The Fed’s great balancing act

Key points

- US inflation report and Fed rate decision: While the market is betting on significant Fed rate cuts, the latest inflation report and other economic indicators do not warrant an immediate need for aggressive action by the Fed.

- ECB rate cut: The ECB cut rates by 25 bps, but concerns over wage growth signal more rate cuts may come if economic conditions worsen.

- DSV acquisition: DSV acquired Schenker in a significant deal that will enhance its global logistics presence, but the integration poses operational risks.

- Week ahead: Key events include FedEx earnings, the FOMC rate decision, and ZEW figures, with markets keenly focused on the Fed's guidance.

US inflation report at odds with market expectations of Fed rate

The US inflation report for August was published on Wednesday and is the last comprehensive macro figure before the Fed decides on its policy on Wednesday. While consensus among economists is a 25 bps cut, the market has a 55% probability for a 25 bps cut and 45% probability for a 50 bps cut. As the market has not fully priced in a 50 bps cut, it would be unusual for the Fed to go with 50 bps as it would be interpreted as a hawkish move and something that could upset markets a lot. The market wants the Fed to be aggressive on its policy rate pricing in 6 rate cuts by the January 2025 meeting indicating that at least two of the next four meetings will include a 50 bps cut.

We think the market is too aggressive and too pessimistic on its outlook for the economy and inflation, just it was earlier this year. Let us look at the facts. The US inflation report for August showed that the US services inflation excluding energy is maybe stabilising around the 4% level, which means we only need a little positive impulse from either energy, food or manufacturing (China) for inflation to suddenly appearing worse again. US Indeed job postings data has also stabilised over the past three months suggesting that the labour market has cooled to a new equilibrium, but not necessarily an equilibrium that puts the economy into a recession. US financial conditions have also eased substantially in recent weekly data points suggesting no signs from credit markets that the economy is deteriorating fast. Finally, the Dallas Fed Weekly Economic Index is indicating 2% annualised real GDP growth and has remained surprisingly stable around the 2% level for two months now.

It is a great balancing act for the Fed, but we do not think the numbers are stacking up yet for the Fed to pre-emptively being aggressive on the policy rate. In his 2018 Jackson Hole speech, Federal Reserve Chair Jerome Powell highlighted the importance of being cautious when the economic outlook is uncertain. He emphasized that monetary policy decisions should be based on careful consideration of evolving economic conditions, rather than rigid adherence to models. Powell also noted that economic changes, such as shifts in inflation and unemployment, are difficult to detect in real-time, further complicating policy decisions. This uncertainty calls for a balanced approach, avoiding both extremes of excessive caution or aggressive tightening. In other words, the Fed will move cautiously on its policy rate as long as we are getting inflation reports like the one for August.

ECB cuts rate as expected citing uneven path ahead

As expected, the ECB went out yesterday cutting the interest rate by 25 bps, but ECB President Lagarde mentioned that wage dynamics are still too strong in Europe for the ECB to move aggressively on its policy rate. As a result, the central bank is open to reduce its policy rate again in October, but it is conditioned on worsening data, or else the next cut will be at the 12 December meeting. Despite gloomy headlines about Germany’s industry and in particular its car industry, the Weekly Activity Index from Bundesbank suggests that economic activity is generally improving.

DSV gobbles up German logistic firm Schenker becoming world leader

After long negotiations and shipping company Maersk pulling from the acquisition talks, DSV announced this morning that it has agreed to acquire logistics firm Schenker from Deutsche Bahn at an enterprise value (market value of equity plus interest bearing debt less cash) of €14.3bn. The deal is an all-cash deal which will be financed through issuing new share capital and debt. DSV expects to cut 1,600-1,900 employees out of 73,000 employees to get cost synergies out of the transaction.

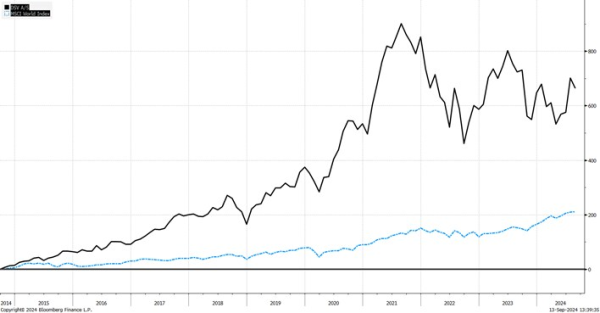

The integration of Schenker is expected to last 2-3 years. Unusual for DSV the logistic company has entered into “social undertakings” to ensure that it would win the bid ahead of private equity firm CVC, which would complicate the speed of cost synergies and ultimately operational efficiency. While DSV has had an almost flawless execution of past acquisitions the integration ahead will be a big mouthful for the company and not without risks. The acquisition will make DSV one of the largest logistics companies in the world. DSV’s revenue over the past 12 months has been €20.3bn. DSV’s return on invested capital has fallen over the past two years to only 10.6% as of latest filing and must quickly rise back to around 12-14% for the share price to continue its positive development. DSV has delivered 22.7% annualised returns over the past 10 years compared to only 12.1% for the MSCI World Index.

The week ahead: FedEx earnings, FOMC rate decision, and ZEW

- Earnings: The key earnings to watch in the week ahead are FedEx (Thursday, aft-mkt) and Lennar (Thursday, aft-mkt). Analysts expect FedEx to report a meagre 2% YoY revenue growth as demand remains weak and pricing power low. A positive catalyst for FedEx shares must come from cost reduction surprises in its transformation programme called DRIVE which aims to improve efficiency while cutting costs across its network. Analysts expect Lennar to report revenue growth of 6% YoY reporting a growth slowdown for the second straight quarter. Lennar is headed for a low growth 2024 fiscal year that ends in November with revenue up only 3.7% YoY and operating margins back to levels from 2020.

- FOMC rate decision: The Fed will announce its decision on its policy rate on Wednesday at 18:00 GMT with economists consensus forecast at 25 bps. The market will react to Powell’s forward-looking statements around the future path of policy rates and comments on the subsequent press conference. The biggest immediate impact on markets will happen if the Fed cuts 50 bps as it could kickstart a negative narrative on the economy.

- ZEW: Figures for September are out Tuesday at 09:00 GMT expected at 17.0 vs 19.2 in August reflecting the persisting headwinds in Germany’s industry illustrated by VW’s decision to potentially closing one of its German car manufacturing plants for the first time in its history.

Previous weekly equity market updates

- Nvidia earnings will show another quarter of explosive growth (23 August 2024)

- The big rebound in equities, Palo Alto earnings on tap (16 August 2024)

- European banks: Strong Q2 earnings as rate cuts loom (14 August 2024)

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)