut in September FOMC meeting has been pulled just that bit lower. The US 2’s v 10s yield curve momentarily un-inverted (now -0.89bp), and we can see US 2-year yields trading at a 156bp discount to the fed funds effective rate – a clear sign that bond traders see Fed policy as far too tight given the dynamics shaping up in inflation and the US labour market.

The short-end of the Treasury curve has been impacted by Fed policy expectations, and we see that US interest rate swaps are pricing 34bp of cuts now for the Sept FOMC meeting – essentially a 1/3 implied chance of a 50bp cut. A poor NFP on Friday and we should see swaps pricing a 50bp cut at a 50/50 implied. We also see 106bp of implied cuts by December, which suggests a small premium of two 50bp cuts this year.

Naturally when we see this sort of bid in the Treasury market, and increased rate cut expectations the USD will attract sellers and we’ve seen that play out, with the USD offered across the FX landscape, bar the MXN and CLP. Interestingly, we’ve seen a better tone (vs the USD) in the high beta pro-growth plays (AUD, NZD, ZAR), a reflection that the weaker US data that focused on the labour market side, as opposed to growth data.

USDJPY shorts have worked and followed in sympathy the moves in the US 2yr, with spot trading lower through EU trade, before the buyers simply walked away during US trade, and we now see USDJPY trading at 143.65 and testing the 26 August lows. The JPY is the superstar FX play at present. There is an unwavering conviction that the Fed is going to bring the Fed funds rate towards a neutral setting somewhat more urgently – in turn, we see speculators front-running the notion that USD deposits accumulated by Asian exporters, and investment funds will either by part liquidating or hedging ratios will be radically lifted. We can also mix in systematic momentum and trend accounts buying the JPY given the technical setup.

US equity has held in well despite the data flow, and we see both the S&P500 and NAS100 close -0.2%. The intraday tape of the S&P500 showed it was largely a sellers’ market, with the S&P500 attempting to move higher early in cash trade, before the sellers took the S&P500 from a high of 5552 into 5503, before settling out at 5520. It seems few are really prepared to put money to work at risk until we get past Friday’s NFP report – that said, investors haven’t given up on equity altogether and on the day, we have seen a rotation into the safety of utilities and staples, while REITS felt the tailwind of lower bond yields.

Tech remains the clear focus though and talk of where to now for Nvidia is the central discussion. On the day we saw Nvidia stage a rally into $109.99 but there just is no conviction to push this higher right now, and despite retracing 70% of the Tuesday 9%+ selloff, we’ve seen the stock close at $106.20 and lower by 1.7%. The AI trade unwinds on a broad basis globally, but is it really a ‘bubble’ as some suggest? I’m sceptical on that call, given Nvidia’s rally has been well correlated with earnings (unlike Cisco in the 90’s) but there is no doubt the wheels in Ai-names are looking shaky.

Preview

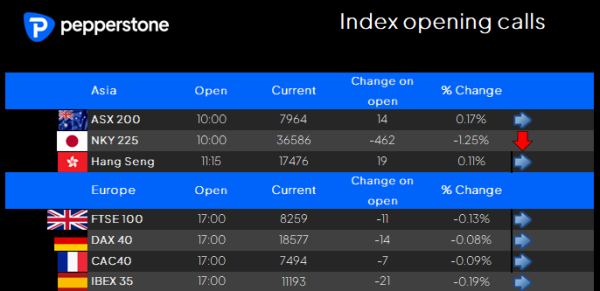

PreviewLooking ahead – our calls for Asia are mixed, with the NKY225 looking to open 1%+ lower, while the ASX200 and HK50 should unwind on a flat note. The moves in the JPY are a factor impacting the performance of the NKY225, where we can price the index in USDs and things look less bad.

By way of risk to navigate, in the session ahead we turn once again to the US data flow as the central focus, with US ADP payrolls, weekly jobless claims and ISM services. The services print has the potential to further rock sentiment, and with the consensus seeing the diffusion index coming in at 51.4 (unchanged from the July read), any read below 50.0 could increase cross-asset volatility.