The Effect of US Presidential Elections on Stock and Bond Market Performance

U.S. presidential elections are not just a significant political event but also have substantial impacts on the stock market. Historically, the different phases of the U.S. presidential cycle—post-election year, midterm year, pre-election year, and election year—have shown varying effects on market performance. While pre-election and election years tend to yield the highest returns, post-election and midterm years often bring more uncertainty and volatility. These cyclical patterns, along with specific market reactions to election days and power transitions in the White House, provide valuable insights for investors and traders. In this article, we will analyze historical data and patterns to better understand how U.S. presidential elections affect the stock market.

U.S. Presidential Cycle and Stock Market Performance

The U.S. presidential cycle can be divided into four phases: post-election year, midterm year, pre-election year, and election year. The last two years are the most successful for U.S. stock markets. In 48 presidential periods since 1833, pre-election and election years have shown significantly better market performance compared to post-election and midterm years. U.S. presidential elections have profound impacts on the economy and financial markets. Wars, recessions, and bear markets tend to begin or occur in the first half of the term (as in the case of the Russia-Ukraine war and the bear market of 2022), while prosperous times and bull markets are more likely to occur in the second half during pre-election and election years.

Market Reactions on Election Days: Long on Election Day and Short the Day After?

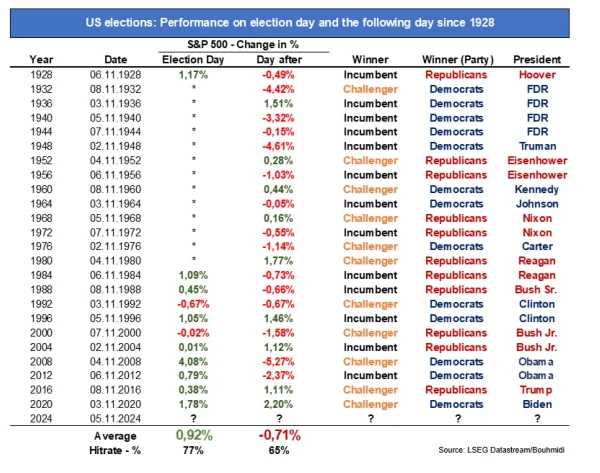

The table below illustrates the price reactions of the S&P 500 on election day and the following day since 1928. Regardless of whether Democrats or Republicans won or whether the incumbent president or challenger triumphed, a clear pattern can be observed in market reactions. On election day itself, the S&P 500 posted an average positive return of 0.92% with a hit rate of 77%. This means that the index closed in positive territory on 77% of observed election days, indicating general market optimism and positive investor expectations on election day.

The day after the election, however, the broader S&P 500 posted an average negative return of -0.71% with a hit rate of 65%. This shows that the initial euphoria on election day often gives way to a correction or sobriety. Until 1980, U.S. financial markets traditionally remained closed on election day to allow voters and market participants to participate in the elections. Since then, however, the markets have remained open on election day. These trends highlight that while election years offer positive returns in the long term, short-term volatility can also occur, which investors and traders should take into account.

S&P 500 performance on US election day and following day since 1928

Corrections After U.S. Presidential Elections?

A change in power in the White House has led to a market low within two years in the last eight decades (1960, 1968, 1976, 1980, 1992, 2000, 2008, 2016, and 2020), with the exception of 1994 (Dow Jones: -2.56%). Even when incumbent presidents remained in office, as in 1964, 1972, 1984, 1988, 1996, 2004, and 2012, U.S. markets often reached their low point within two years. Exceptions were 1984 (after three years), 2004 (after one year), and 2012 (no low point, QE). If this pattern repeats in the future, the next significant market low could be expected in 2025 or 2026.

S&P 500 – Monthly Chart

The Presidential Indicator as a Forecast Tool

When the S&P 500 rises between July 31 and October 31 in U.S. election years, the incumbent president retains power in 11 out of 13 election years or 85% of the time since 1936. A negative performance of the S&P 500 in this three-month period immediately before the election led to a change in power in 8 out of 9 years, which corresponds to a success rate of 89%. Exceptions to this pattern occurred in 1968, 1980, and 1956. Based on market performance so far this year, the indicator currently points to a Democratic victory.

In summary, the historical analysis of U.S. presidential elections and their impacts on the stock market reveals recurring patterns and offers valuable insights for investors preparing for future market movements.

What’s on the horizon for the global bond markets?

The 2024 US presidential election is just around the corner. As the world's largest economy with unparalleled influence over global trade, economic outlook, and geopolitics, the process and the outcome for the event of 2024 is poised to create ripple effects that impact interest rates, inflation expectations, and ultimately bond markets globally.

Uncertainties and haven demand

Needless to say, the presidential election in the most influential nation, with over 300 million people, will inject significant policy uncertainty both domestically and globally. Investors in global bond markets are highly sensitive to these uncertainties. And for bonds, especially US Treasuries, which are typically viewed as safe-haven assets, likely to see rising demands during this period of turbulence. For instance, in 2000/2001, the yield on the US 2-year bond dropped nearly 60% in the 12 months following the election.

US 2-year vs. US 10-year bond yield

Impact on inflation and growth expectations

However, another scenario could move bond markets in the opposite direction. If the future leader of the United States introduces higher political and economic risks into the world's largest economy, investors would inevitably demand a higher risk premium, driving yields higher.

For instance, if a candidate advocates for aggressive fiscal spending, which could potentially lead to rising debt and higher inflation, and even higher interest rates, bond yields may increase as investors adjust for upcoming inflationary period and thus seek higher returns.

In this scenario, bond markets outside the US may become more vulnerable due to the attractiveness of a stronger dollar and the potential for capital reallocation. This shift in investor preferences often leads to repricing across international bonds, including German Bunds and Japanese Government Bonds (refer to the comparison chart between US 2-year bond yield and JGB 2-year below). Conversely, a more fiscally conservative candidate could reduce inflation concerns, helping to keep bond yields lower.

For example, following the 2016 US election, the yield on the US 2-year bond surged 96% in a year, from 0.88% to 1.51%, as President Trump’s economic strategy focused on fiscal stimulus, including large-scale infrastructure spending, tax cuts, and deregulation. While these policies were expected to boost economic growth and favour equities, they also led to higher inflation and increased government borrowing.

US 2-year bond yield vs. Japanese Government Bond (JGB) 2-year yield

Geopolitical and Trade Implications

Another key aspect the US election could influence global bond markets is through the future administration's trade policy. A strong focus on protectionism or trade barriers, as demonstrated by both the Trump and Biden administrations, can escalate global trade tensions, disrupt supply chains, and raise costs, fuelling inflationary pressures. These risks often lead to volatility in global bond markets as investors reassess their exposure to trade-reliant economies. Countries heavily tied to US trade and geopolitical policies, like China, Mexico, and Canada, are likely to face heightened bond market fluctuations as the election campaign progresses.

US and China 10-year government bond yield comparison

Conclusion

US elections carry broad implications for global bond markets, influencing inflation expectations, monetary policy, geopolitical risk, and the global trade outlook. The interaction between fiscal policy uncertainty, potential shifts in the Federal Reserve's response to differing fiscal directions, and changes in the global trade environment are poised to introduce volatility in fixed income investments. For global investors, understanding these complex dynamics is essential, as navigating bond markets during election cycles requires a nuanced approach that accounts for both domestic and international factors.