The FTSE Finish Line - October 1 - 2024

The FTSE Finish Line - October 1 - 2024

FTSE Whipsaw Start To The Quarter As Geopolitical Risk Rises

The UK's leading FTSE 100 index remained largely unchanged on Tuesday, as declines in luxury stocks were balanced by gains in precious metal mining companies, while investors awaited crucial updates regarding geopolitical risk as wire reports suggest Iran is readying a missile attack against Israel. Both the FTSE 100 and the FTSE 250 mid-cap index were hovering around the flatline as markets digest Iran headlines.

In single stock stories UK's Greggs, a leading bakery and fast-food chain, experienced a 4.9% drop, making it the top loser on the FTSE mid-cap index. The company reported a slowdown in underlying sales growth during the third quarter compared to the first half, as consumers continue to face economic uncertainty. While the like-for-like sales growth was 5% in the third quarter, it was lower than the 7.4% recorded in the first half. Despite the softer sales growth, Greggs maintained its full-year profit before tax outlook and remains on track to open 140-160 net new stores. The company also expects cost inflation for 2024 to be towards the lower end of the previously announced 4%-5% range. Year-to-date, Greggs' stock has gained around 15%, outperforming the FTMC's 7% gains.

Mulberry Group, a British luxury retailer, has rejected a £83 million ($110.81 million) takeover offer from sportswear retailer Frasers. The company stated that the offer lacked the support of its majority shareholder, Challice, and did not recognise Mulberry's "substantial future potential value." Frasers, controlled by British businessman Mike Ashley, is Mulberry's second-largest shareholder. Mulberry's shares have declined by approximately 21% year-to-date.

Shares of Enfamil formula maker Reckitt declined 1.15%. The company's unit, Mead Johnson, along with US-based Abbott, is facing a trial over its premature baby formula causing a severe intestinal illness. Plaintiffs argue the companies failed to warn about the risk of necrotising enterocolitis from cow's milk-based formula. The trial is part of a sprawling litigation that has already resulted in verdicts of $60 million against Reckitt, with close to 1,000 similar cases pending. Reckitt said the lawsuit's claims are not supported by evidence and that their products are essential for premature babies. Reckitt shares have fallen about 15% year-to-date.

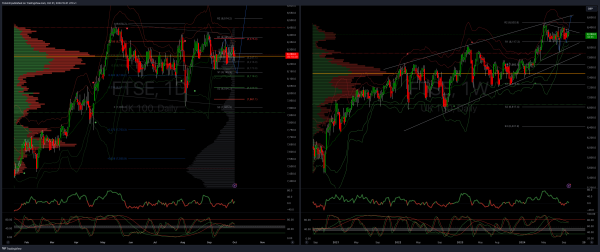

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish