The Daily Fix – When good news is most definitely good news for risk

The chase is on, and while there are always risks that could impact, there is little in the data flow now to really derail sentiment in the immediate near-term.

As the week has rolled on traders have grown less concerned about right-tail risk (i.e. inflation) but now the left-tail risk – growth – is in a better spot and the consensus is again subscribing to the ‘soft landing’ thesis. Given the rally in risk, it’s here where recession hedges, placed in response to the week’s mini-panic, really start to impact portfolio returns – if you’re an active manager and need to beat a benchmark, that obviously matters.

US data thematic of a ‘soft landing’ scenario

Consumption was always a major focal point, and whether retail sales are a true representation of aggregate demand mattered little today. The market looked at the 1% m/m increase in US retail sales (+0.4% increase in the ‘control group’ element) for what it was and as a wholly positive outcome. Weekly jobless claims came in at 227k and did their part to further lift sentiment, and this was further backed by Walmart, who reported better comp sales and lifted its profit outlook – opining that they see a stable consumer going forward, which, if the Fed did listen into the earnings call, is exactly what they would want to hear.

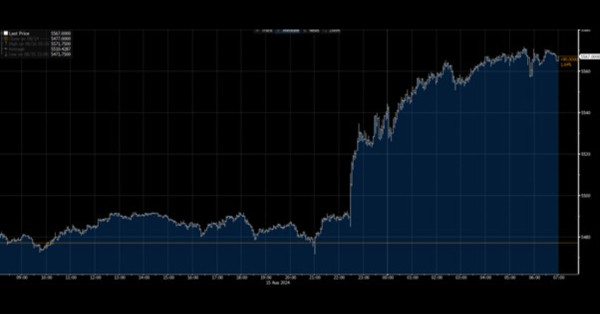

S&P500 futures – intraday view

Preview

PreviewThe move in risk from the data was clear-cut, and traders had to respond and react dynamically. S&P500 futures ripped from 5490 to 5571, where once again the sellers stood aside and pulled the bulk of orders to higher levels. On the daily timeframe, we see S&P500 futures above the 50-day MA and now see a test of the 5600-pivot high (1 August) – Subsequently, a break of 5600 and the probability of new all-time highs in US equity becomes real.

We can look at the broad quality of the move in US equity, as this can help with our probabilistic assessment and how the journey from A to B, moves towards wherever C could be. Granted, tech and consumer discretionary has smashed it on the day, but small caps have worked incredibly well too (the Russell 2k closed +2.5%), which is what you’d want to see when US data is far better than expected. Participation in the rally was solid, with 82% of S&P500 stocks higher on the day, with S&P500 cyclical sectors recording the biggest outperformance relative to S&P500 defensives of the year.

Momentum favours the brave in these times, and for those whose strategy is to buy high and sell higher (strength beget strength), this is the market environment to play out your edge. Consider that since 2020 the S&P500 has closed the 7th day lower in 52% of the 21 occurrences, but in the five days following for 6 consecutive days of higher closes, the index is higher in about 2-in-3 of those 21 occurrences.

Hedges cost money when the index rips

Hedges have been unwound, notably in the volatility space, with the VIX now at 15% and lower than it was before the mini ‘growth scare’ episode. S&P500 skew (i.e. 1-month put volatility minus 1-month put call volatility) has come back to 3 volatilities, while IWM (Rusell 2k ETF) 1-month put implied volatility - a hedge fund favourite ‘recession hedge’ – has pulled back to 22%.

The moves in US Treasuries and rates were punchy, with the US 2-year Treasury +14bp on the day to 4.09%, and with a less pronounced sell-off in the long-end of the Treasury curve, we’ve seen a solid bear flattening of the US 2s v 10s yield curve to -18bp (+6bp on the day) – with ‘curve steepeners’ (i.e. funds buying the 2yr and selling the 10yr Treasury) another classic US recession hedge.

We see US interest rate swaps implying 29bp of cuts now for the September FOMC meeting, where a 25bp cut seems the obvious play, as the data just isn’t there to warrant a 50b cut. Notably, the only real landmine between now and the 18 September FOMC meeting is the US nonfarm payrolls on 6 September. Fed chair Jay Powell speaks at Jackson Hole next Friday and should guide to a 25bp cut and giving the Fed optionality for further cuts in the meetings ahead.

FX moves on the day

The trade in FX has been less clear cut – we’ve seen the USD gain vs the ‘funding’ currencies (JPY, CHF and to a lesser extent EUR) but the pro-cyclical / high beta currencies (MXN, CLP, and AUD) have outperformed – so on the day, expressing a view on US economics through the USD meant being selective.

The obvious trade was in USDJPY, which reacted as you’d expect with US yields moving higher, where we saw the pair spike a lazy 200 pips off the bat (from ¥147.30 to ¥149.30) on the retail sales data, before consolidating through US trade but closing out into rollover at session highs. ¥150 is the obvious big level to watch out for here.

Preview

PreviewTurning to Asia and we close out the week on a high, with the NKY225 on a tear, where our JPN225 index is now 24% off its 5 August lows – a weaker JPY is clearly helpful an index priced in JPY, but there are other factors compelling traders to run this index long. The ASX200 will open on a strong note too, and traders can think about a tilt at 8k, although that is a factor for next week, but we should see materials fire up, and for those selling banks because of historically high valuation, well, there should become more expensive today. Our HK50 call is also firmly in the green, although we did see Alibaba report earnings and they haven’t really impressed, with its ADR closing unchanged, which is a miss in such a hot market.

Good luck to all,